- Despite the upbeat Spanish CPI, EUR/USD remains under selling pressure.

- Markets await the final US GDP price index for new momentum.

- Technically, the 1.0800 level provides strong support.

The EUR/USD price remained bearish on Wednesday despite small bounces. The pair is trading at 1.0820 at the time of writing. The bearish trend continues to dominate amid a stronger dollar.

-Are you interested in learning about the best AI trading forex brokers? Click here for details –

The dollar remains bullish despite some poor US economic data released yesterday. CB Consumer confidence was 104.7 points below the expected 106.9 points and below 104.8 points in the previous reporting period.

The Richmond Manufacturing Index was reported at -11 points versus -5 estimated, the HPI fell 0.1% even as traders expected a 0.2% rise, while the S&P/CS Composite-20 HPI met expectations.

Moreover, Durable and Core Durable orders were better than expected.

Today the Spanish Flash CPI was better than expected, but the EUR was unable to capitalize on it. German retail sales and the change in unemployment in Germany could revive the EUR/USD pair tomorrow.

The US will release revised UoM consumer sentiment, pending home sales, final GDP, jobless claims, Chicago PMI and final GDP price index. Positive economic data boosts the dollar.

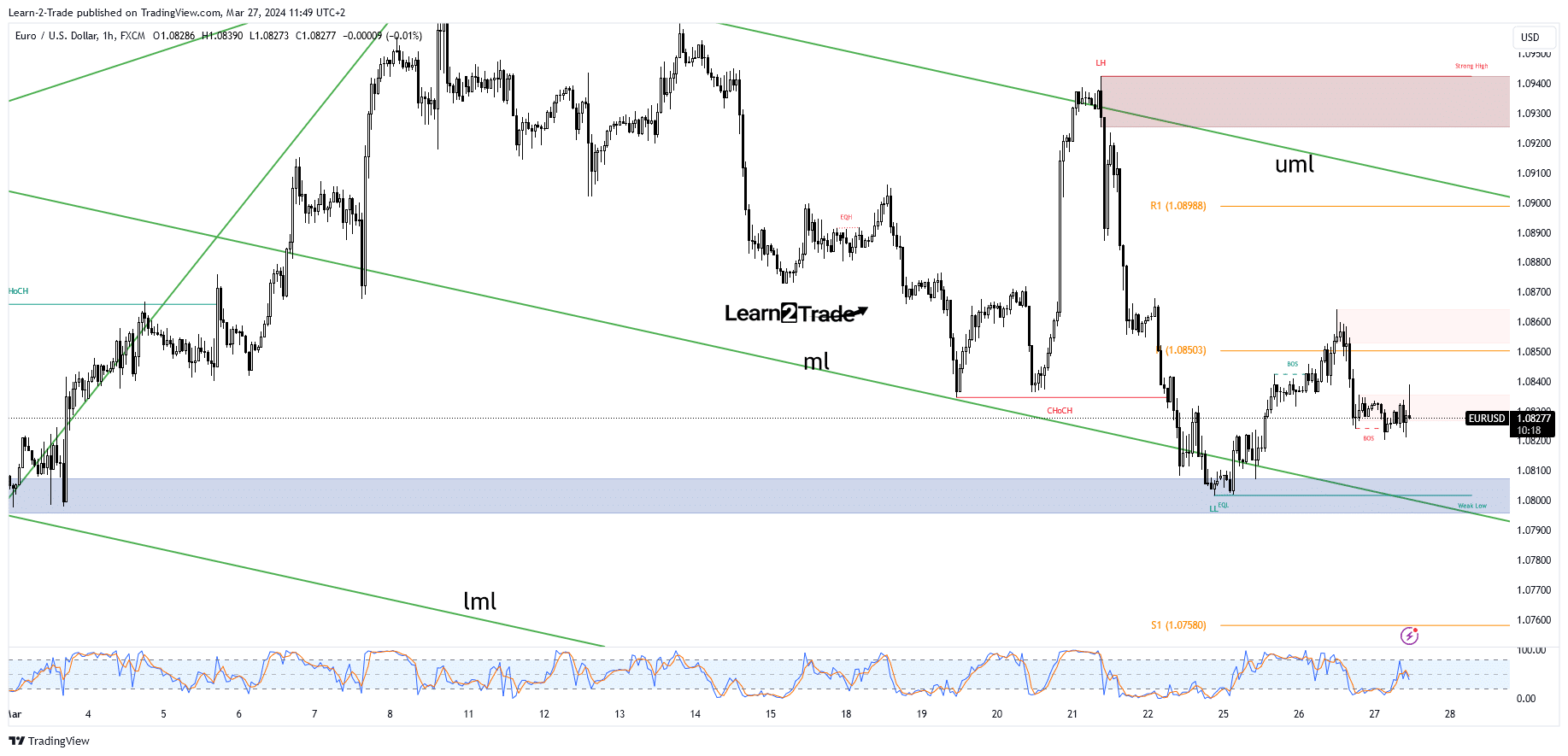

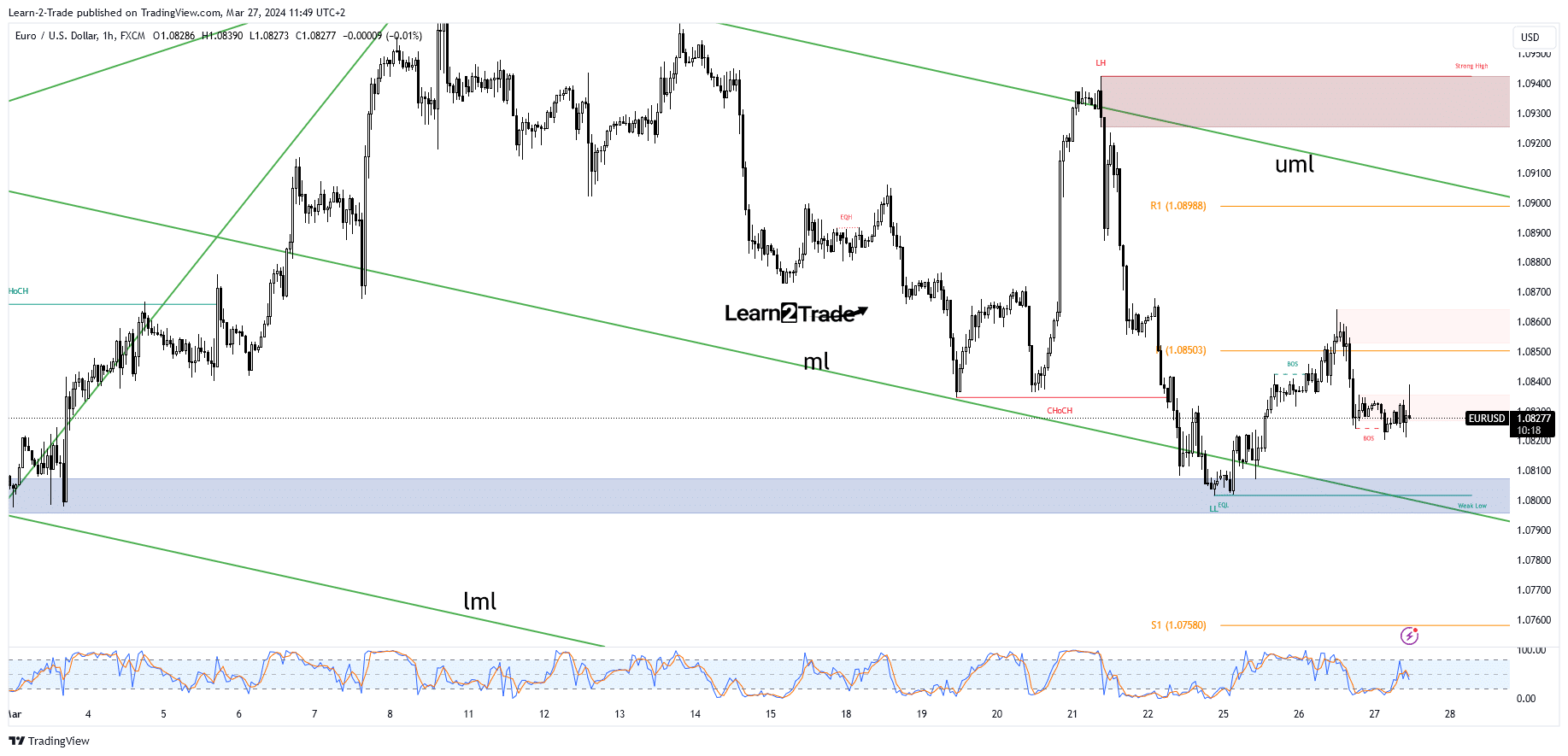

Technical analysis of EUR/USD price: Sellers are in charge

Technically, the currency pair recovered after failing to reach the psychological level of 1.08 or stay below the falling midline (ml) of the villa. The bounce was temporary as the price could not stay above the weekly pivot point of 1.0850.

-Are you interested in learning more about forex indicators? Click here for details –

After a minor rally, a pullback could be natural as the price could try to retest support levels and demand zones to accumulate bullish energy and buyers. We have a strong demand zone above the psychological level of 1.08.

Retesting this zone and printing only false breakouts should spark new bullish momentum. A drop and close below 1.08 and below the midline (ml) could trigger further declines.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.