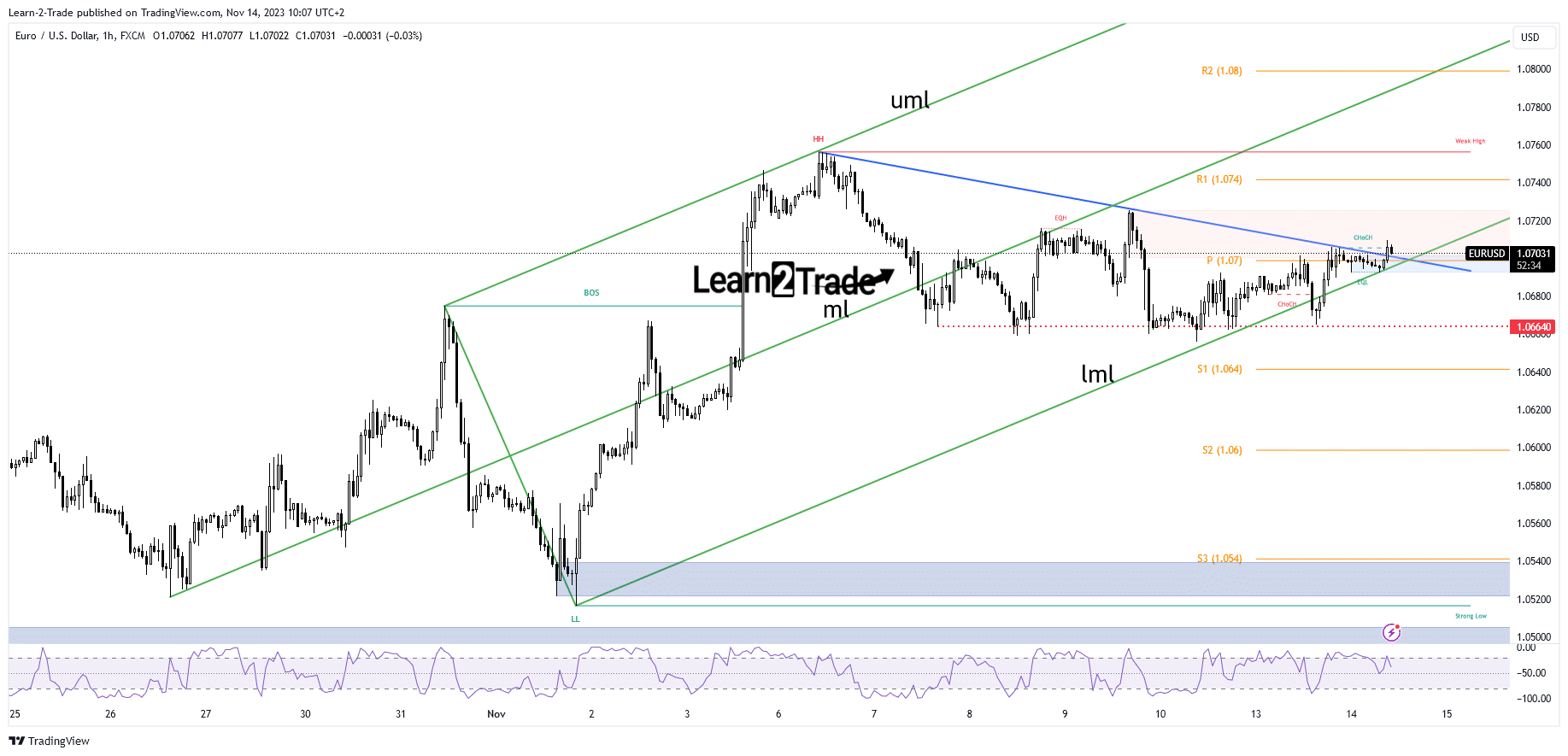

- The bias is bullish as long as it is above the lower median line (lml).

- Removing the former high activates further growth.

- US CPI should bring sharp movements today.

EUR/USD rose in the late New York session as the US dollar fell again. Right now, things are looking positive for the euro in the short term, even with some minor setbacks. Further pullbacks in the Greenback could trigger a deeper correction.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

Yesterday, the balance of the US federal budget was -66.6 billion, which was not as bad as the expected -70.5 billion. Before that it was -171.0B. Today we have the ZEV Economic Sentiment of the Eurozone, which is expected to be 6.1 points compared to the previous 2.3 points. German ZEV Economic Sentiment could be 4.9 in November, compared to -1.1 in October. Also, Flash GDP of the Eurozone could show a decline of 0.1%, and Flash Employment Change could show an increase of 0.2%.

The important thing today is the US inflation data. CPI m/m could show a 0.1% increase, down from September’s 0.4% increase. The CPI could post a 3.3% year-on-year increase, and the Core CPI should again show a 0.3% increase in October. I think if inflation is lower, that could weaken the USD.

Technical analysis of EUR/USD prices: fluctuations in the supply area