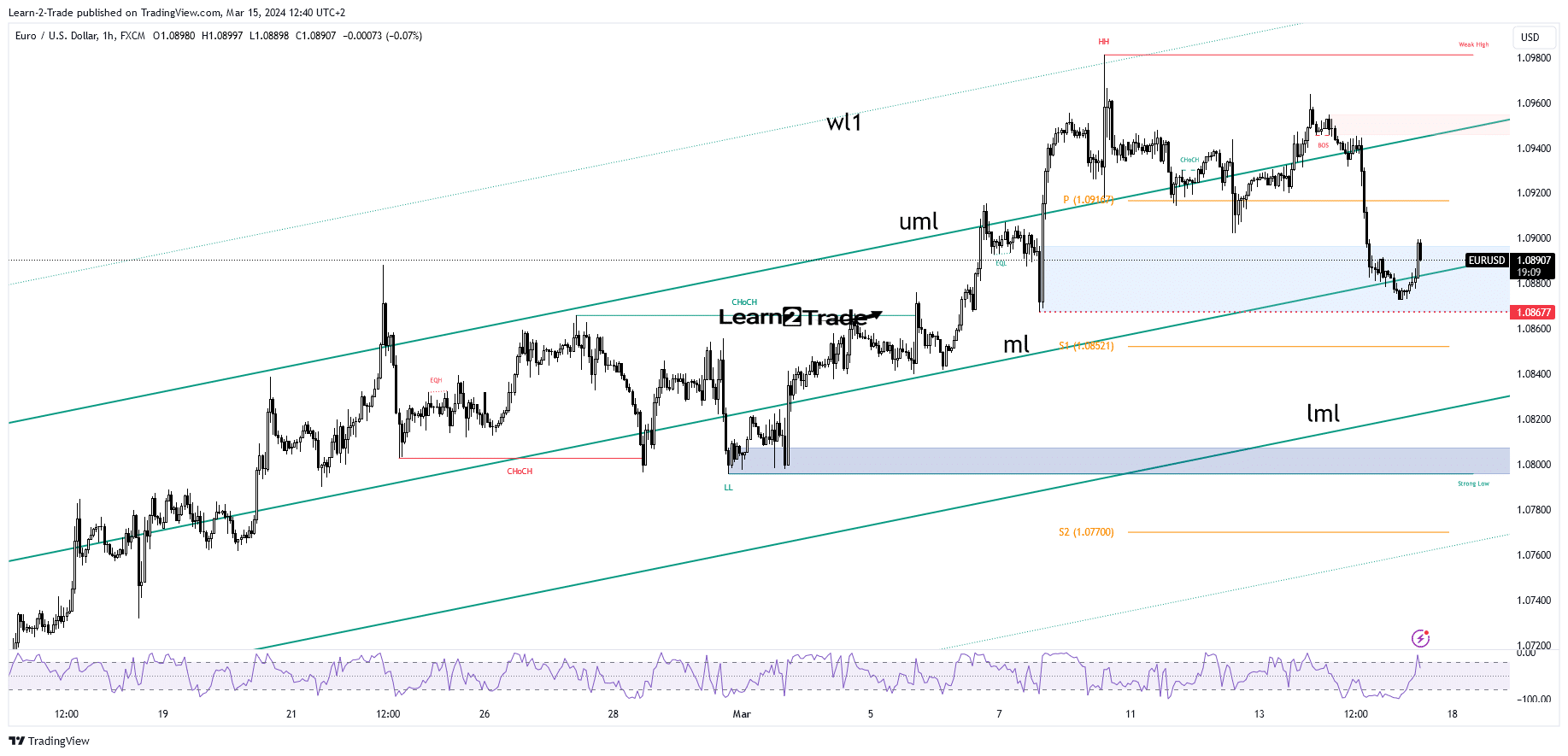

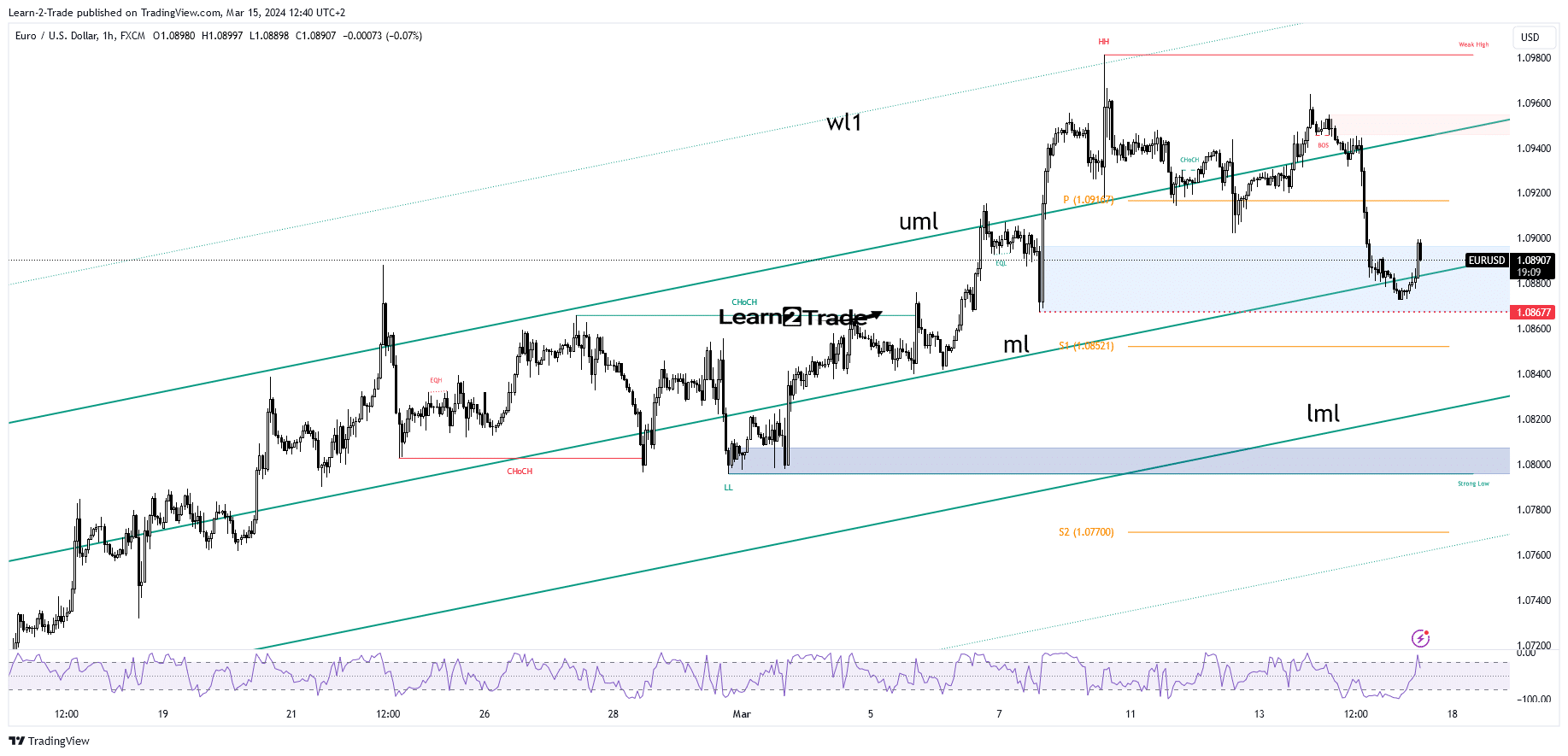

- The bias remains bullish as long as it is above the median line (ml).

- A new lower low triggers more dips.

- US economic data should have a big impact today.

EUR/USD is trading in the red at 1.0890 at the time of writing and is struggling to recover. After the last bearish move, you can expect an upward correction.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

The US dollar turned upside in the short term, weighing on today’s currency markets.

Yesterday, the dollar received a helping hand from US economic data. Retail and Core Retail saw significant growth in February after a significant decline in January. In addition, PPI, Core PPI and Unemployment Claims were better than expected.

Today, US economic numbers should move the price. The Empire State Manufacturing Index is expected to be at -7.0 points.

Prelim UoM Consumer Sentiment could jump from 76.9 points to 77.1 points. Industrial production could see a 0.0% decline after a 0.1% decline in the previous reporting period, while the capacity utilization rate could remain at 78.5%.

Moreover, data on inflation expectations and import prices prelim UoM will also be released. Positive data helps the dollar continue its appreciation.

Technical analysis of EUR/USD price: Correction

The currency pair turned to the downside after registering only a false breakout with a major break through the warning line.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

If you don’t stay above the upper middle line (uml), it could lead to a bigger correction in the short term. Now the pair has found demand again, right below the midline (ml) and above the key downside barrier at 1.0867.

The bias remains bullish despite the current decline as long as it is above these barriers. The new lower low triggers more declines towards the lower median line (lml) and to the 1.0800 psychological level. On the other hand, stabilization above the middle line (ml) may herald a new rally.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.