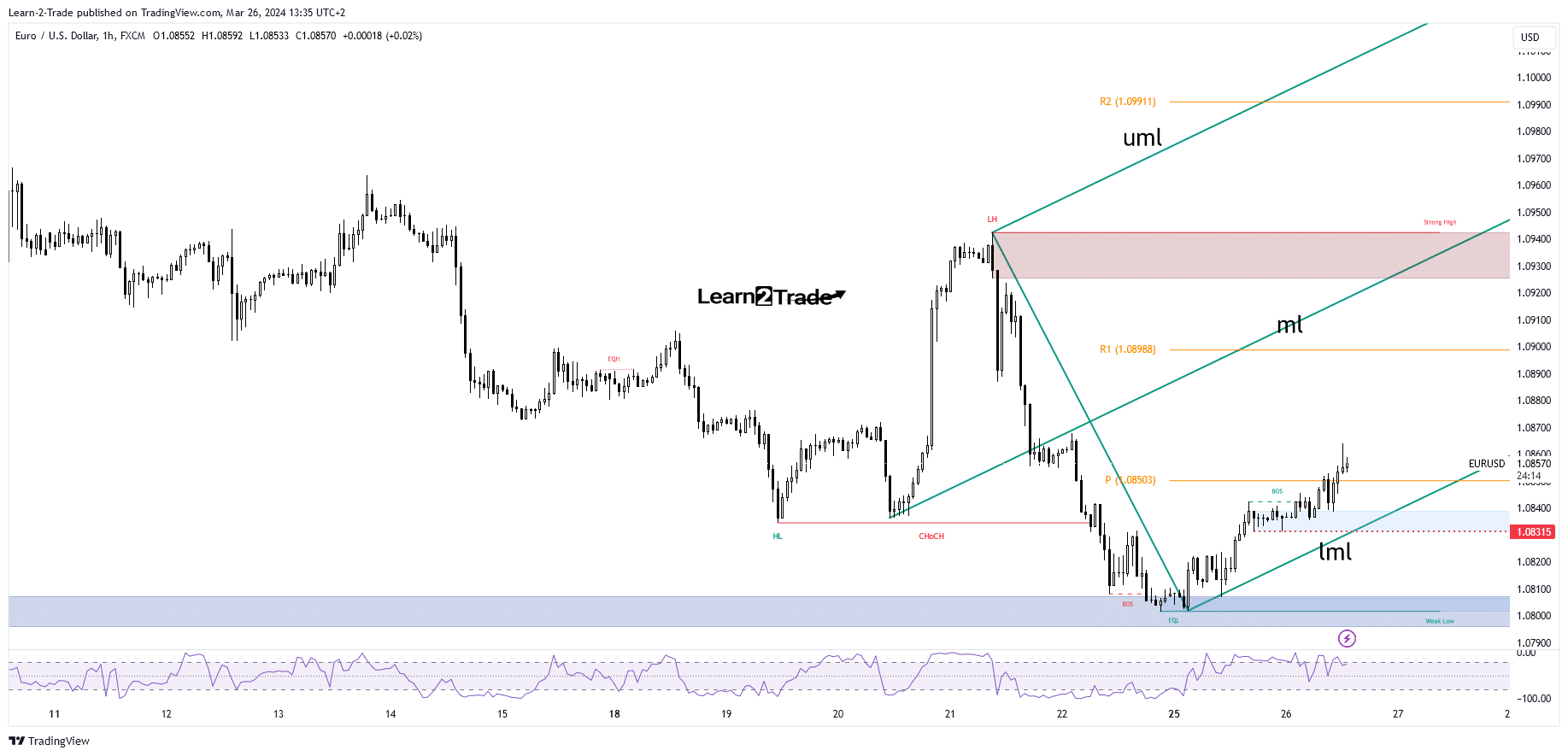

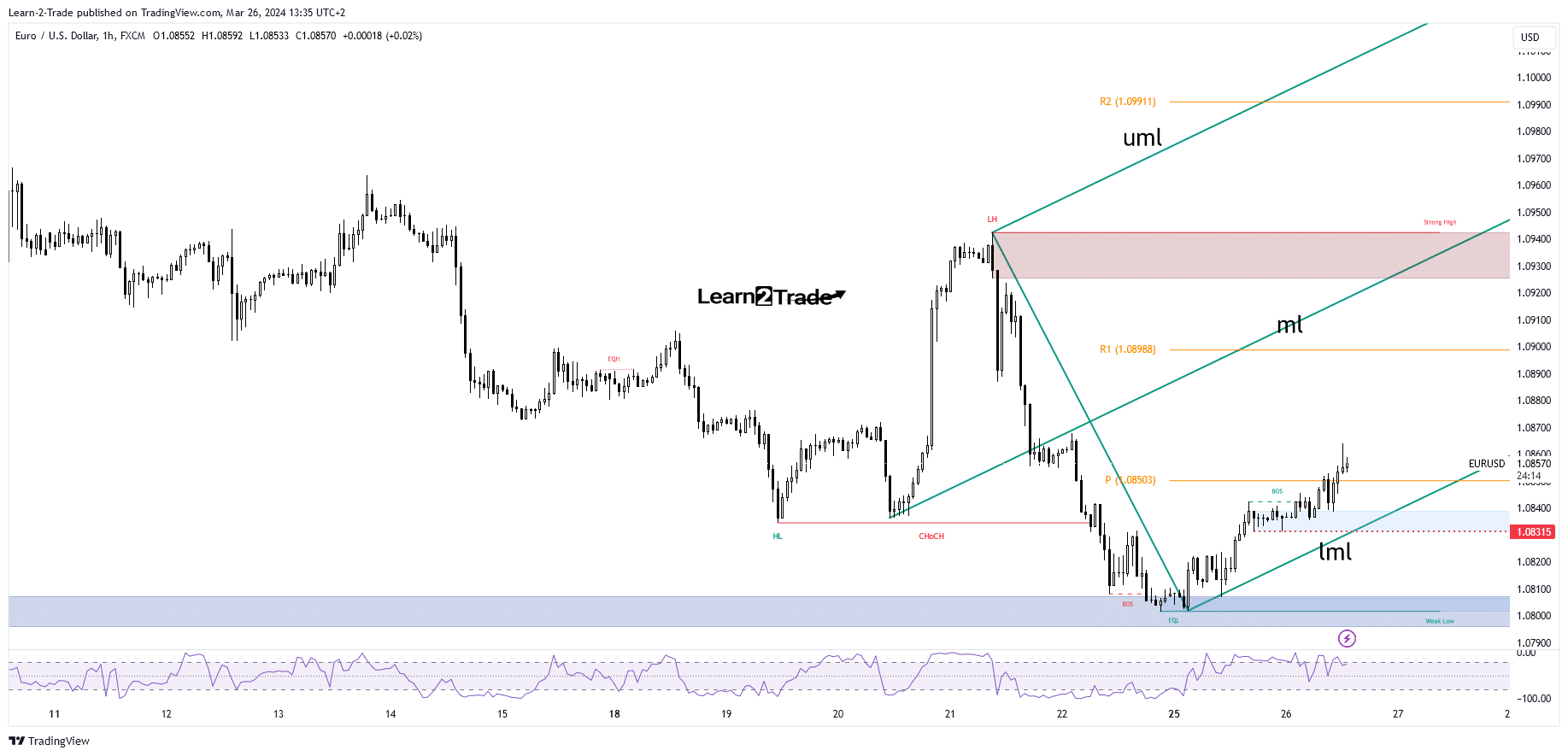

- R1 is seen as the next potential target.

- The bias is bullish as long as it remains within the body of the rising villas.

- US data could sway the price later today.

EUR/USD strengthened in the short-term, briefly moving above the mid-1.0800 level. The pair looks to correct the strong sell-off seen last week.

Basically, the US dollar took a hit yesterday from US new home sales. The economic indicator was 662 thousand, compared to the expected 675 thousand and below 664 thousand in the previous reporting period.

-Are you interested in learning about the best AI trading forex brokers? Click here for details –

Today, the EUR got a helping hand from the German Gfk Consumer Climate, which jumped from -28.8 points to -27.4 points. Later, US economic data should be decisive in the short term.

Durable goods orders could post a 1.2% rise after falling 6.2% in the previous reporting period, while core durable orders should post a 0.4% gain in February after a 0.4% decline in January.

HPI and S&P/CS Composite-20 HPI could report better data in January compared to December.

The most important event is CB Consumer Confidence. The indicator is expected to jump from 106.7 points to 106.9 points, which could be good for the dollar.

Technical analysis of EUR/USD price: bullish movement

Technically, the EUR/USD pair has bounced back after reaching the demand zone above the psychological level of 1.0800. It has now broken above the weekly pivot point of 1.0850 and seems determined to move closer to new highs.

-Are you interested in learning more about forex indicators? Click here for details –

I drew ascending pitchforks, trying to capture more growth. Price tested the lower middle line (lml), confirming this as dynamic support.

Price could extend its momentum if it stays within the body of the ascending forks. The weekly R1 of 1.0898 and the midline (ml) represent potential targets.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.