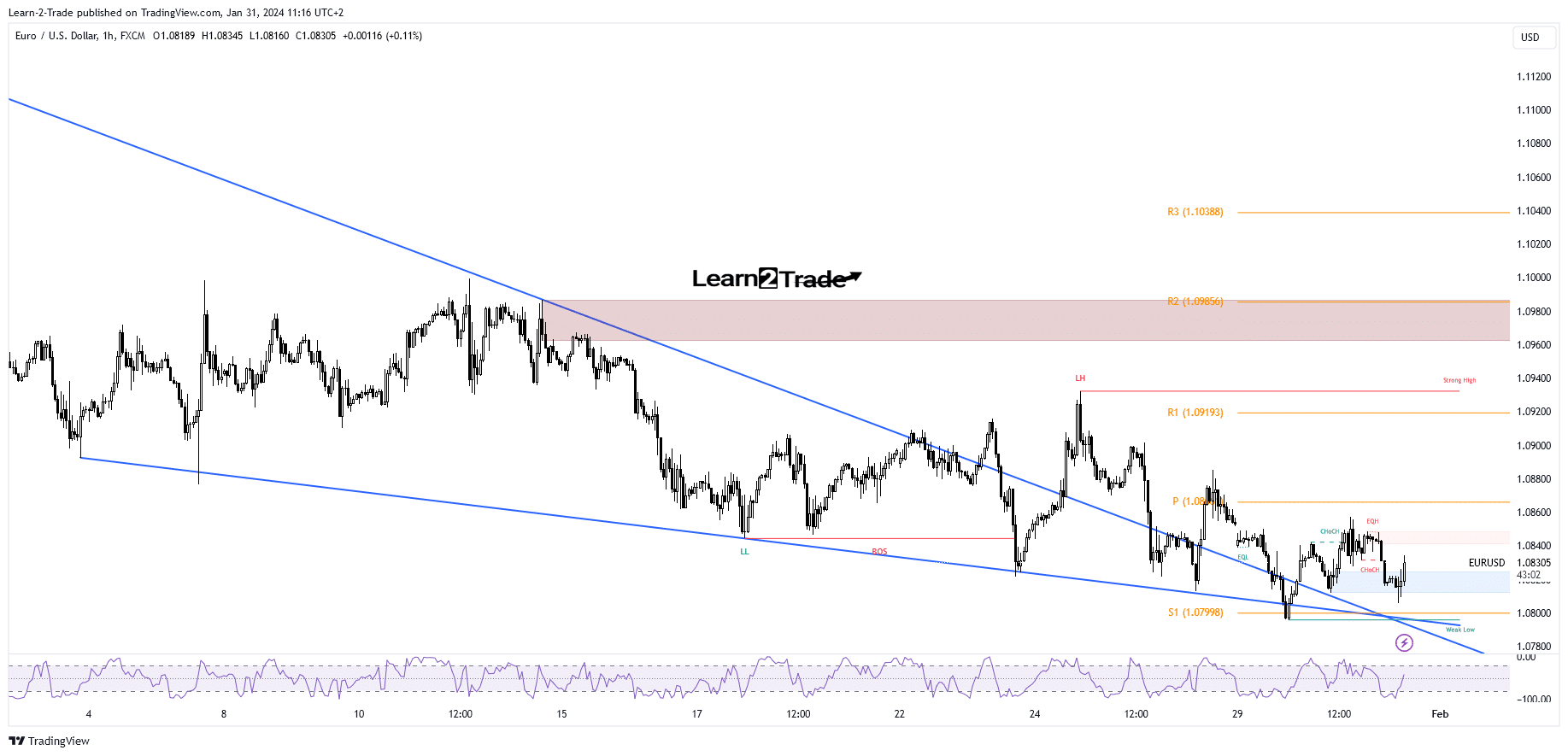

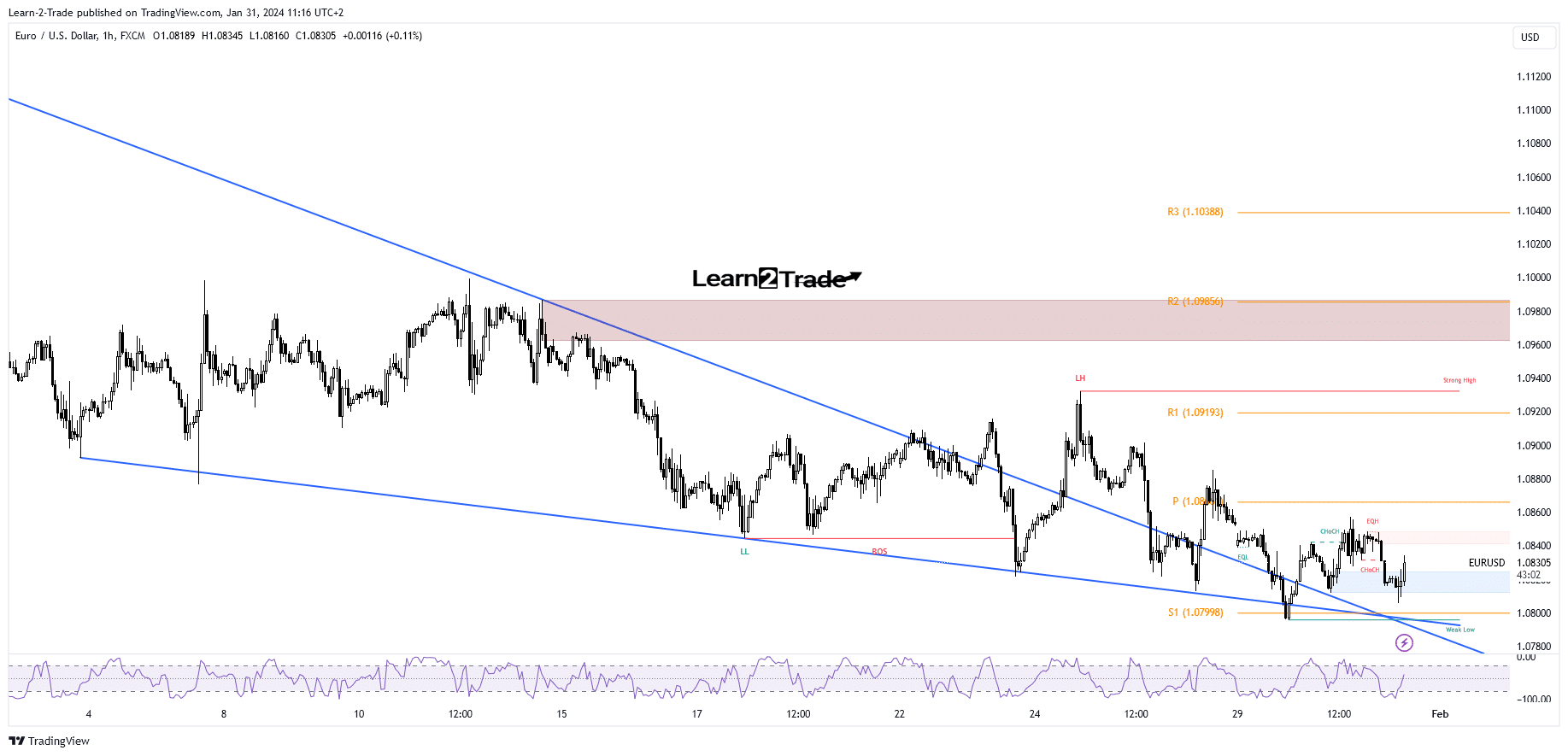

- An exit from the falling wedge pattern signaled a reversal of the EUR/USD price.

- The FOMC and US economic numbers should bring a lot of volatility.

- Only a new higher high triggers a higher jump.

EUR/USD fell to 1.0795 on Monday, where it once again encountered strong demand. Its failure to stay below the psychological level of 1.0800 shows the exhaustion of sellers.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

After such a drop, a return to the upside is very likely. However, the fundamentals remain the key drivers today. In the short term, the price fell slightly as CB US consumer confidence was reported at 114.8 points, above the expected 114.2 compared to 108.0 points in the previous reporting period. Meanwhile, JOLTS Job Openings reached 9.03 million, although traders were expecting a potential drop to 8.73 million.

The Federal Reserve is expected to keep the federal funds rate at 5.50%, but the FOMC press conference and FOMC statement may change the mood.

Furthermore, the US will release the ADP Non-Farm Employment Change which could fall from 164K to 148K, and the Employment Cost Index, which could see a 1.0% increase after a 1.1% increase in the previous reporting period. Also, the German Prelim CPI could also have an impact.

Technical analysis of EUR/USD price: A leg up

As you can see on the hourly chart, the EUR/USD price has jumped above the downtrend line signaling that the downtrend may be over.

A false break below the Falling Wedge support and through the weekly S1 at 1.0799 confirmed exhausted sellers.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

Now it tried again to retest the broken downtrend line before jumping higher. After the last jump, the exchange rate came back again to test the buyers again.

I think the EUR/USD pair could generate new momentum higher as long as it stays above the psychological level of 1.08. However, only a new higher high confirms the rebound of the limit.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money