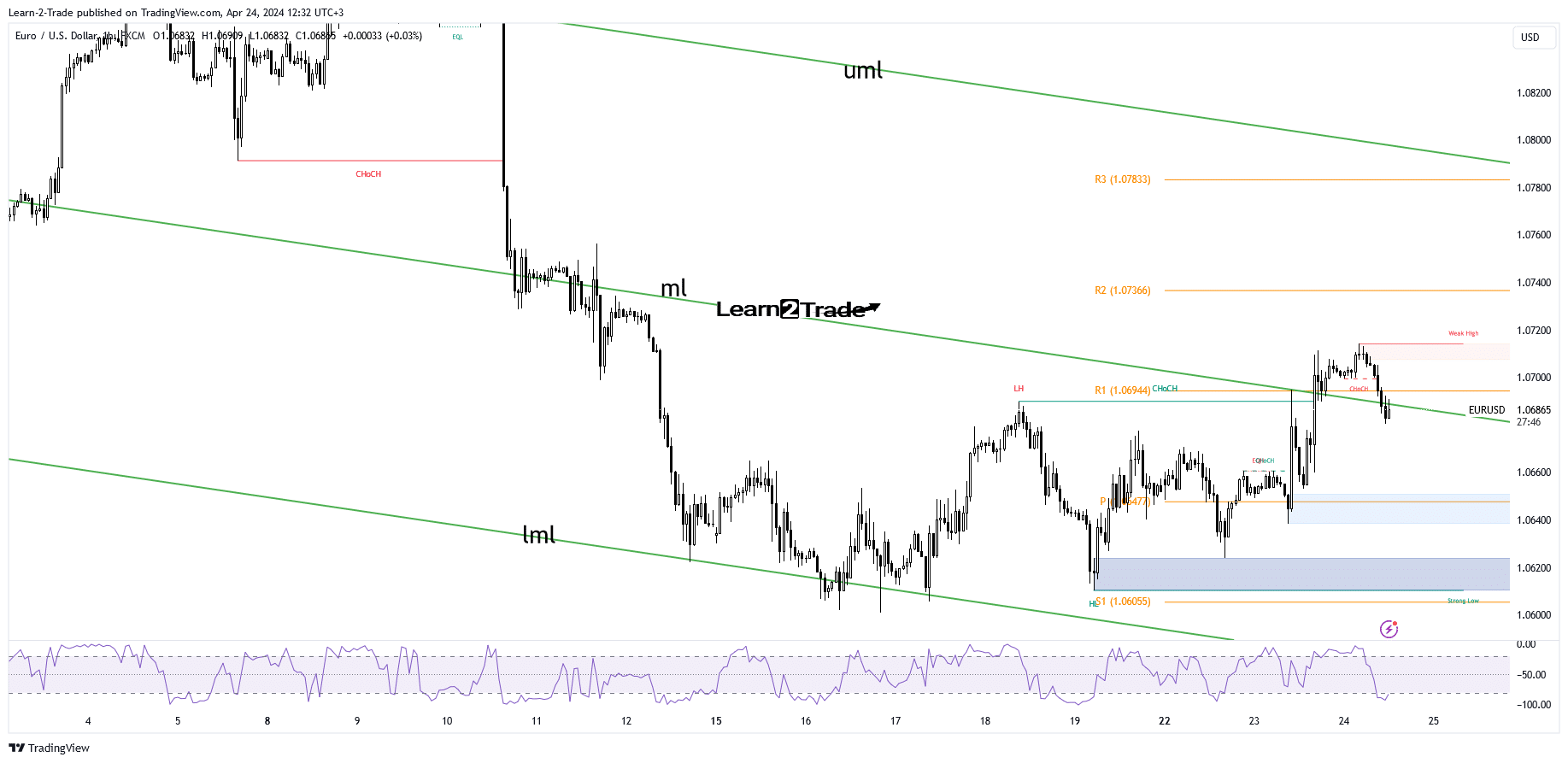

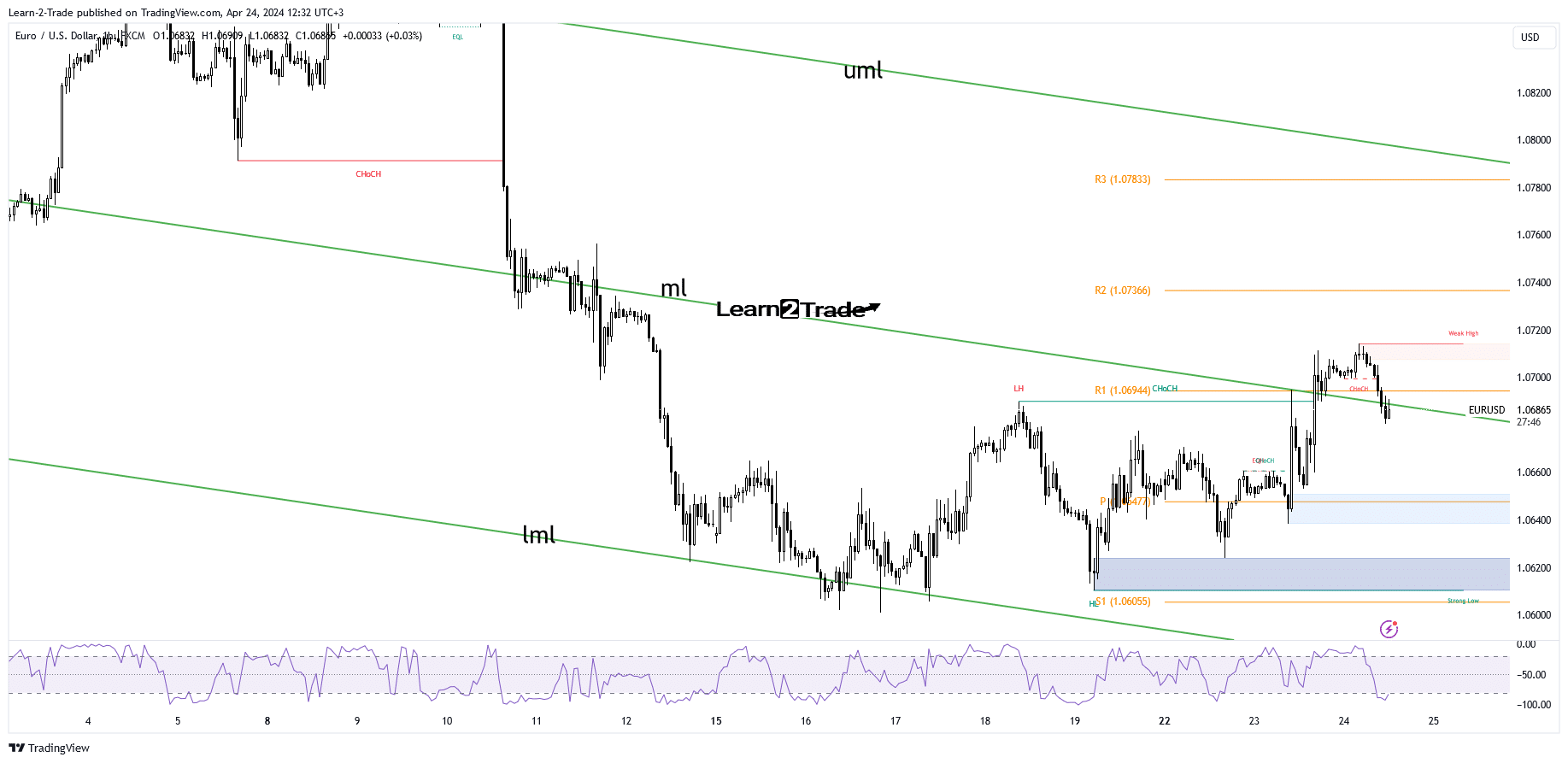

- Staying above the median line indicates further growth.

- US and Canadian figures should kick off the action later today.

- The EUR/USD pair is trying to confirm its breakout.

The EUR/USD price touched 1.0714 today, registering a new weekly high. However, the pair failed to stay above the psychological level of 1.07 and is now trading at 1.0686 at the time of writing.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

The US dollar recovered in the short term. As a result, the currency pair slipped lower. However, the dollar remains sluggish as the US Flash Services PMI fell from 51.7 points to 50.9 points, although traders were expecting a potential rise of 52.0 points, confirming a slowdown in expansion. Meanwhile, the Flash Manufacturing PMI unexpectedly fell from 51.9 to 49.9 points, heralding another contraction in the sector.

On the other hand, the eurozone, the French and German service sectors confirmed further expansion, so the euro strengthened. Today, the EUR received a helping hand from the German Ifo business climate and jumped from 87.8 points to 89.4 points, above the expected 88.9 points.

Later today, US durable goods orders are expected to report a 2.5% rise, compared with an estimated 1.3% rise, while durable goods orders could post a 0.3% rise for the second month in March.

Furthermore, Canadian retail sales could weigh on the dollar.

Technical analysis of EUR/USD price: Retraction of gains

Technically, the EUR/USD price rose after canceling a break below the weekly pivot point of 1.0647. It jumped above the median line of the descending villas (ml) and the R1 of 1.0694. These represented obstacles to the upside, and price attempted to confirm a breakout by retesting these levels.

-Are you looking for automated trading? Check out our detailed guide-

Staying above the midline may herald a continuation to the upside. On the contrary, a stabilization below this line may again signal a deeper decline towards the weekly pivot point of 1.0647.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money