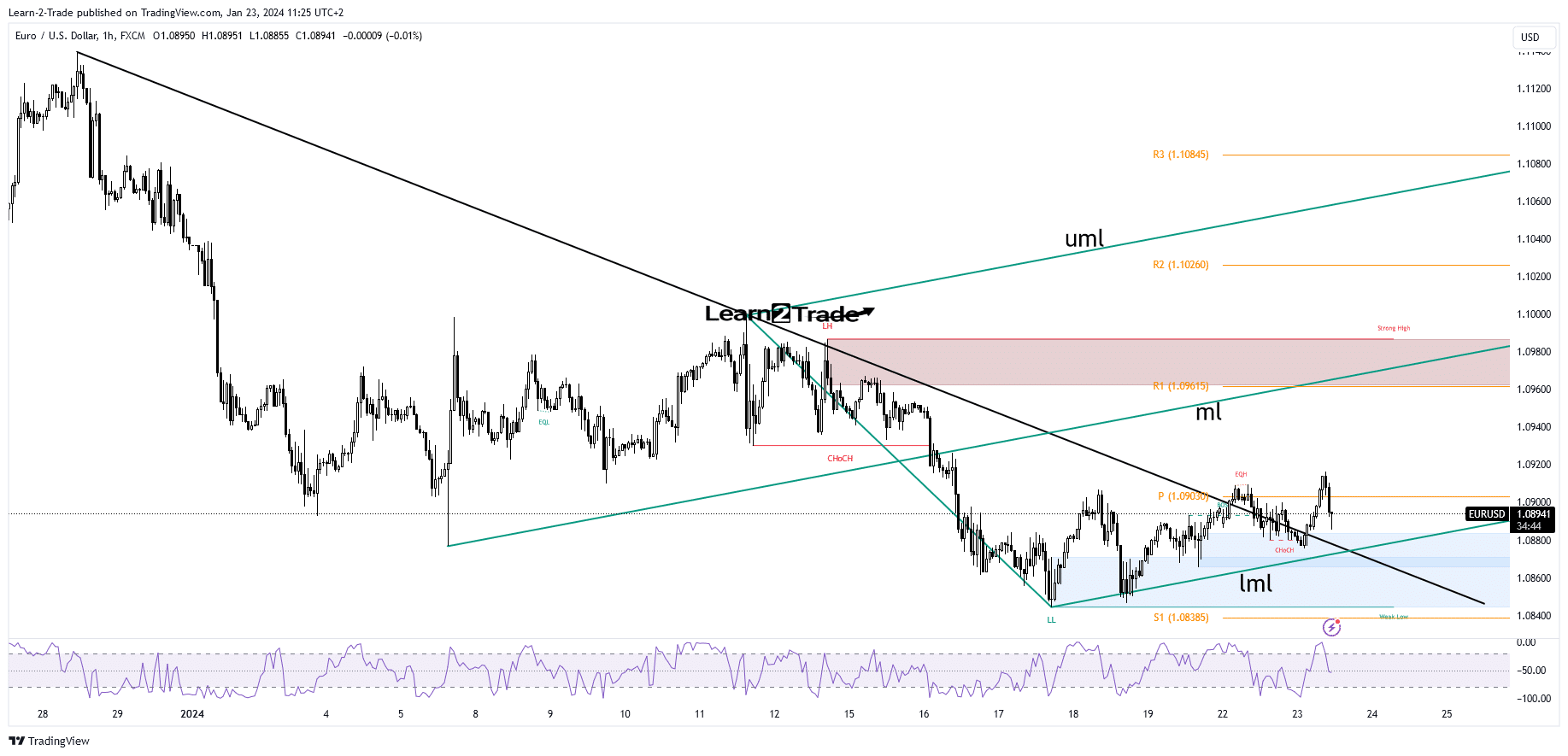

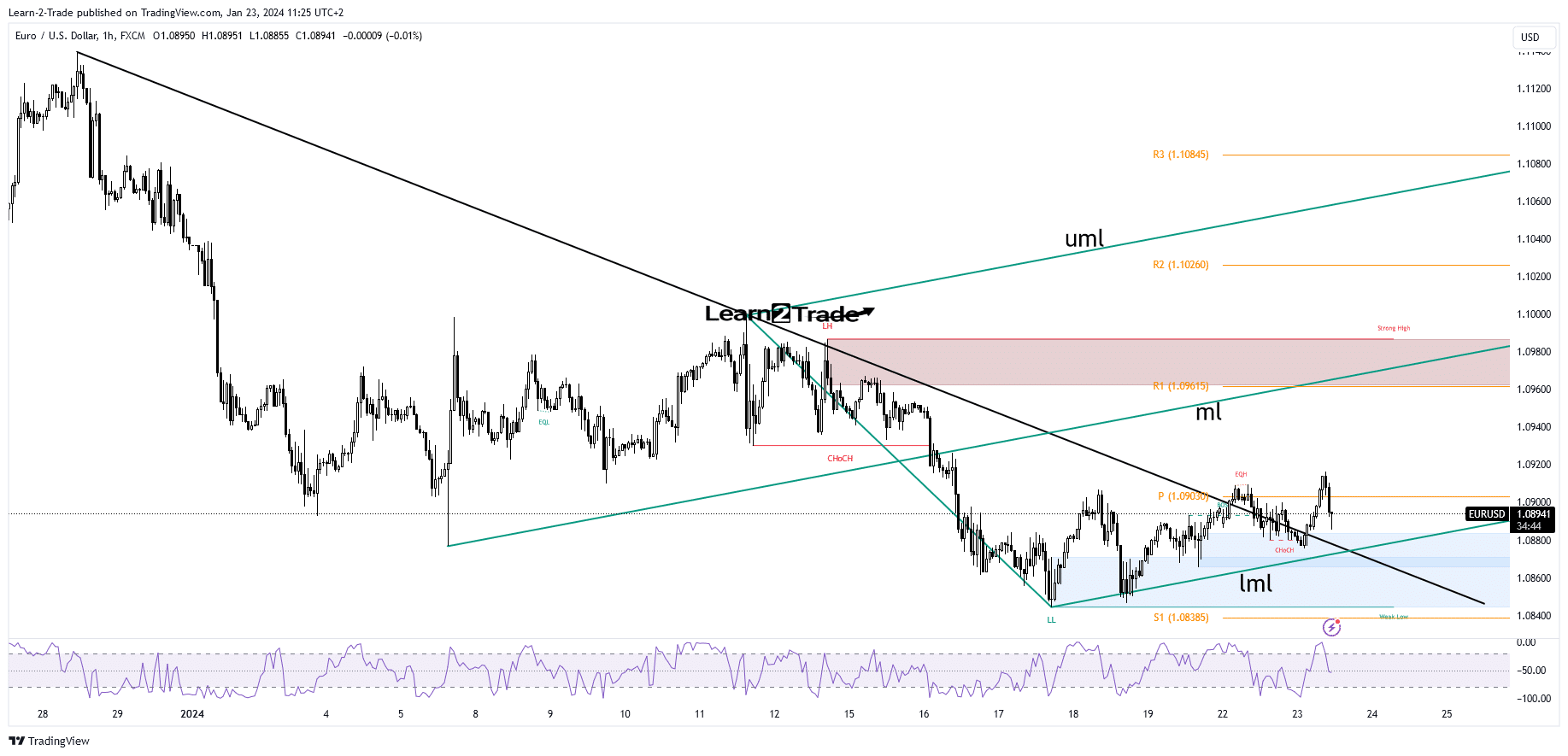

- The EUR/USD pair could jump higher if it stays above the lower median line.

- Eurozone and US data should move the rate tomorrow.

- Removing the lower middle line reverses the above scenario.

Today EUR/USD climbed to a new high near 1.0915. The pair fell slightly to 1.0870 as the US dollar regained strength.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

In the short-term, downside pressure remains high as the US dollar has shown signs of being overpriced despite positive US data of late. Yesterday, the CB Leading Index reported a 0.1% decline versus the 0.3% decline expected after a 0.5% decline in the previous reporting period.

Today, the BOJ maintained monetary policy as expected and had less impact on the EUR/USD pair. Consumer confidence in the Eurozone is expected to be -14 points compared to -15 points in the previous reporting period. In addition, the US will release the manufacturing index in Richmond, which could jump from -11 to -7 points.

Fundamentals should be decisive tomorrow, as the US and Eurozone release data on manufacturing and services.

Eurozone service and manufacturing sectors could remain in contraction territory. Also, the Bank of Canada is expected to keep the overnight rate at 5.00%.

Technical Analysis of the EUR/USD Price: Selling Bias

The EUR/USD pair confirmed its break through the downtrend line and jumped above the weekly pivot point of 1.0903, but failed to stay above it. Now he could test the zones of immediate demand again. The broken downtrend and the lower median lines (LML) are the key obstacles to the downside.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

The rate could rise to new highs if it stays above these lines. Technically, the price could be attracted by the middle line (ml). The upside scenario could be reversed if the price breaks the lower middle line (LML).

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.