- The bias remains bullish as the dollar index is bearish.

- A new higher high activates further growth.

- US CB consumer confidence should be decisive.

EUR/USD is trading in the green at 1.0948 at the time of writing. The pair is struggling to continue its rally as the US dollar remains bearish despite minor bounces.

–Are you interested in learning more about scalping brokers? Check out our detailed guide-

Yesterday, the dollar took a hit from the economic indicator of new home sales in the US which reached 679 thousand against the expected 724 thousand and compared to 719 thousand in the previous reporting period.

Today, the German Gfk Consumer Climate reached -27.8 points against the expected -28.2 points and above -28.3 points in the previous reporting period.

However, only economic data from the United States could change the mood in the short term. CB consumer confidence may fall from 102.6 to 101.0 points. This could be bad for the dollar.

Additionally, the Richmond Manufacturing Index is expected to be up 1 to 3 points in the previous reporting period, the HPI could post a 0.4% gain, while the S&P/CS Composite-20 HPI could post a 4.0% gain. The USD needs strong support from the US economy as bad data should weigh on the dollar.

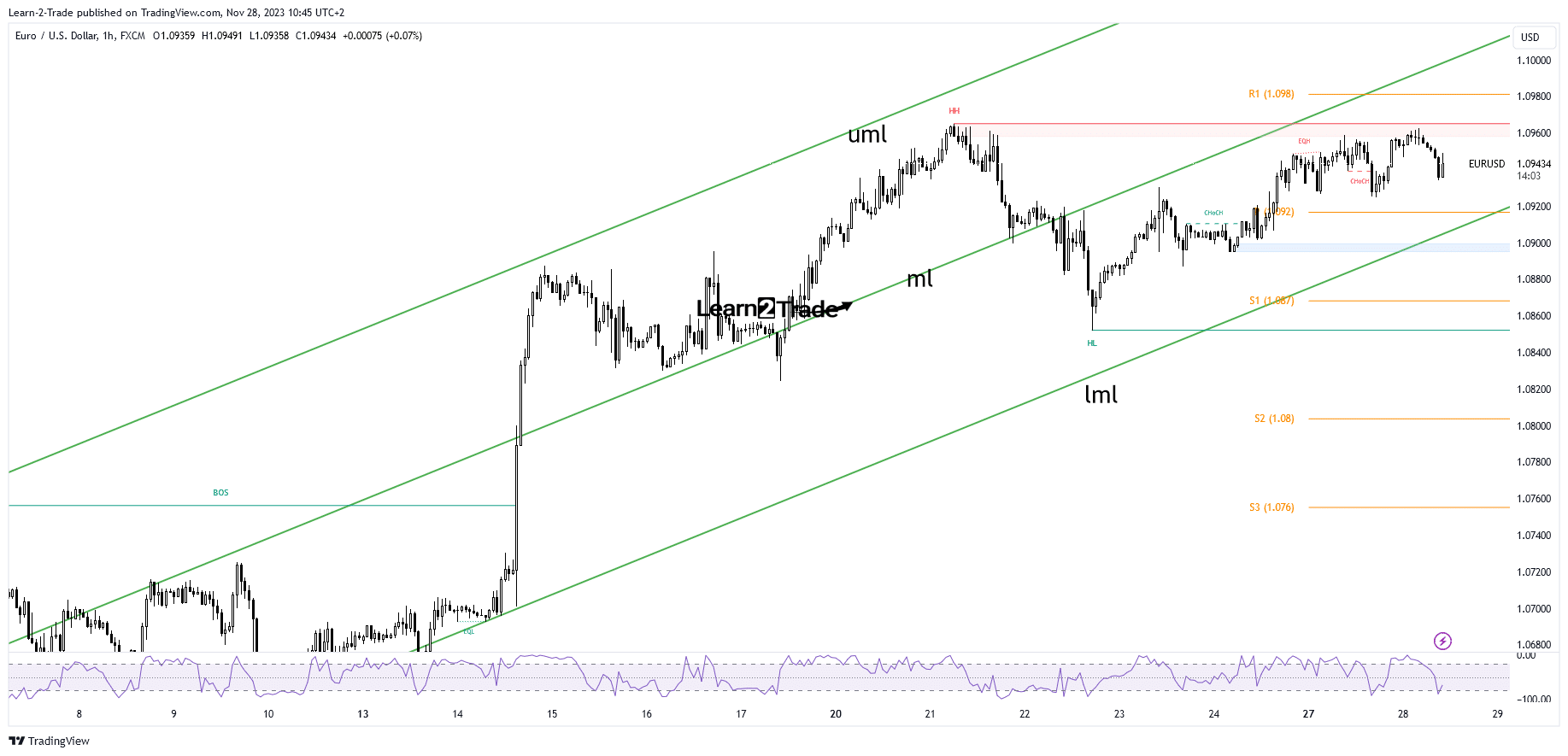

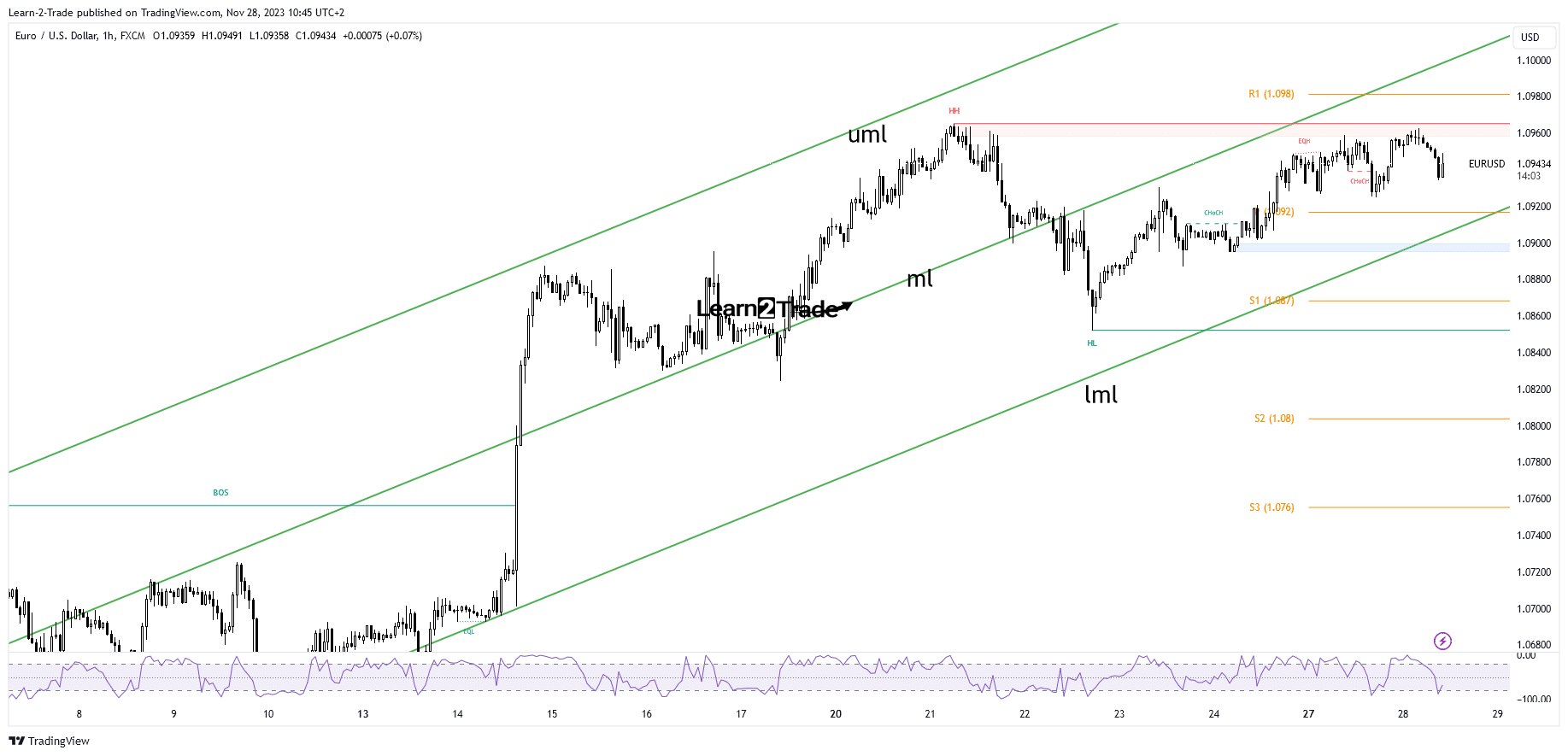

Technical analysis of EUR/USD price: Supply zone

From a technical point of view, the EUR/USD price jumped higher after breaking the corrective decline. However, it failed to reach the middle line (ml) which shows that buyers are exhausted.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Now the pair has reached a supply zone near the former high of 1.0965. It remains to be seen how they will react around this static resistance. A valid breakout (new higher high) may herald further growth towards the middle line (ml).

On the contrary, false breakouts through a resistance level can cause a reversal. However, it could trigger a significant decline only if the price falls below the lower middle line (lml).

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.