- EUR / USD Sunday forecast is slightly subordinate in the middle of risk aversion.

- The conflict in the feeding of Hawkish and the Middle East continues to be more difficult for risky assets.

- Tariff concern is installed as a deadline of 9. July rely large.

The EUR / USD Weekly Forecast remains slightly encouraged as a week closed with slight negative changes. The US dollar maintained the strength as the global risk aversion increased the Iranian-Israel conflict.

–Are you interested in learning more about the next cryptocurstical to explode? See our detailed guide-

The situation of the Middle East continues to deteriorate the sense of risk, weight on risk sensitive assets. Iranian regimen refused to give up the nuclear program while President Trump allowed two weeks that Iran reaches negotiations before a crucial American military action. Meanwhile, both countries continue bombing for more than eight days.

The federal reserve retained interest rates unchanged as planned, with a mild caress in a tone that surprised the market. So, Greenback has gained the country partly. The President Fed Powell noted that inflation remains above the goals and the risk of reaction is still in the midst of the Trump Tariff. However, he confirmed that the Central Bank would centure rates twice until the end of 2025. Years. Meanwhile, the next price is associated with cooling inflation and data on the labor market.

On the other hand, the European Central Bank meeting in the June first week discovered the end of the cycle mitigation after delivery of eight consecutive feet. The President of Lagard said they were well set and no longer reduced prices. Last week, various ECB officials hit the wires, and some wore an optimistic tone, while some showed concerns around the growth of the eurozone.

At the front tariffs, the final period from July 9. July continues to mitigate the global sense of risk. The US trading negotiations remain in the air, without evident progress. President Trump said Europe does not offer a fair deal. The situation with Japan and Canada is also the same. This means that the headings associated with the tariff will soon be dominated by markets.

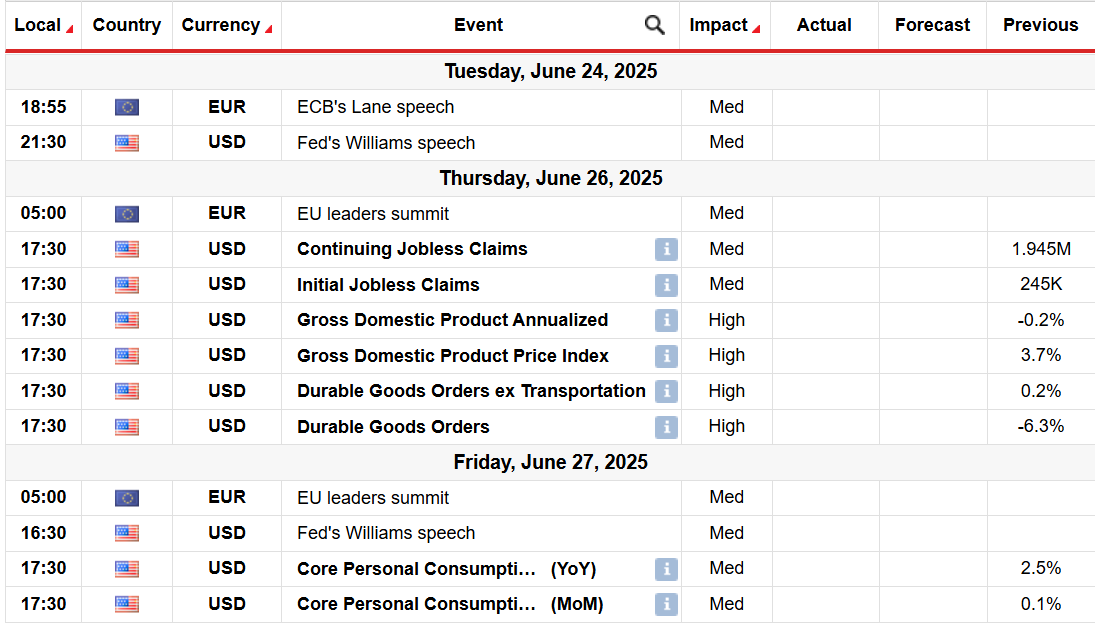

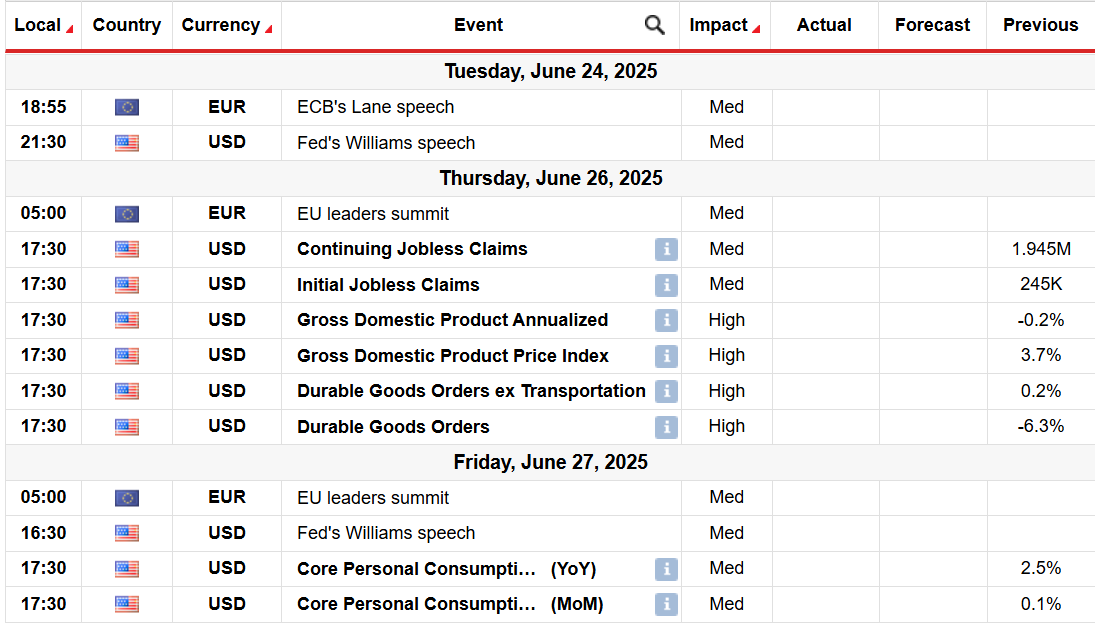

Key events for EUR / USD next week

Next week brings key data on both sides. PMI reading from the EU and the US are due next week. Moreover, American Core PCE, an important measurer for inflation also reaches Friday. Other main events include American GDP and lasting orders for goods.

In addition to these data, some speak from ECB and FED consistent and can provide an incentive for the market.

EUR / USD Sunday technique Technical forecast: Return within the Usttrend

EUR / USD Daily chart shows a mild return from multi-succumbent heights according to dynamic support of 20-day SMA. This support is strong enough for the Bikovski trend to be intact. Meanwhile, the RSI daily is also at the 59.0 level, suggesting upside down bias.

–Are you interested in learning more about forex indicators? See our detailed guide-

Alternatively, closing below the 20-day SMA can collect sales traction. The couple can go to 1,1450 per night of 1,1400. However, the path of the least resilience lies upside down.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.