- US consumer inflation report beat estimates.

- The PPI report on Friday confirmed that US inflation was higher than expected.

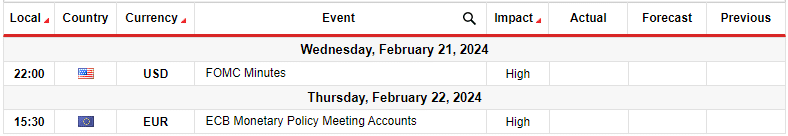

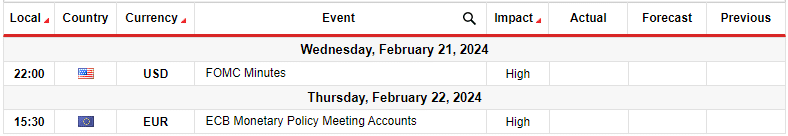

- Traders will review the meeting minutes from the last ECB and Fed meetings.

The EUR/USD weekly forecast is slightly bearish, as resilient inflationary pressures in the US are likely to keep the dollar strong.

EUR/USD ups and downs

The pair had a slight decline, well above the lowest level reached during the week. This shows that after the decline, the pair rose as the week ended. Notably, the dollar strengthened at the start of the week after the US consumer inflation report beat estimates.

–Are you interested in learning more about automated Forex trading? Check out our detailed guide-

While there was a lackluster retail sales report, Friday’s PPI report confirmed that US inflation was stronger than expected. Meanwhile, the euro rallied on hawkish comments from the ECB’s Francois Villereau. Francois said the sooner the central bank starts cutting rates, the better. This way, they can do it gradually.

Next week’s key events for EUR/USD

Next week, traders will get a chance to review the meeting minutes from the latest ECB and Fed meetings. This will provide clues as to what these major central banks might do next. In the past week, markets continued to adjust the outlook for monetary policy in the US and the Eurozone following incoming data and remarks from policymakers.

In the US, upbeat inflation data led to lower rate cut expectations. Meanwhile, there were mixed signals in the eurozone. ECB President Lagarde was against early cuts. On the other hand, François Villerois said it would be better to start earlier and gradually lower the rates.

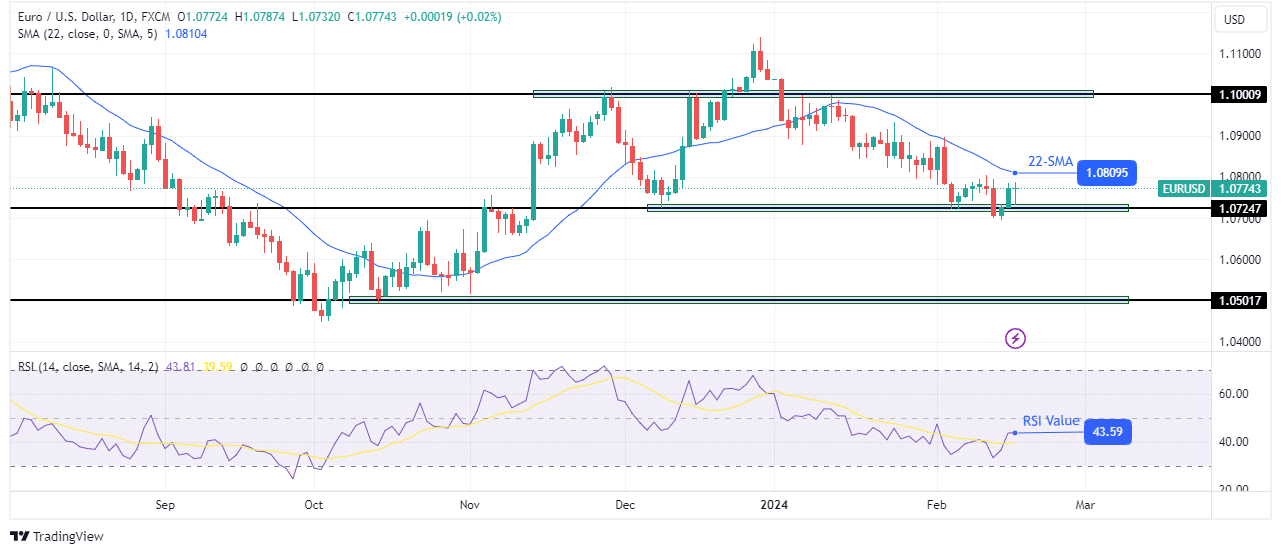

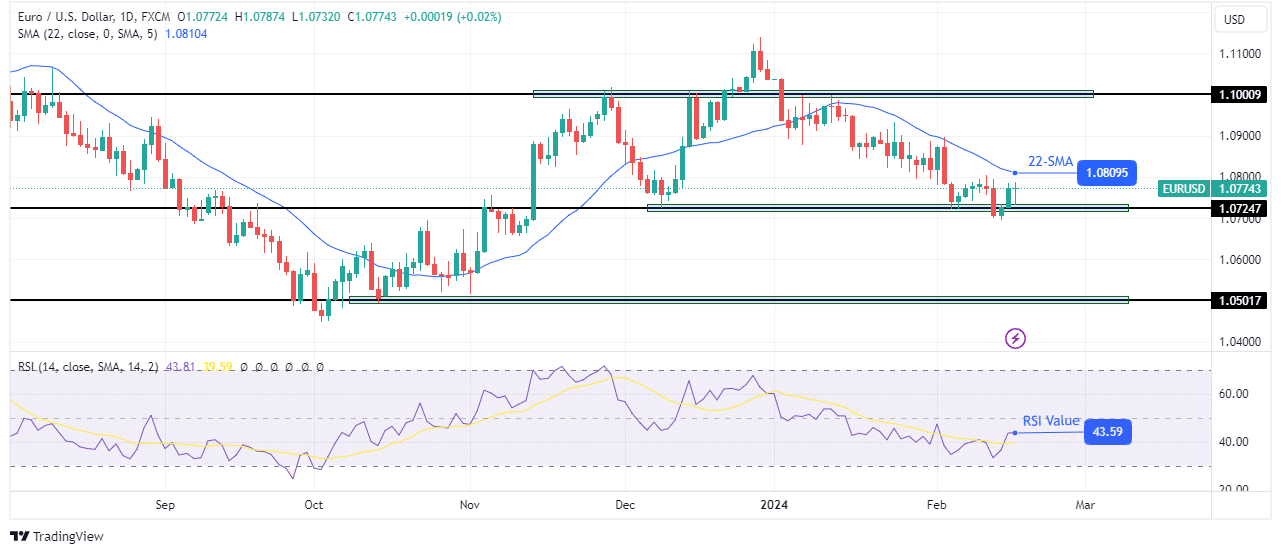

EUR/USD weekly technical forecast: Bears pause at 1.0724 support

On the technical side, the price declined and paused at the 1.0724 support level. The bias for EUR/USD on the daily chart is bearish as the price is below the 22-SMA and the RSI is below 50.

–Are you interested in learning more about forex signals? Check out our detailed guide-

The last time the price encountered support at 1.0724, it reversed, breaking above the SMA to make a higher high. Therefore, there is a chance that the bias will change if the bullish momentum strengthens at 1.0724. However, the RSI must go above 50 and the price above the SMA for the current move to reverse. Otherwise, the bears will break the 1.0724 support to retest the 1.0501 support.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.