- US jobless claims rose to 231,000 more than expected last week.

- Markets are predicting two Fed taperings in 2024, with the first likely in September.

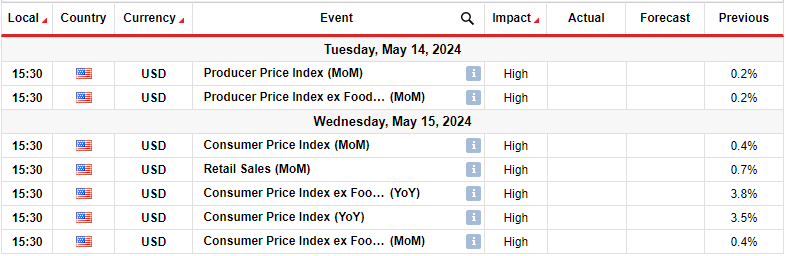

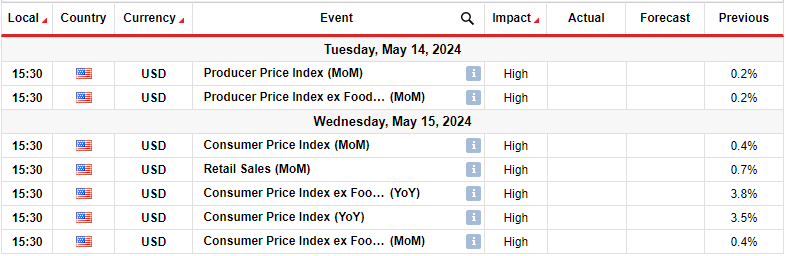

- Next week, the US will release its reports on wholesale and consumer inflation.

The EUR/USD weekly forecast points to more bullish momentum as easing US labor markets support Fed rate cut expectations.

EUR/USD ups and downs

The EUR/USD pair had a mildly bullish week characterized by dollar weakness. Investors continued to be cheated by the poor nonfarm payrolls report when the U.S. released weaker employment data.

–Are you interested in learning more about crypto robots? Check out our detailed guide-

Jobless claims rose to a more-than-expected 231,000 in the previous week, pointing to more cracks in the resilient labor market. As a result, expectations of a Fed rate cut have increased. Markets are now predicting two cuts in 2024, with the first likely in September.

Next week’s key events for EUR/USD

Next week, the US will release its reports on wholesale and consumer inflation. At the same time, investors will pay attention to the retail sales report. Inflation data will have a significant impact on the market as it will provide insight into the prospects for a Fed rate cut. There is a lot of anticipation for this particular report, as recent data from the country shows a slowing economy. Therefore, market participants are waiting to see if this will lead to lower inflation.

At the same time, data on retail sales will show the state of demand and consumer spending. A fall in sales would indicate further economic deterioration, allowing the Fed to begin cutting rates in September. However, if any of these reports come in higher than expected, investors will push back the timing of a Fed rate cut.

EUR/USD Weekly Technical Forecast: Bulls Challenge Strong Trendline Resistance

On the technical side, EUR/USD is trading above the 22-SMA. At the same time, the RSI is supporting bullish momentum as it trades above 50. However, while the sentiment is bullish, the larger trend remains bearish as price continues to make lower highs and lows.

–Are you interested in learning more about buying Dogecoin? Check out our detailed guide-

Moreover, although the price made a deep pullback, it respected its bearish trend line. At this point, the bulls are retesting the resistance trend line. If the resistance remains as firm as before, the price will drop below the 22-SMA to retest the 1.0601 support level. On the other hand, the bullish bias will strengthen if the price breaks the trend line and the 1.0850 resistance level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money