- The US economy remains resilient despite high interest rates.

- The data raised the likelihood of a gradual Fed rate cut cycle.

- Inflation in the Eurozone decreased from 2.6% to 2.2%, approaching the central bank’s target.

The EUR/USD weekly forecast shows more downside potential as easing euro zone inflation points to a more dovish ECB.

EUR/USD ups and downs

The EUR/USD pair had a bearish week, with the dollar strengthening while the euro weakened. Data during the week showed that the US economy remains resilient despite high interest rates. Consumer confidence rose, and the economy grew by 3.0%. Meanwhile, inflation remained stable at 0.2%. Consequently, this increased the likelihood of a gradual cycle of Fed rate cuts, boosting the dollar.

–Are you interested in learning more about day trading brokers? Check out our detailed guide-

Meanwhile, inflation in the eurozone eased from 2.6% to 2.2%, moving closer to the central bank’s target. As a result, investors are more confident that the European Central Bank will cut rates again in September.

Next week’s key events for EUR/USD

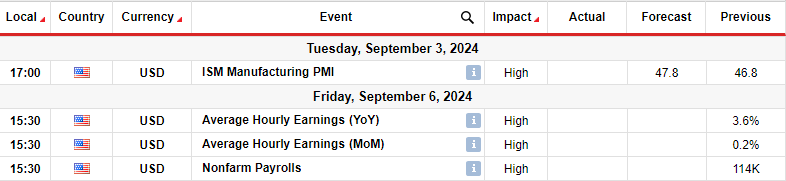

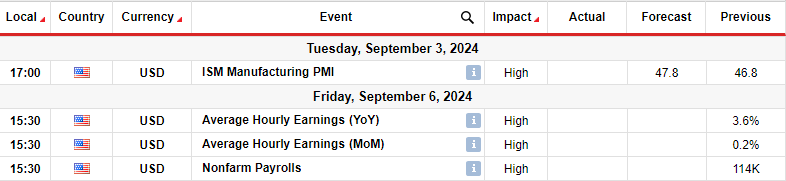

Next week, investors will focus on manufacturing activity data and the monthly US employment report. Notably, the manufacturing sector underperformed compared to the service sector, remaining in contraction. Economists expect a slight improvement from 46.8 to 47.8.

Meanwhile, the non-farm payrolls report will show the state of the labor market, a key sector of the US economy. The latest report showed major cracks as the unemployment rate jumped and job growth slowed. That raised fears of a looming recession and raised expectations of a Fed rate cut. Another such report could raise expectations of an aggressive Fed rate-cutting cycle, boosting the euro against the dollar.

EUR/USD Weekly Technical Forecast: Bulls give up on short pullback

On the technical side, the EUR/USD price is falling after reaching a new high near the critical level of 1.1200. However, it is still in a bullish trend, sitting above the 22-SMA with an RSI above 50. Therefore, although the bears have taken over, it could only be temporary.

–Are you interested in learning more about automated trading? Check out our detailed guide-

Price is approaching the 22-SMA support, where it could pause and bounce higher. However, the last time the bears retested the SMA, the price broke the line before the reversal. Consequently, this could happen again. If so, the price could find support at other levels, including the 0.5 Fib, 1.1001 support and the bullish trend line. However, if the price breaks below all these levels, it will indicate a new bearish trend.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.