- EUR / USD Weekly weather remains pressure on soft American data and increased expectations from reducing feedback rates in the middle of mitigation growth.

- The couple is located near 1,1750, with neutral RSI and SLAS indicating consolidation.

- The cooling momentum implies limited upside down, while constant pause is above 1,1800 can lead to potential gains.

EUR / USD pair has been evenly traded around 1,1750 last week. The couple received a mild bikar in the middle of repeated weaknesses of American dollars and stable data on the eurozone.

–Are you interested in learning more about automated forex trading? See our detailed guide-

Due to the constant shutdown of the American governments, with Fridays as a fifth day, the uncertainty of the investors deepened. Consequently, it has delayed crucial publication such as reports of nonfarm salary and increased concern about fiscal stability. The American dollar index (DKSI) contains close to 97.75, pointing out the vigilance of investors and rejection of trust in Greenback.

American economic data signaled the Waning Momentum. ISM services PMI fell 50 with 52, reflected stagnation in the growth of the service sector, while the employment index maintained a contraction at 47.2. At the same time, the price markets in the amount of the lower part in the upcoming meeting, the CME FedVatch tool reveals, how policies creators catch up with the slowing growth and fiscal disorders.

The side of the eurozone remains countless. The Composite PMI HCOB jumped at 51.2, highest than May, indicating moderate private sector activity. In September, inflation rose to 2.2%, slightly above 2% ECB goal, but within variable boundaries.

The President of the ECB Christine Lagarda confirmed the economic stability of the block, indicating the immediate shift of the policy. With fed favoring of good tone and ECB that support a neutral tone, the EUR / US residence supported by growth policy growth.

All in all, if the American political and fiscal insecurity continues, Euro can be accessed 1,1820-1.1850.

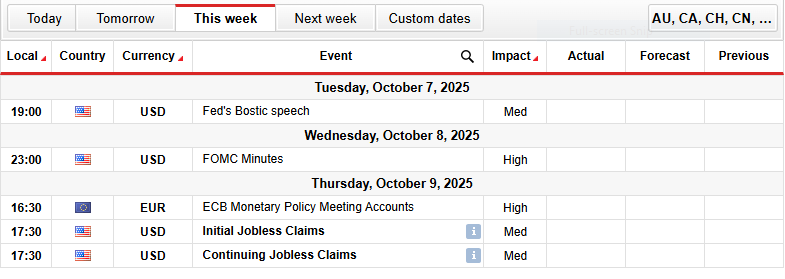

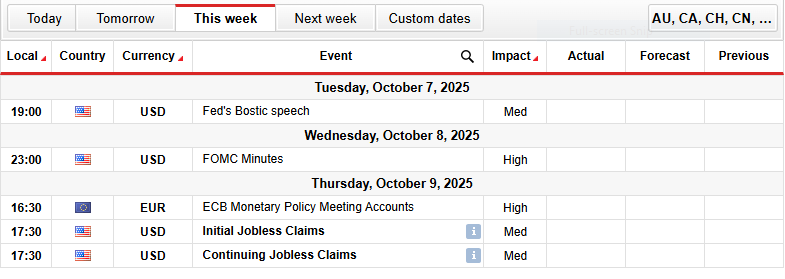

EUR / USD Key events next week

- Fed’s Bostic Speech (Tuesday).

- Minuters Fomc (Wednesday).

- ECB Monetary Meeting Policies (Thursday).

- Initial unemployment requirements (Thursday).

- Requirements for continuous unemployed (Thursday).

EUR / USD Sunday technical forecast: SMY SEE BEFORE SECTION

EUR / USD floats around the subordinate consolidation zone between 1,1700 and 1,1750, signals uncertainty before us the development of American dollars. The 50-day SMA on 1,1677 provides support, while 100-day SMA in 1,1616 and 200-day SMA at 1,113 remains, indicating that the longer-term trend remains bullass.

–Are you interested in learning more about forex signals? See our detailed guide-

RSI is close to 52, suggesting a neutral momentum with a directional interruption area. The permanent move above 1,1750 can press EUR / USD according to 1.1820-1.1880. In case of falls below 1,1670, sales can be renewed according to 1.1610.

He provided the EUR / USD above the 50-day SMA, the bias remains moderately fluctuating. However, the RSI flattened near middle range involves the momentum is softening and an explicit termination certificate before the next direction is required.

Looking for forex trading now? Invest in Ethorro!

67% of retail orders lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.