- Tensions between Russia and Ukraine escalated this week as the two countries exchanged missiles.

- Traders worried about Trump’s tariff proposals.

- Data on business activity in the Eurozone revealed a sharp slowdown in the economy.

The EUR/USD weekly forecast points south as traders fear a sharp downturn in the Eurozone economy and a looming ECB rate cut.

EUR/USD ups and downs

The EUR/USD pair had a bearish week amid geopolitical and trade tensions and poor economic data from the Eurozone. Tensions between Russia and Ukraine escalated this week as the two countries exchanged missiles. Moreover, Russia has threatened to use nuclear energy, raising fears of increased tensions that would hurt the Eurozone economy. As a result, the euro fell.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

At the same time, traders are worried about Trump’s tariff proposals, which could reduce demand for European cars. Consequently, the economy could deteriorate, which will affect the euro. Finally, markets raised the odds of a December ECB rate cut after data on business activity in the eurozone revealed a sharp slowdown in the economy.

Next week’s key events for EUR/USD

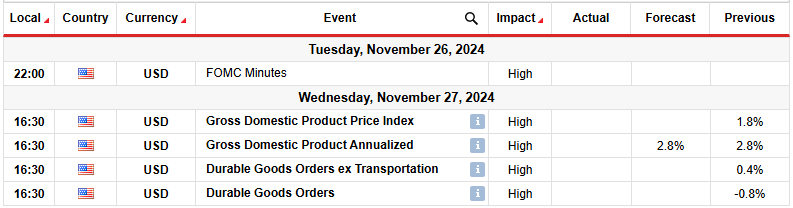

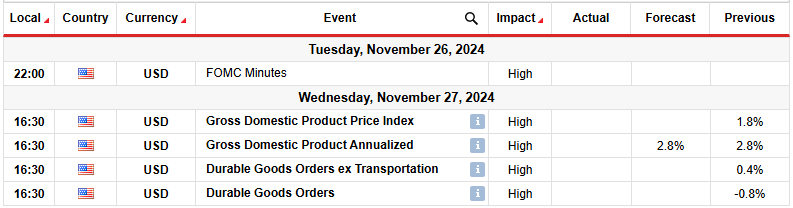

Next week, the US will release reports, including Fed minutes, GDP and durable goods orders. The core durable goods orders and GDP reports will show the health of the US economy. The upbeat numbers will show a resilient economy, reducing the likelihood of a rate cut in December. On the other hand, if the numbers are worse than expected, market participants will add bets for a December Fed rate cut.

Meanwhile, the minutes from the FOMC meeting will contain clues about the Fed’s future policy moves. Since the meeting took place after Trump won the US election, policymakers may have become more cautious. The cautious tone could reduce the likelihood of another rate cut this year.

EUR/USD Weekly Technical Forecast: Bearish sentiment builds below 1.0500

From the technical side, EUR/USD the price broke below the 1.0500 support level after a sharp decline from the 22-SMA resistance. Price reversed to the downside after making a double top and breaking below the SMA. The bulls tried to take control by breaking above the SMA. However, the price made a bearish candle that led to a rapid decline.

–Are you interested in learning more about forex broker scalping? Check out our detailed guide-

Meanwhile, the RSI is showing strong bearish momentum, which means the downtrend is likely to continue next week. Therefore, the bears could target the critical support level of 1.0301. The trend will reverse only when the price breaks above the 22-SMA resistance and the RSI starts trading above 50.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.