- The weekly forecast EUR / USD turned Bullash after feeding chair left good remarks in terms of speeding.

- The positive PMIS eurozone limited the flakes for the euro.

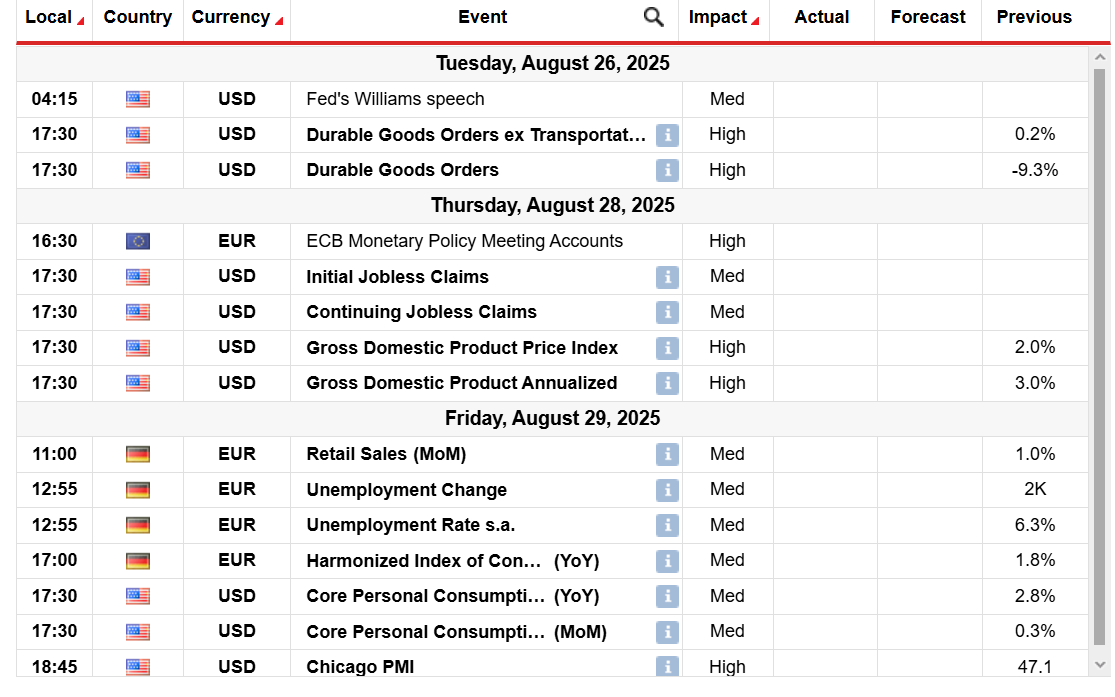

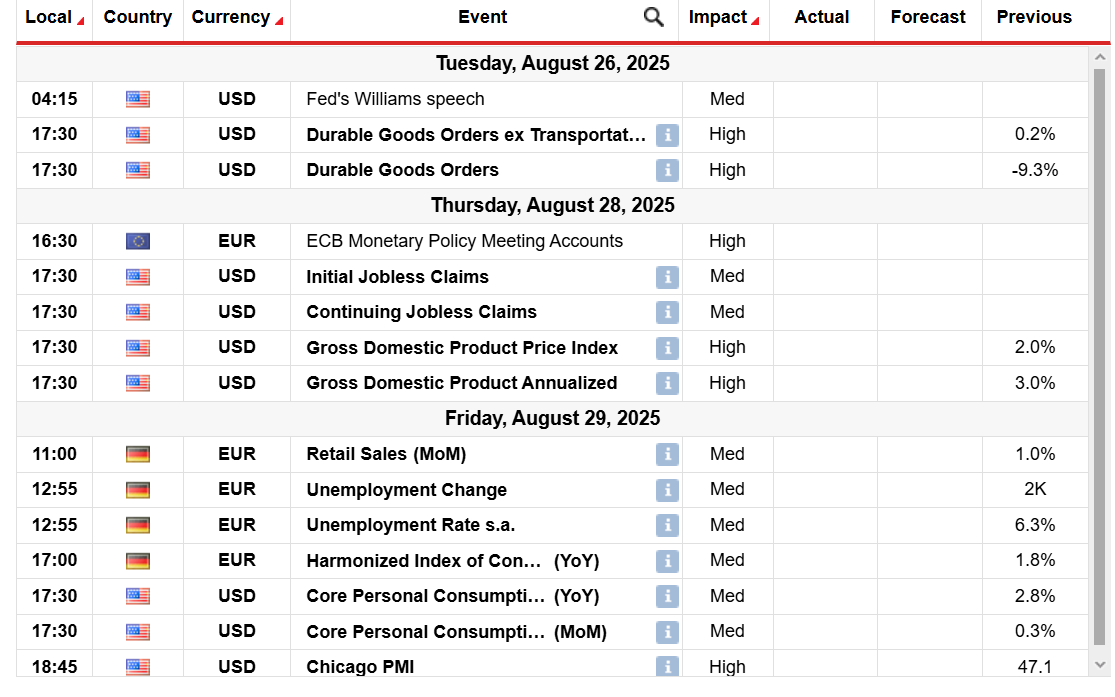

- Markets Macro publishing eyes and from the eurozone and the US next week.

The euro has completed a week with buying noise, and EUR / USD breaks through the level 1,1700 after the fall to 1,1583 during the week. The late rally came as a result of the steep fall of the American dollar after the Fed Store Powell delivered beef speeches in Jackson Hole. He confirmed the first cutting of the course in September and introduced a new policy of flexible target inflation. As traders began to prices in a new relief cycle, the swing in the dollar bursted, correcting it on a neutral country.

–Are you interested in learning more about crypto robots? See our detailed guide-

The European side of the story also helped the bulls. Flash PMI data in August indicated that the euro area economy received momentum, because the composite PMI 51.1 was highest in 15 months. The output in the production sector increased to a three-year peak, adding evidence of the gradual healing of the economy as a whole.

Inflation reading was held in accordance with anticipation, with a harmonized consumer price index (HICP) at 2 and the basic number to 2.3% showing a sense of stability. But Germany is again restraint on the appearance of how revised K2 GDP contracted 0.3%, and the prices of manufacturers were weak, underlining structural challenges in Europe.

The economic strength between the dollar was first seen at the antipodes and Asian front with weekly portable PMI figures, especially with the production of aromatization in the United States. The data initially supported Greenback, but the turn towards Powell dvarfed data and created a sharp turning in it. Markets are already prices in almost certain September, with more talks on additional relief later in the current year.

Forward, the main monitoring events are macro editions that can or to engage in this goodbye belief or to challenge them. In the USA, lasting orders of goods on Tuesday, K2 Revision of GDP on Thursday, and the July Core of the PCE index price on Friday are on the radar. SHORTE-A-A printing that the dollar will expand its losses and pressed EUR / USD larger, and in the other way, it is true in case of stronger data on expected data.

In Europe, Germany will be at the Center for August IFO, Business Climate Survey, July retail sale and preliminary HICP inflation. Positive German data would be an incentive for the euro, although additional softness will limit the gatherings. In addition, an indicator of economic feelings will also give a wider picture of recovery in the EU.

EUR / USD Sunday technique Technical forecast: Bull Eding 1,1800

The daily for EUR / USD shows the bias of the bakery because the price broke above the estuary of 20- and 50-day ma near 1.1650. The couple marked Highs near 1,1745, where he saw a slightly taking profit. If phenomena appears, a couple must find acceptance above resistance 1,1750. The next key level appears at 1,1800.

–Are you interested in learning more about Dogeco’s purchase? See our detailed guide-

On the side, 100-day mais near 1.1483 indicates key support for a pair of forwards from 1,1400 (round number). However, the daily RSI was sharply moved above level 50.0, suggesting the way of the least resilience lies upside down.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.