- The US PPI and CPI reports confirmed that inflation is on a consistent path towards the 2% target.

- US retail sales jumped and jobless claims fell.

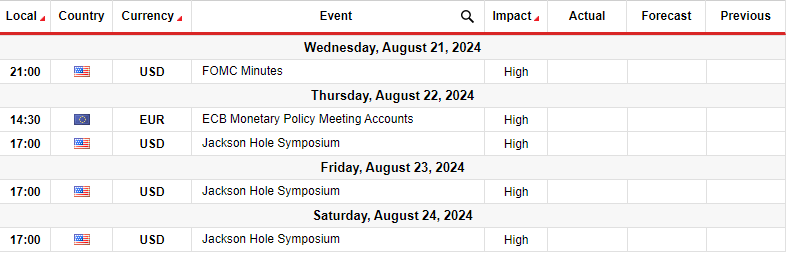

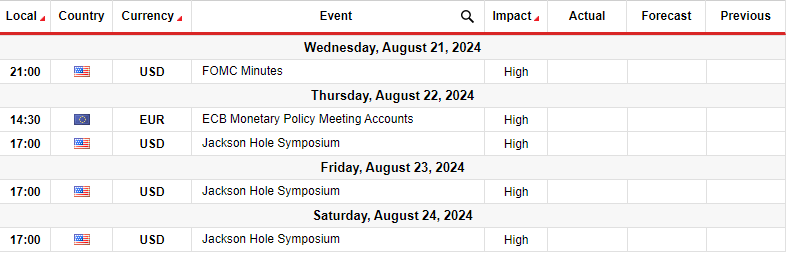

- Next week, investors will be closely scrutinizing the minutes from the Fed and ECB policy meeting.

The EUR/USD weekly forecast shows solid bullish momentum as US inflation data suggests a rate cut by the Fed at its September meeting.

EUR/USD ups and downs

The EUR/USD pair ended the week higher as the euro rose amid dollar weakness. The dollar had a tough week as data raised the likelihood of a 25 bps Fed rate cut in September. The US PPI and CPI reports confirmed that inflation is on a consistent path towards the 2% target. Therefore, traders are more confident that the Fed will start reducing borrowing costs. This attitude continued to put pressure on the US dollar, boosting the euro.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

Meanwhile, the economy painted a mixed picture. Last week there were fears of a recession. However, retail sales jumped this week and jobless claims fell, pointing to a resilient economy.

Next week’s key events for EUR/USD

Next week, investors will closely scrutinize the minutes from the meetings of the European Central Bank and the Federal Reserve. In addition, Fed Chairman Powell will speak at the Jackson Hole Symposium. Minutes from the policy meeting will contain clues about the outlook for ECB and Fed rate cuts.

While the ECB has started to reduce borrowing costs, markets are expecting the Fed’s first tapering in September. Similarly, economists expect the ECB’s next rate cut in September. However, inflation in the Eurozone has stalled, while it is easing in the US. Therefore, there is a good chance that Fed policymakers will be more dovish than ECB officials.

When Powell speaks next week, he could hint at the future, which could lead to major volatility in the US dollar.

EUR/USD Weekly Technical Forecast: Bulls retest uptrend channel support

On the technical side, the EUR/USD price is trading in a bullish channel and has retested the channel resistance. Furthermore, it is trading above the 22-SMA with the RSI almost overbought, supporting the bullish bias. Bulls moved sharply from support at 1.0800 towards channel resistance.

-If you are interested in Forex day trading, please read our getting started guide-

Price could move back to the 22-SMA or channel support line from here. However, the next target is at the 1.1051 level as the direction is up. The uptrend will continue as long as the price continues to make more highs and lows.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.