- The euro strengthened on optimistic data on business activity in the Eurozone.

- The dollar was weak as business activity in the US fell more than expected.

- The core PCE price index was in line with expectations, holding 0.3%.

The EUR/USD weekly forecast is slightly bullish as the dollar faces pressure from weakening economic indicators.

EUR/USD ups and downs

The week was bullish for the EUR/USD pair as the euro strengthened on upbeat data on business activity in the Eurozone. Still, policymakers remain confident the ECB will implement its first rate cut in June.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

Meanwhile, the dollar was weak as business activity in the US fell more than expected. Moreover, data on gross domestic product missed forecasts, indicating a slowdown in the economy. Despite this, inflation data remained high, leading to lower rate cut expectations. The week ended with the core price index PCE, which was in line with expectations, holding 0.3%.

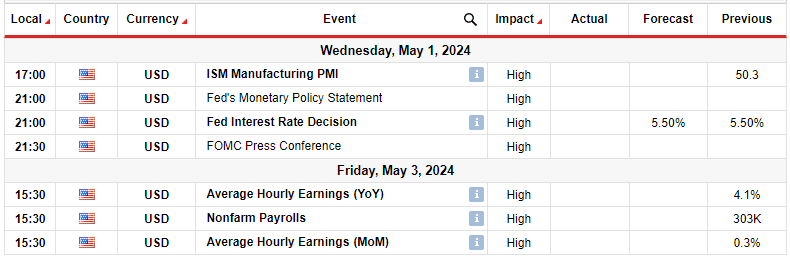

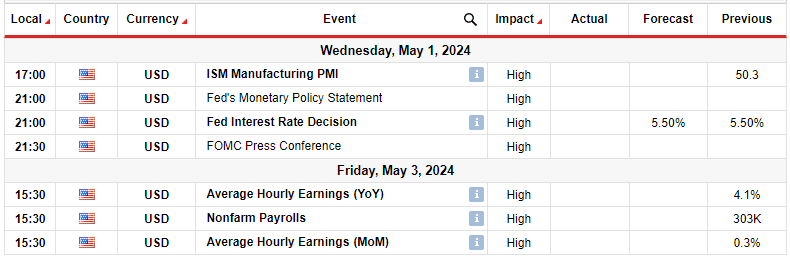

Next week’s key events for EUR/USD

Next week, the US will have three key events: the FOMC policy meeting, the ISM manufacturing PMI and the NFP report. All of this will go a long way in shaping the outlook for a Fed rate cut.

At the Fed meeting, markets expect the central bank to hold rates at 5.50%. However, more emphasis will be placed on what policymakers say about the future, especially inflation. The hawkish guidance could lead to lower expectations of a rate cut, which would send the EUR/USD pair lower.

Similarly, investors will look to the non-farm payrolls report for policy guidance. The last few months have shown solid demand in the labor market, delaying Fed rate cuts. Another upbeat report could push back the timing of the first rate cut to November.

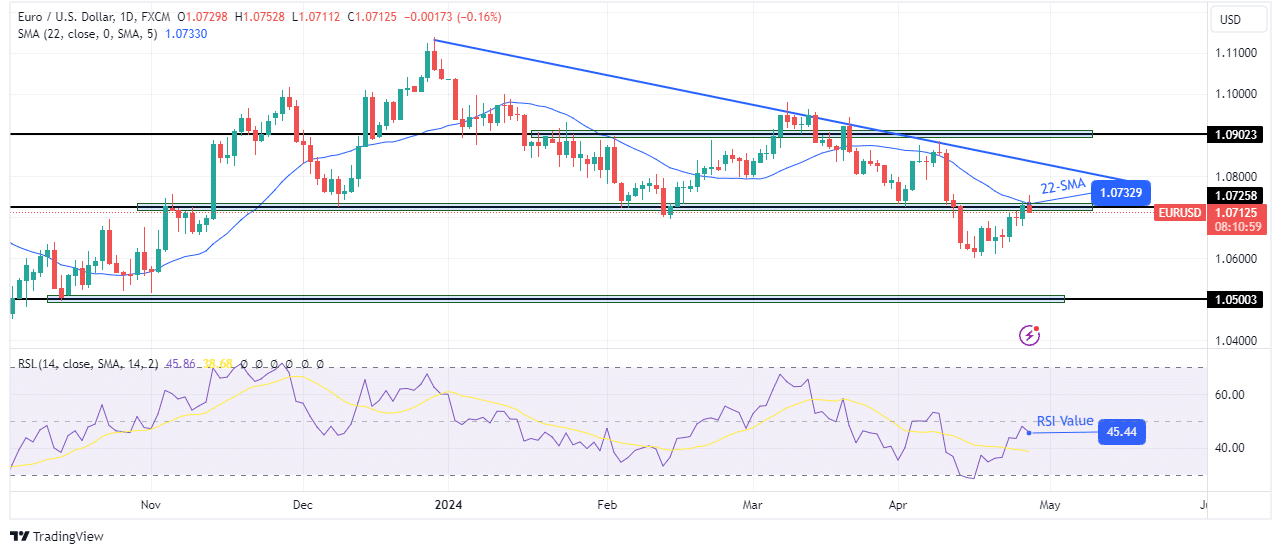

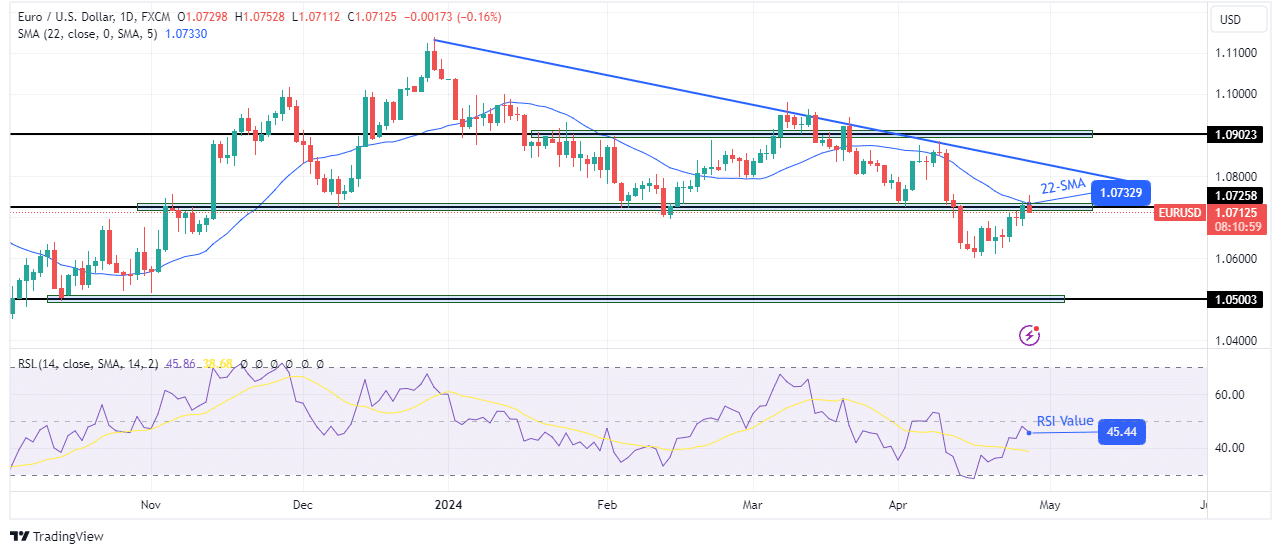

EUR/USD weekly technical forecast: Bearish around 1.0500 as pullback meets resistance

On the technical side, the EUR/USD price is trading near the key resistance level of 1.0725 and the 22-SMA line. Price retests this level after breaking below to make a new low.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

It is noticeable that the bias is bearish as the price has made a series of lower lows and highs. At the same time, it respected the bearish trend line and the 22-SMA as resistance. Therefore, chances are high that this trend will continue next week.

The price could bounce lower to retest the key support level of 1.0500. Furthermore, if it breaks above the SMA, then it will encounter trendline resistance, which is likely to reverse it lower.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.