- The weekly forecast EUR / USD shows the migration of investors from American property.

- Market volatility was recorded after Trump implemented reciprocal tariffs.

- The data was discovered weaker than the American consumer and wholesale inflation and wholesale.

EUR / USD Sunday forecast was strongly until investors start crossing from American property, supporting the euro.

UPS and Devices EUR / USD

EUR / USD pair had a bicole as a dollar failed in the middle of economic uncertainty. Meanwhile, the euro gathered together with secure currencies in a single like Jen. Market Volubility was recorded after Trump implemented reciprocal tariffs on Wednesday. The movement caused panic as investors concerned about the global economy.

– Are you interested in learning about forex indicators? Click here for detail-

However, the dollar briefly jumped when Trump paused these tariffs in most countries. However, the furious trading wars between China and the US kept the lid on the winnings. Meanwhile, the euro gathered.

In addition, the data was detected weaker than us consumers and wholesale inflation and wholesale. As a result, expectations on the schedule at the supply rates increased further weighing on the dollar.

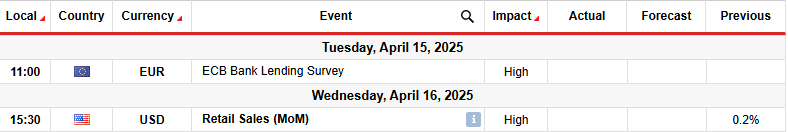

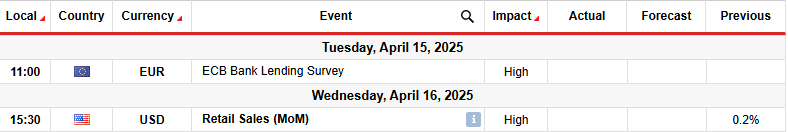

Key events next week for EUR / USD

Next week market participants will focus on the US sales report. The report will display consumer consumption and shape Outlook to reduce the rates of the feedback rates. In the previous month, sales increased by 0.2%. In March, economists predicted a significant increase of 1.4%. Sale of softer than expected importance will signal the weaker demand, exercise for feeding to reduce interest rates.

At the same time, the European Central Bank will hold a policy meeting on Thursday. Economists expect the Central Bank to reduce 25-BPS rates.

EUR / USD Sunday technique Technical forecast: Book piercing key 1.1204 Resistance

On the technical side EUR / USD The price had a strong running bull, pushing the price by the level of resilience at 1,1204. Rally also put the price far above the 22nd, showing that the bulls have a strong lead. Meanwhile, the RSI entered the region with excessive offspring, indicating a solid molbar momentum.

–Are you interested in learning more about the Review of the British Trade Platform? See our detailed guide-

The bulls took responsibility when the previous trend paused near the level of support from 1,0201. After picking, they kept the price above the 22nd, respecting it as strong support. The price made a series of larger high and lowest falls, showing a developed bakery trend.

Given the solid bias, the price could soon reach the key level 1,1603. However, after such a steep momentum of SMA, the bulls may need to rest. Therefore EUR / USD can be pulled to reset recently broken level 1,1204 before climbing more.

Looking for forex trading now? Invest in Ethorro!

75% of accounts in retail loses money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.