- The euro is weak in the middle of French political turmoil while reviving the appeal of the dollar-Haven.

- The euro regained temporary strength after the French political conditions had facilitated, but sentimental was maintained by bear bias in the middle of weak eurozone data and divided Fed Outlook.

- Traders are looking forward to the consumer price index and a harmonized consumer price index at the market direction.

The weekly forecast EUR / USD remains softer due to political and political turbulence during the week. The couple fell to two-month lowest part around 1,1540 before a modest jump over 1,1600.

–Are you interested in learning more about Forex Conventions? See our detailed guide-

The US dollar is reinforced at the beginning of the week as a global sense of risk weakened. Persistent shutdown of the American government, unresolved budget negotiations in Congress and Fresh friction Freshly with cinema revive risk aversion and demand for a safe dollar. Meanwhile, the euro faced pressure due to political instability in France due to the resignation of Prime Minister Sebastien Lecornu.

In addition, the constant shutdown resulted in limited American economic data. Investors focused on September meetings of federal reserves, which proposed a divided board at a further decrease in the rate. Due to the increase in the work market concern, this year the thin most struck two more courses of the course this year. Meanwhile, Trump hinted at a massive tariff at Chinese goods later this week, which care for monetary expectations, which led to capital sale and moderate return dollar.

From the eurozone, mixed economic data and deterioration of trust limited the recovery of the euro. The decline in German factory orders and industrial production underlines concerns about poor regional growth. Meanwhile, the president of the ECB Christine Lagard emphasized that the achieved disinfulations and politics were achieved in a good place.

Late the week, the euro shortened modestly, because Emmanuel Macron re-written Sebastian Lecorn. The decision facilitated French political tensions while the dollar softened in the middle of which he invented an appetite that risks. All in all, the pair remains sensitive to political and political developments in Europe and the United States.

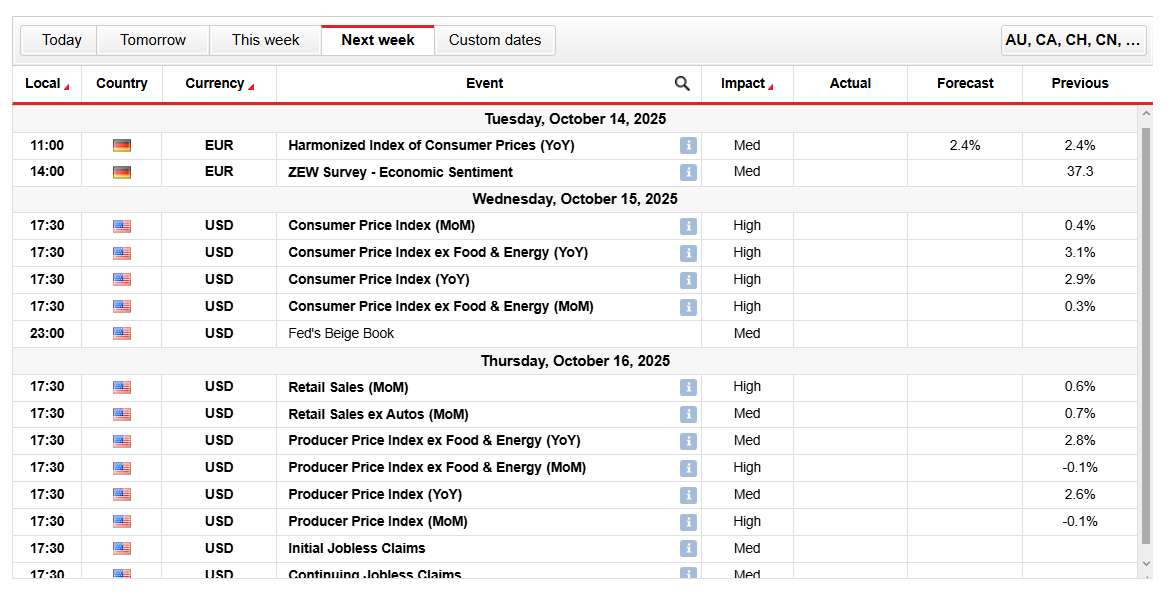

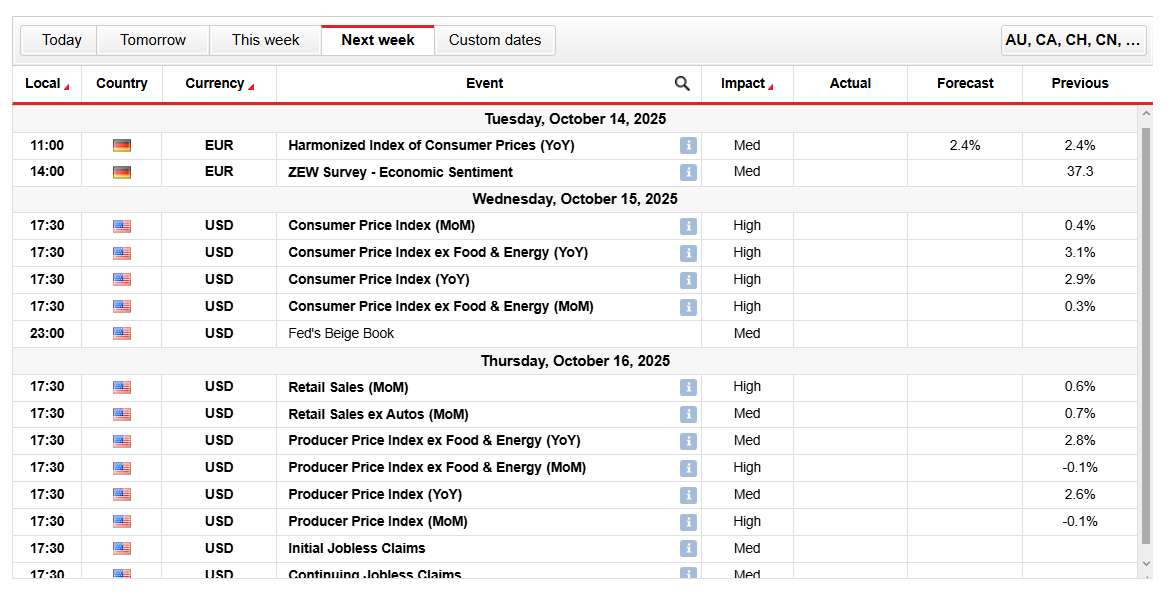

EUR / USD Key events next week

Market volatility could increase with key eurozone and American data releases in the next week. Euro traders will carefully monitor Germany HICP and ZEV feel. USA, Consumer Price Index, Producer price index and retail sales could lead to inflation and policy expectations. Meanwhile, the Fed Beige The Book could end the odds of hitting feet and overall sense of risk.

EUR / USD Sunday technical forecast: Pressure remains below 1,1700

EUR / USD Sunday technical forecast shows that the couple was found a short relief after moving to 1,1550 support, and then a modest jump to 1,1620. However, a couple signaling for a moment, there is also below 50- and 100-day mass that still limits recovery attempts. The overall structure favors the snowflake, with a 200-year-old about 1,1220, which could be a medium-term target for sellers. Meanwhile, the immediate resilience is 1,1630, 1,1690 and 1,1725.

–Are you more interested in learning more about Etherum price forecasting? See our detailed guide-

The RSI was also moved near the 47, moved on the territory covered. Proposes a temporary corrective bounce before renewed sales. If not held above 1,1600, it could strengthen the bear bias according to 1.1500-1.1450. In contrast, the extended move above 1,1700 can switch feelings for a neutral or bullish perspective. The pair remains vulnerable as long as it remains below the keys of the average moving average.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.