- A modest increase in the activity of the service sector neutralized the contraction in production.

- The dollar is set for its weakest monthly performance of the year.

- The data confirmed a contraction of the German economy of 0.1% in the third quarter.

The EUR/USD outlook paints a bullish picture at the start of the new week, with the Euro holding steady, building on momentum from Friday’s bounce amid a weaker dollar. The dollar’s decline followed a mixed PMI report, creating an upbeat landscape for the euro against the dollar.

–Are you interested in learning more about scalping brokers? Check out our detailed guide-

In particular, S&P Global reported a modest increase in activity in the services sector, offsetting the contraction in manufacturing. However, the survey’s employment index fell to 49.7 in the first contraction since June 2020, from 51.3 in October. Accordingly, the dollar was weak on Friday.

Moreover, the dollar is set for its weakest monthly performance of the year. Due to rising expectations, the Fed has finished raising interest rates and could start cutting them next year.

Separately, data on Friday confirmed a 0.1 percent contraction in the German economy in the third quarter. Ruth Brand, president of the statistics office, noted: “The German economy started the second half of the year with a slight decline in performance. Moreover, facing challenges such as high energy costs and higher interest rates, Germany has been one of the weakest European economies this year.

In addition, the Bundesbank’s monthly economic report predicts a likely contraction in the German economy in Q4. However, there could be a slight improvement early next year. Meanwhile, German business morale improved in November.

EUR/USD key events today

- New US Home Sales Report

- US Building Permit Report

Technical outlook for EUR/USD: Bearish divergence indicates a potential price decline

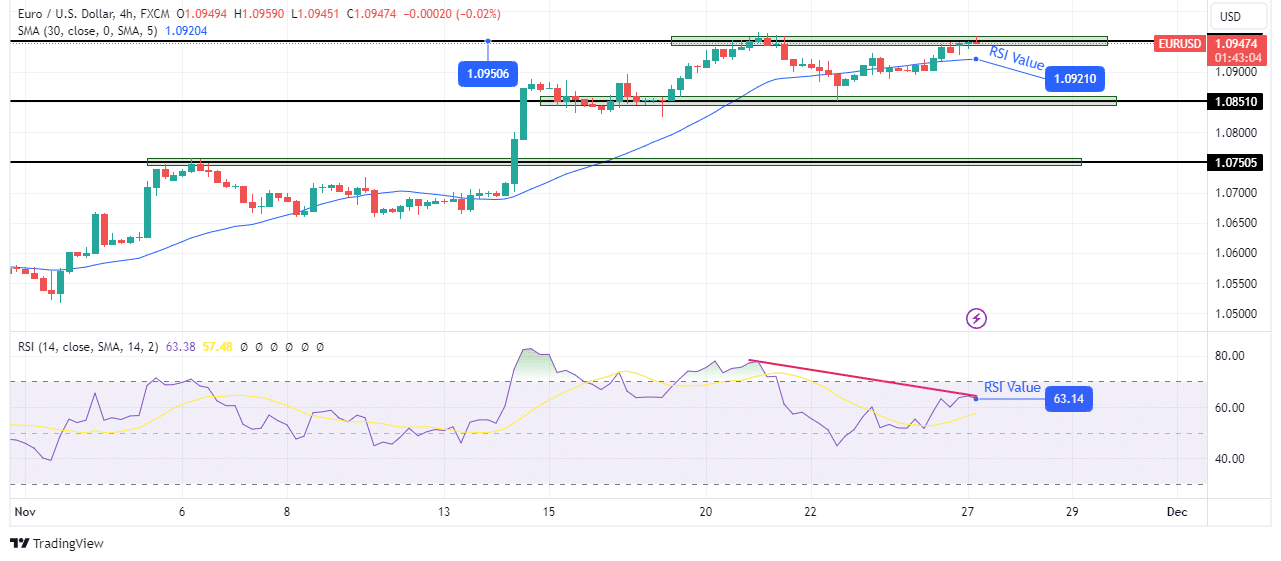

On the technical side, EUR/USD bulls are back in control after a false breakout below the 30-SMA. The price initially rose to the 1.0950 resistance level, where it paused, and the bears resurfaced. Surprisingly, the bears were strong enough to break the 30-SMA support. However, this downward momentum did not last as the bears failed to sustain the decline. Consequently, the bulls came back and took control by breaking above the 30-SMA.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Currently, the price is again facing resistance at 1.0950. Furthermore, the RSI is showing weaker bullish momentum. The price is likely to fall to 1.0851 if there is a bearish divergence.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.