- There was optimism that the hiking cycle of the Federal Reserve was over.

- The data revealed a larger-than-expected drop in the number of Americans filing new jobless claims.

- Minutes from the Fed meeting revealed a cautious stance on monetary policy.

The EUR/USD weekly forecast is shaped by a bullish trend, fueled by a weaker dollar amid optimism surrounding the Fed’s break. Consequently, this has led traders to expect a potential rate cut.

–Are you interested in learning more about scalping brokers? Check out our detailed guide-

EUR/USD ups and downs

Although EUR/USD ended the week higher, it barely moved due to the US Thanksgiving holiday. However, the primary catalysts were Fed minutes and US data. The dollar fell amid optimism that the Federal Reserve’s hiking cycle was over. Moreover, the economy remains strong enough to avoid recession.

Economic reports on jobless claims, durable goods and consumer sentiment showed easing but suggested the economy could remain firm enough for a soft landing.

Meanwhile, minutes from the Fed’s latest meeting revealed a cautious stance on monetary policy. However, market participants are starting to prepare for rate cuts.

Next week’s key event for EUR/USD

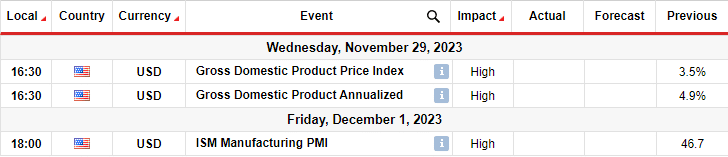

Next week, key data from the US, including GDP and manufacturing PMI, will provide insight into the economy. Namely, the GDP report will reveal whether the economy has expanded or contracted, while the PMI report will indicate the business activity of the manufacturing sector.

Bets for a Fed rate cut increased this week due to recent poor data from the US. Still, the Fed’s minutes showed that the Fed will remain resilient, albeit cautious, in its fight against inflation. Therefore, if next week’s data comes in lower than expected, expectations for a Fed rate cut could increase. It would also result in a greater depreciation of the dollar.

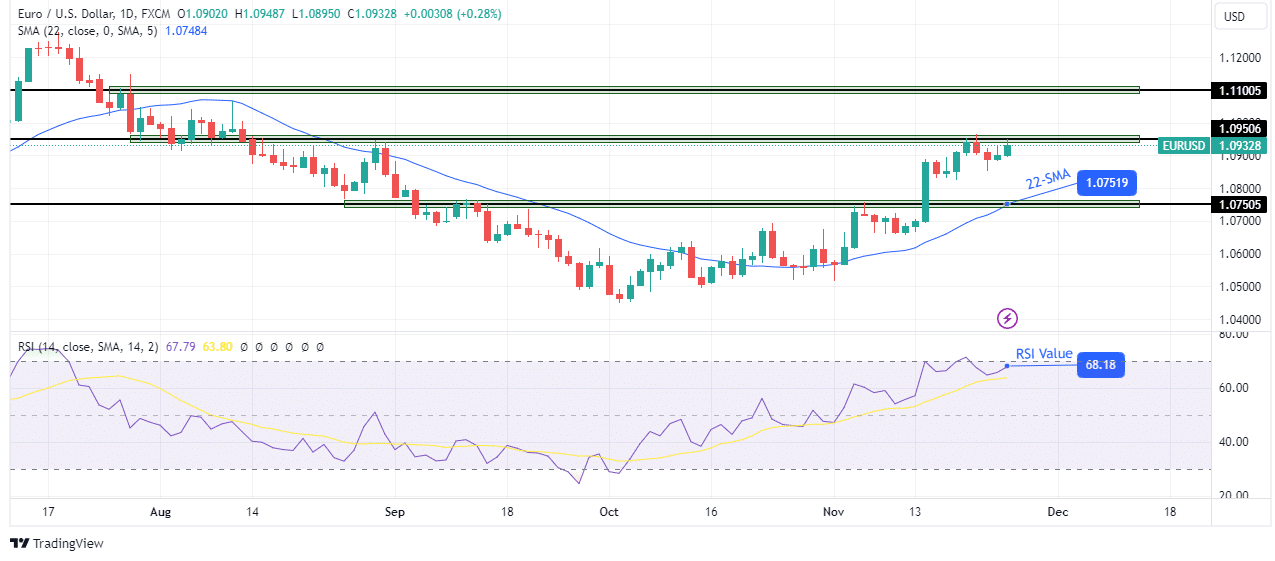

EUR/USD weekly technical forecast: Bulls increase to resistance at 1.0950

On the technical side, the EUR/USD price is bullish and the price has risen to the resistance level of 1.0950. Further supporting the bullish bias is the RSI trading near the overbought region. Moreover, the bulls are finally making strong swings from the 22-SMA.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

In the coming week, bulls could experience resistance at 1.0950, resulting in a pullback. However, given the bullish bias, the price is likely to stop at the 22-SMA, which acts as support for the uptrend. However, if the bulls are strong enough, the price will break above 1.0950 without a pullback. This move would then allow the bulls to retest the 1.1100 resistance level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.