- Data on Friday revealed a significant drop in UK retail sales.

- Investors still believe the BoE will cut rates more slowly than the ECB and the Fed.

- Data released late last week indicate that US economic activity remains strong.

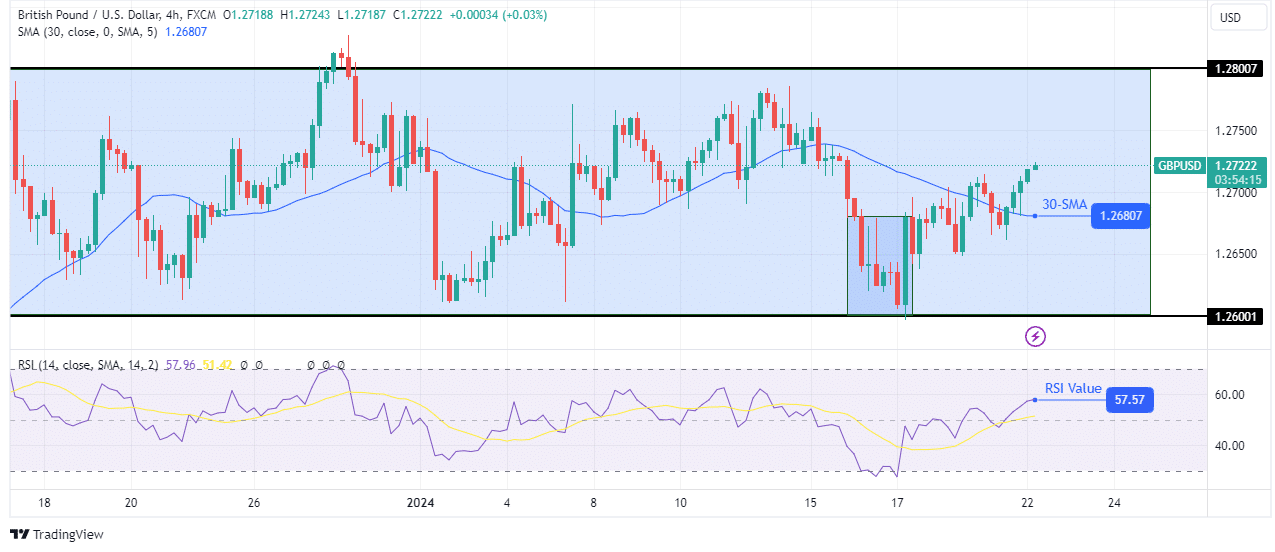

The GBP/USD forecast hints at a modest bullish trend after Monday’s slight rally, which has temporarily broken Friday’s downward momentum. On Friday, the pound collapsed as retail sales fell sharply, marking the biggest drop in three years.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

Despite this, the currency finds support in persistent inflation. Moreover, investors believe that the Bank of England will not cut rates as quickly as the ECB or the Fed. At the moment, market indicators point to roughly a 50% chance that the BoE will cut rates in May.

What’s more, the pound experienced the smallest drop among the G10 currencies, while the dollar strengthened throughout the year.

On Friday, UK data revealed a surprise drop in consumer spending in December. Consequently, this increased recession risks and halted the currency’s recent appreciation.

The Office for National Statistics attributed the 3.2% fall in retail sales between December and November to earlier-than-usual Christmas shopping, particularly for food.

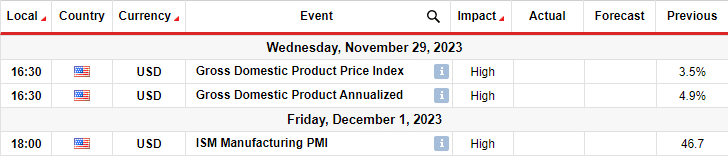

Meanwhile, data released late last week showed that US economic activity remains strong even with the highest interest rates in decades. As a result, market expectations have been revised. Starting in March, there are fewer bets on a Fed rate cut. Traders have changed their bets, predicting that a rate cut is likely to start in May.

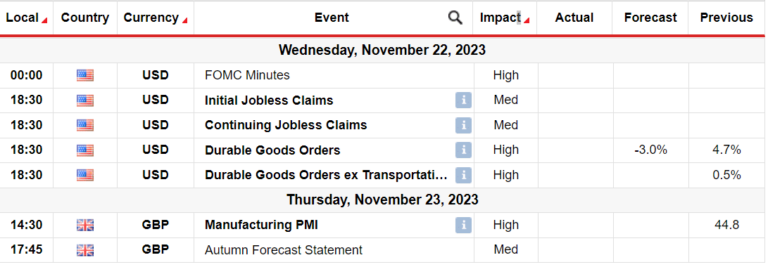

GBP/USD key events today

Investors are not expecting key events today. Therefore, the pair could move sideways as markets absorb last week’s releases.

GBP/USD Technical Forecast: Range between 1.2600 and 1.2800

On the technical side, the GBP/USD price remains trapped between resistance at 1.2800 and support at 1.2600. Every time the price approaches the resistance at 1.2800, the bears take control. Meanwhile, when it approaches 1.2600, the bulls take over.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

Notably, the latest bullish takeover came when the pair touched the 1.2600 support level. At this point, the price made a bullish candle, swallowing the previous six candles. This indicated an increase in bullish momentum. Moreover, the takeover is confirmed when the price breaks above the 30-SMA. Bulls are now targeting resistance in the 1.2800 range.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.