- November British inflation data fell well below expectations.

- Markets are fully expecting a 25 basis point cut in the Bank of England rate in June 2024.

- Market participants are now pricing in a 69% chance of the Fed’s first tapering in March.

Disappointing November UK inflation led to a bearish GBP/USD forecast on Wednesday. The figures, well below expectations, reinforced the perception that a Bank of England rate cut could be on the horizon, sending the currency lower.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Notably, Britain’s annual consumer price inflation fell to 3.9% from October’s 4.6%, the lowest rate since September 2021. Moreover, the figure fell short of all forecasts in a survey of economists, which had predicted 4.4% . In addition, core inflation unexpectedly cooled, falling to 5.1% from 5.7%.

Inflation measures remain above the Bank of England’s 2 percent target. Therefore, the data support the argument that it is too early to consider cutting interest rates, especially with core inflation well above target levels. Currently, markets are fully expecting a 25 basis point cut in the Bank of England rate in June 2024. At the same time, there is over a 50% chance of a cut in May.

Elsewhere, the US dollar remained strong on Wednesday as traders weighed in on the likelihood of a Fed rate cut. The dollar fell after last week’s Federal Open Market Committee meeting, where policymakers forecast three rate cuts for 2024.

Furthermore, market participants are now pricing in a 69% chance of the first rate cut at the March Fed meeting, followed by a 63.3% chance of another rate cut in May. Richmond Fed President Thomas Barkin said Tuesday that the central bank’s ability to meet rate cut projections depends on the economy’s performance.

GBP/USD key events today

- Consumer Confidence USA CB

GBP/USD Technical Forecast: Bears take control after lower high

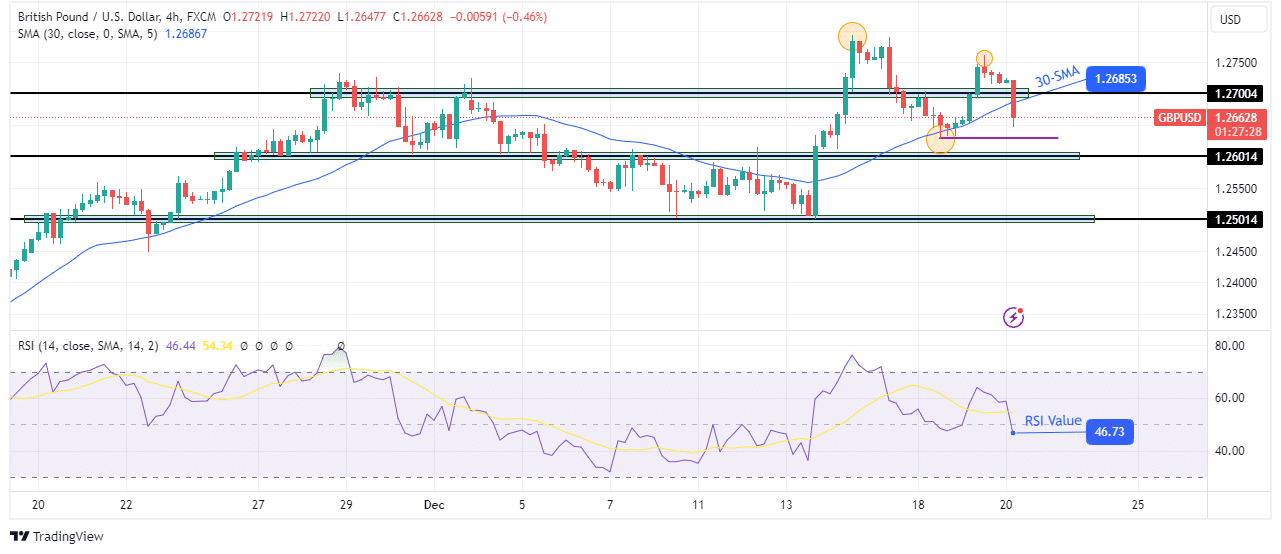

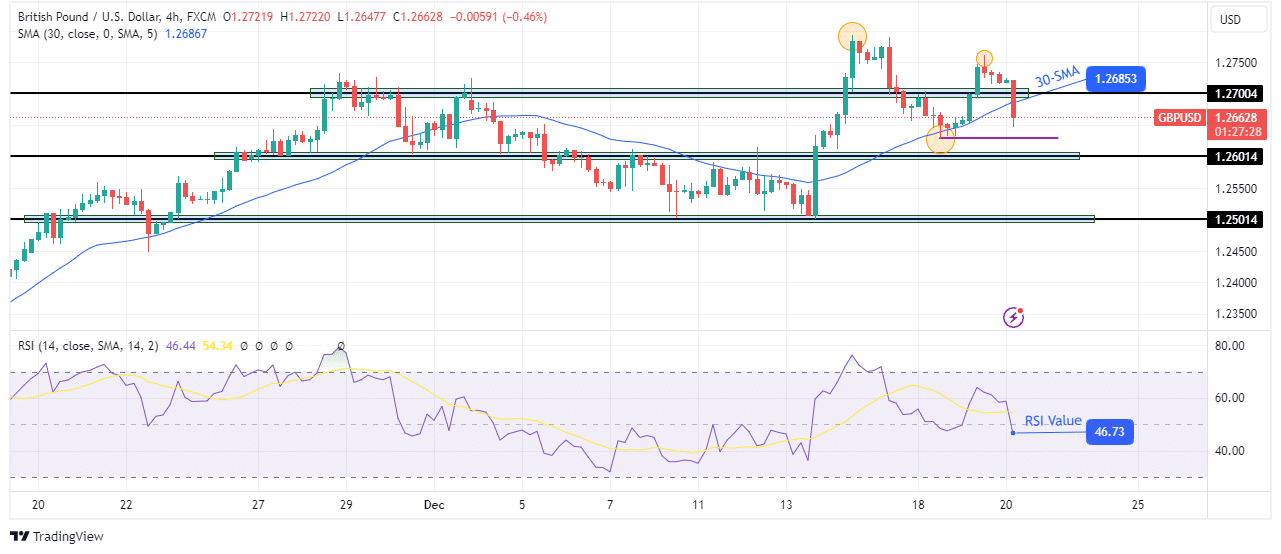

On the technical side, GBP/USD broke below the 30-SMA support line after making a lower high. The bulls initially respected the 30-SMA as support, but failed to make a higher high to continue the uptrend. Accordingly, the price fell below the key level of 1.2700. Furthermore, the RSI has broken below 50 and is currently supporting a solid bearish momentum.

–Are you interested in learning more about forex tools? Check out our detailed guide-

However, to confirm this new direction, the bears must break below the previous low to make a lower low. If this happens, the price is likely to break below the key support at 1.2601, allowing the bears to target the support level at 1.2501.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.