- Annual inflation in the UK was held at 4.0%.

- The US released an upbeat inflation report showing persistent inflation.

- The possible time for a Fed rate cut has gradually moved from March to May and now June.

Today’s GBP/USD forecast is bearish as the currency falls on news of stable UK inflation data for January. This came as both a surprise and a relief to the Bank of England, especially given economists’ forecasts were leaning towards an increase.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Meanwhile, data released on Tuesday in the US revealed a rise in inflation. Accordingly, there was a decline in rate cut expectations.

Annual inflation in the UK was held at 4.0%. This figure surprised economists who had expected an increase of 4.2%. So it was a relief for the Bank of England, which wants to cut interest rates. Moreover, it indicates that inflation is likely to decline in the coming months.

On the other hand, the US released an upbeat inflation report, showing persistent inflation. The annual figure has declined. However, the decline was much smaller than economists had expected. In addition, monthly core inflation rose to 0.4%, beating forecasts and showing the economy remains hot.

The dollar jumped immediately after the report as investors trimmed bets on a cut in US interest rates. The possible time for a Fed rate cut has gradually moved from March to May and now June. The change came as the US economy continued to show resilience in 2024 despite high interest rates. Moreover, policymakers are in no rush to cut rates.

The contrast in inflation outcomes in the UK and the US further contributed to the decline in GBP/USD.

GBP/USD key events today

- Speech by Governor BOE Bailey

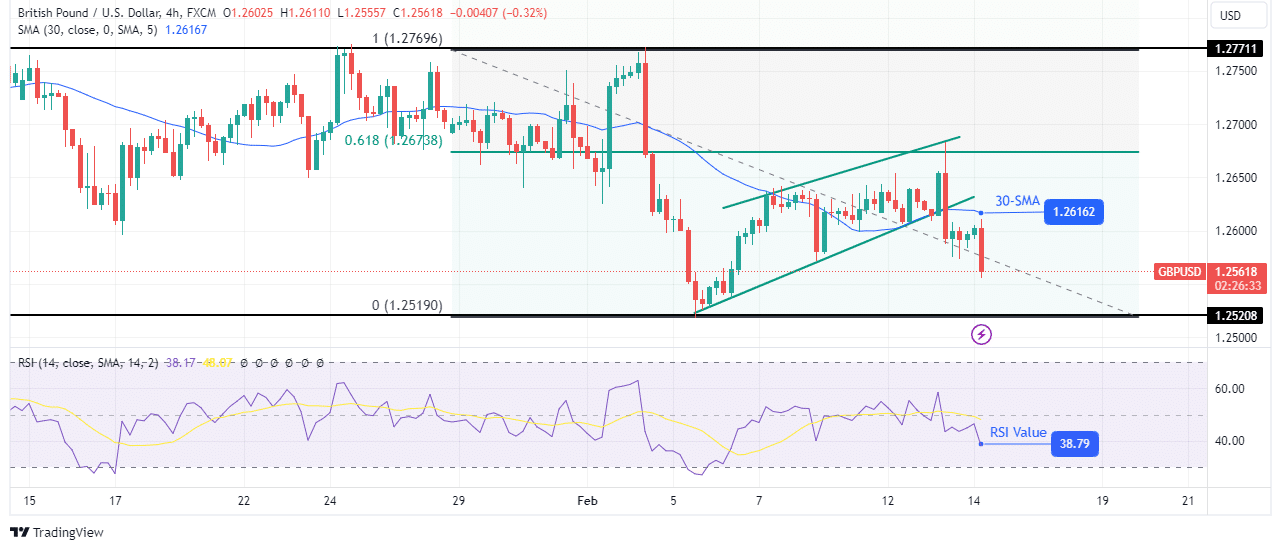

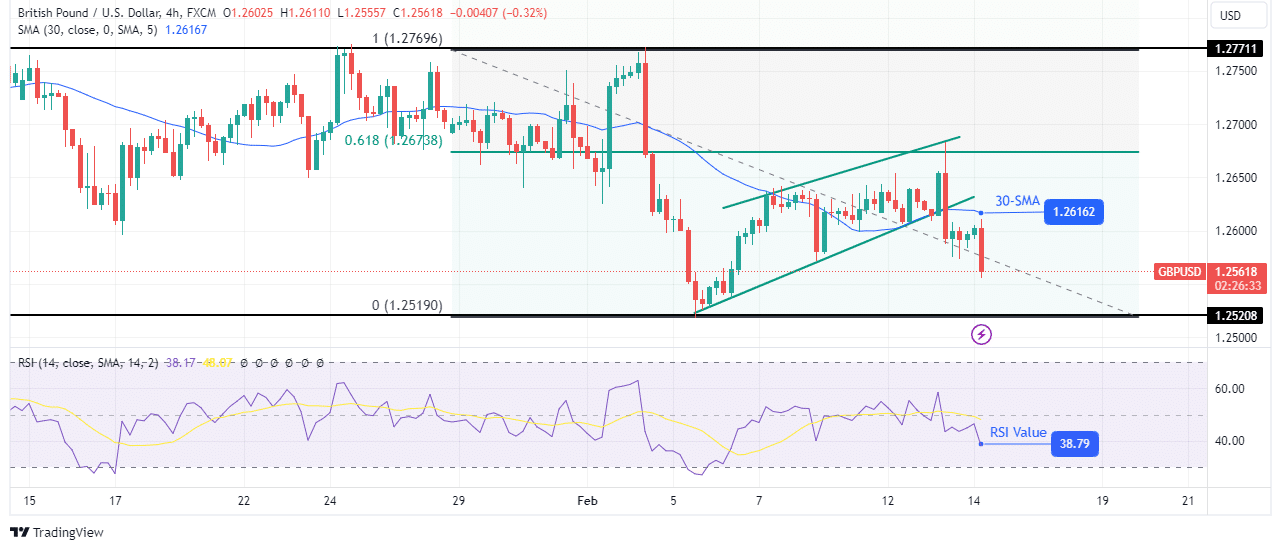

GBP/USD Technical Forecast: Support at 1.2520 in bearish eye in strong move

On the charts, GBP/USD is in a strong bearish move, moving towards the 1.2520 support level. Initially, the pair made a solid, impulsive move from the 1.2771 level to the 1.2520 level. After that, the corrective move reached the 0.618 Fib retracement level, returning to the previous bearish move.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

At this Fib level, the bears made a candle that engulfed which signaled a continuation of the previous bearish move. Furthermore, the price broke out of its corrective pattern, pushing well below the 30-SMA. However, the bears must break below the support at 1.2520 to make a new low and confirm the downtrend.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.