- UK house prices rose in February for the first time in more than a year.

- BoE chief economist Hugh Peel said he did not expect a rate cut anytime soon.

- US manufacturing PMI fell to 47.8 in February.

The GBP/USD outlook took on a bullish tone as the pair continued its upward trajectory on Monday, boosted by encouraging data from the UK and encouraging remarks from the Bank of England on Friday. At the same time, there were bad economic data from the USA on Friday. As a result, the pound strengthened while the dollar weakened.

–Are you interested in learning more about CFD brokers? Check out our detailed guide-

Data from Great Britain on Friday showed that house prices rose in February for the first time in more than a year. The rise came as mortgage costs fell in anticipation of a BoE rate cut, leading to a recovery in the property market. It also indicates that the economy is doing much better than expected.

In addition, the pound gained support after BoE chief economist Hugh Peel said he did not expect a rate cut anytime soon. Namely, most policymakers claim that inflation must show a clear downward trend before the central bank starts cutting rates.

Although headline inflation has declined, core inflation remains persistent, with a slower decline. Therefore, even after the BoE starts cutting rates, policy could remain restrictive. The BoE’s first rate cut could come in August.

Meanwhile, the outlook for a rate cut in the US improved after data showed a contraction in the manufacturing sector in February. The US manufacturing PMI fell to 47.8 in February from 49.1 in the previous month.

GBP/USD key events today

Investors will continue to absorb Friday’s announcements as there are no major reports today.

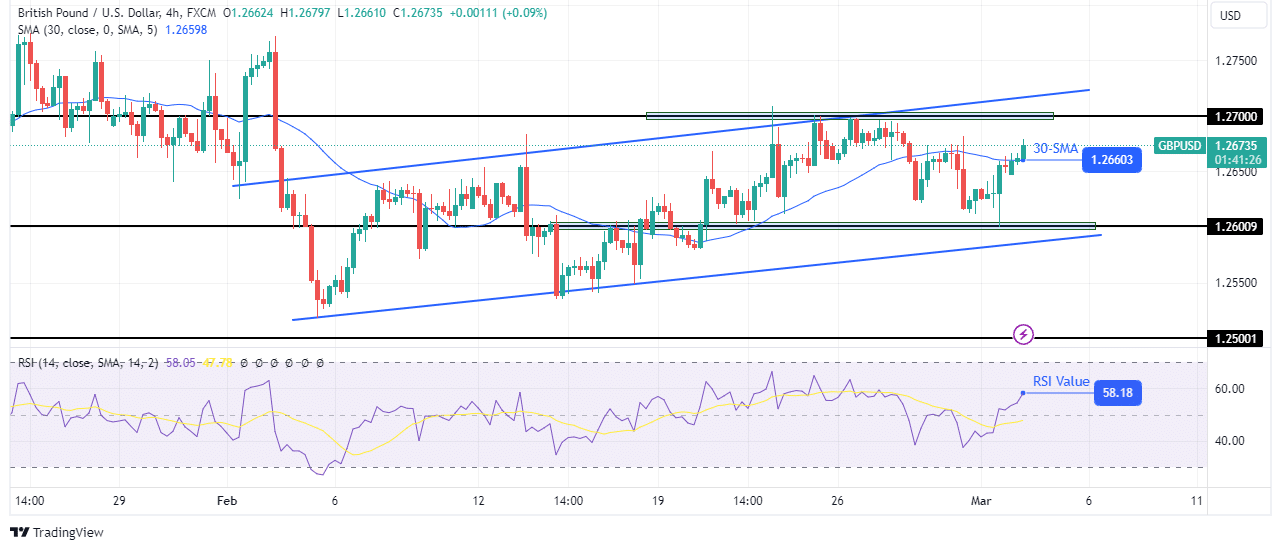

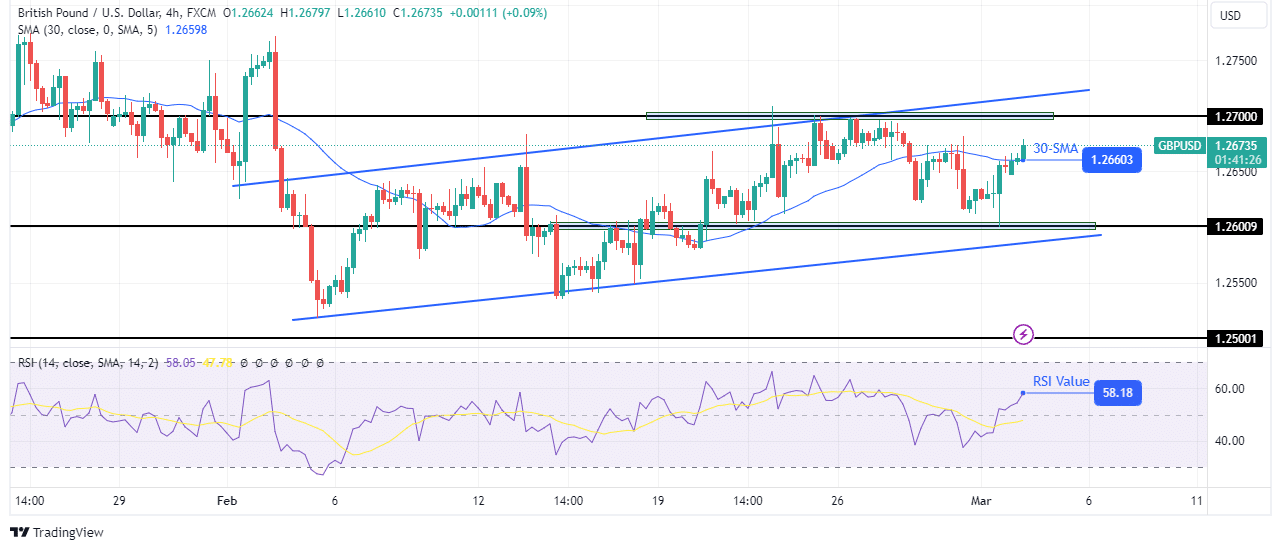

GBP/USD Technical Outlook: A shallow bullish channel trend hints at a correction

On the technical side, GBP/USD is bullish as it trades above the 30-SMA, with the RSI in bullish territory above 50. At the same time, the price is trading in a bullish channel, respecting its support and resistance. The bulls took over after the price bounced off the key psychological level of 1.2600. With the bulls in the lead, the next target is at the key level of 1.2700 or above on channel resistance.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

However, the bullish channel is shallow and could be a corrective move. Therefore, bears can wait to break out of this channel at any time. If the resistance remains firm, the price is likely to fall to retest the channel support.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.