- The Fed’s Waller said recent inflation readings support a delay in rate cuts.

- The probability of a Fed rate cut in June has dropped to 60%.

- BoE’s Jonathan Haskell cautioned against expecting a premature cut in interest rates.

The GBP/USD outlook is bearish as the dollar strengthens amid fading expectations of a Fed rate cut. Moreover, market participants are preparing for more economic data from the US that could provide clues about the Fed’s rate cut.

-Are you interested in learning about the best AI trading forex brokers? Click here for details –

The dollar rallied after Fed Governor Christopher Waller said recent inflation readings supported a delay in Fed rate cuts. Notably, some policymakers have lost confidence in the progress of inflation after the latest report beat forecasts. As a result, investors also doubt whether the Fed will be able to implement three rate cuts.

The probability of a rate cut in June fell to 60%, which boosted the dollar. However, this figure could change as more data comes in. The US will release data on GDP and jobless claims. However, the focus is on Friday’s core PCE report, which will show the state of inflation.

Another higher-than-expected inflation figure could further strengthen the dollar as it dampens expectations of a rate cut. Moreover, markets could reduce prices by less than three in 2024.

Meanwhile, the Bank of England took a more dovish stance. However, some policymakers still believe rate cuts are a long way off. The BoE’s Jonathan Haskell cautioned against expecting an early cut in interest rates. According to him, although headline inflation has declined, the BoE is focused on persistent and core inflation, which remains high. Therefore, June could be too early for the central bank to start easing monetary policy. Markets currently expect the first cut to be in June or August.

GBP/USD key events today

- Last quarterly US GDP

- First jobless claims in the US

- USA is waiting for the sale of the house

- US consumer sentiment

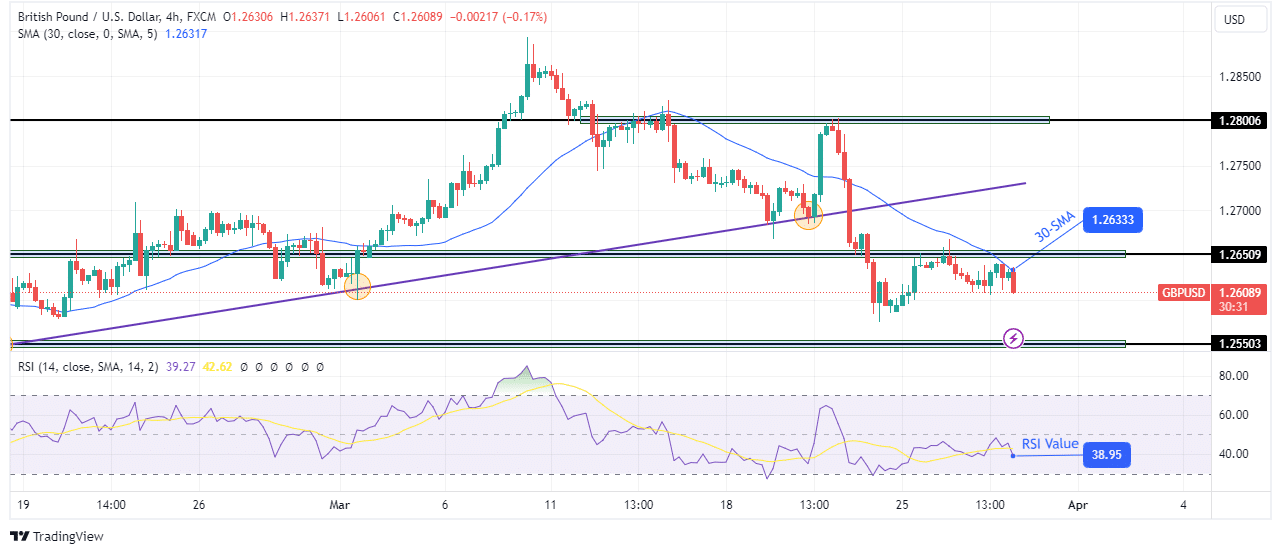

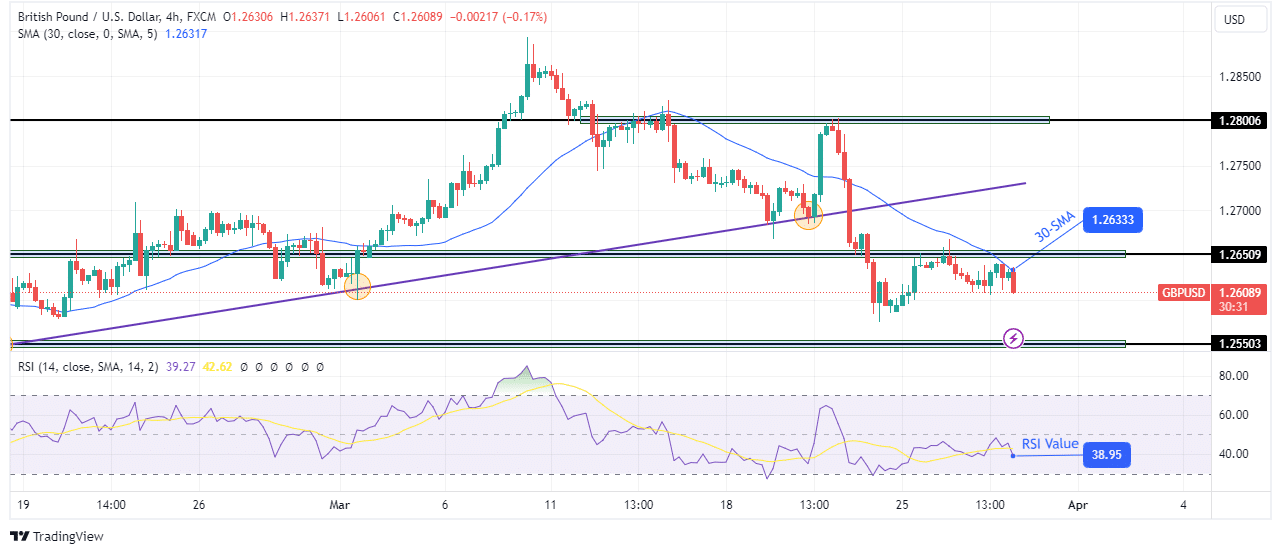

GBP/USD Technical Outlook: Price declines after resistance at 1.2650

On the charts, the GBP/USD price is falling after retesting and respecting the key resistance level of 1.2650. The bearish bias is strong as the price has established its downtrend with lower highs and lows. At the same time, it now respects the 30-SMA as resistance and could soon swing well below the line.

-Are you interested in learning more about forex indicators? Click here for details –

Meanwhile, the RSI is in bearish territory, below 50. Therefore, the bears could soon make another lower low. The next immediate downtrend target is at the 1.2550 support level. The decline will continue below this level if the price remains below the SMA.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.