- Investors awaited more clues on the Fed’s policy outlook in the US inflation report.

- Business data suggested the UK economy was more resilient than feared in December.

- Data on Friday revealed a mixed picture of the US economy.

Monday saw GBP/USD bearish, driven by a stronger dollar, as investors gasped for further insight into the Fed’s policy stance through the US inflation report. This key report keeps investors away from risky assets, supporting the dollar. Moreover, investors are still absorbing the data released on Friday in the US and the UK.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

Business data suggested the UK economy was more resilient than feared in December. The UK construction sector showed a possible recovery from the slump caused by interest rates rising to a 15-year high of 5.25% in August. Notably, the S&P Global/CIPS UK Construction Purchasing Managers’ Index for December rose to 46.8 from November’s 45.5. However, it remained below the 50.0 growth threshold for the fourth consecutive month.

In addition, data from the Halifax mortgage lender revealed an annual increase in UK house prices in December. It is the first in eight months, which indicates stabilization in the real estate market. As a result, traders lowered their expectations for a BoE rate cut. They currently forecast a cut of around 120 basis points in 2024, compared to the 140 basis points expected on Thursday.

Meanwhile, in the US, employment rose more than expected, while the unemployment rate fell. However, the US services sector weakened significantly last month, showing a mixed picture of the US economy.

GBP/USD key events today

Investors are not expecting any key developments from the US or the UK today. As such, they will continue to absorb Friday’s reports.

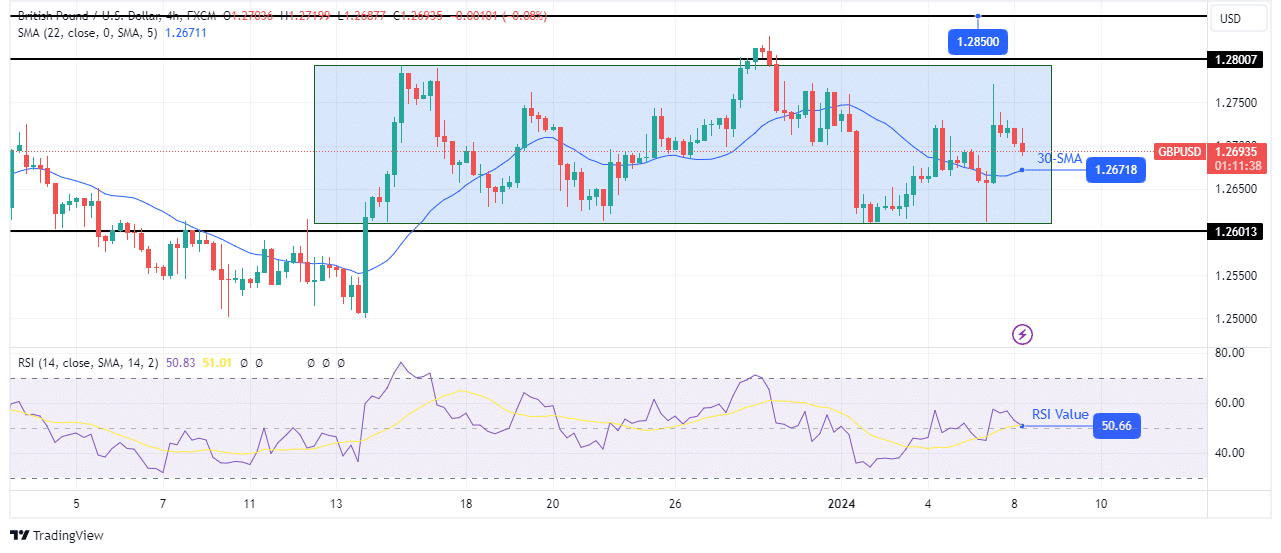

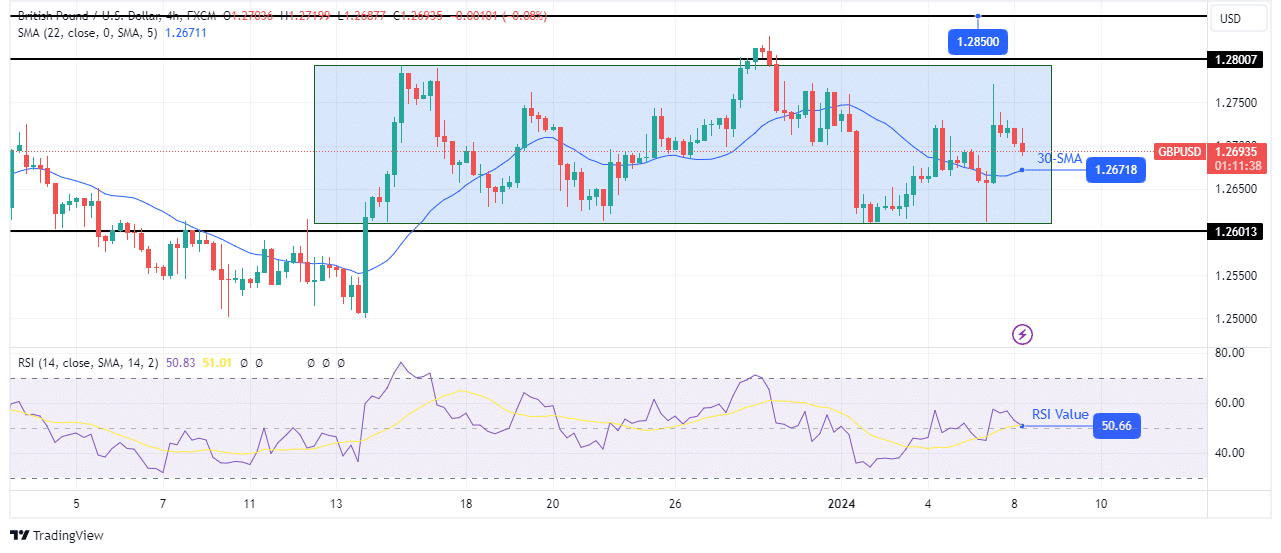

GBP/USD Technical Outlook: Bulls Take Range Lead

On the technical side, the pair oscillates between the resistance at 1.2800 and the support level at 1.2601, with no clear direction. However, the bulls are ahead within the range as the price is above the 30-SMA. Furthermore, the price made a stunning bullish candle after breaking above and retesting the 30-SMA. This indicates strong bullish momentum that could push the price to retest range resistance near the 1.2800 level.

–Are you interested in learning more about Telegram Groups for Forex Signals? Check out our detailed guide-

However, the pair is likely to continue its sideways movement until the bears or bulls break out of the range. A bullish trend will emerge if the price pushes above the resistance at 1.2800.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money