- The Bank of England kept rates on hold on Thursday.

- UK inflation fell from 4.0% in January to 3.4% in February.

- There is a 75% chance that the Bank of England will cut rates in June.

The GBP/USD outlook worsened as the pound’s slide deepened following BoE rate cut signals. The Bank of England kept interest rates on hold on Thursday and said conditions could soon allow the central bank to start cutting rates.

-Are you interested in learning more about Bitcoin price prediction? Click here for details –

For months, the pound benefited from the view that the BoE would be among the last major central banks to cut rates. However, that view has changed, and the currency is falling. Britain has had much higher inflation than most major economies. Consequently, the BoE has remained hawkish as other central banks prepare to cut rates.

However, data on Wednesday revealed a more significant drop in inflation in February than expected. Inflation fell from 4.0% in January to 3.4% in February. As a result, there is no longer any reason for the BoE to remain hawkish. Most hawkish policymakers turned more neutral at the policy meeting, agreeing to keep rates current. Accordingly, there has been an increase in rate cut bets. There is currently a 75% chance the Bank of England will cut rates in June, up from 65% before the meeting.

Meanwhile, the Fed was also dovish at its policy meeting on Wednesday, maintaining its outlook for a rate cut. Markets expect first Fed tapering in June. Furthermore, Powell maintained his forecast of three rate cuts in 2024.

Going forward, investors will focus on which side will be more dovish as central banks move closer to cutting interest rates. In addition, it will focus on the expected size and pace of rate cuts.

GBP/USD key events today

- Euro summit

- Fed President Powell is speaking

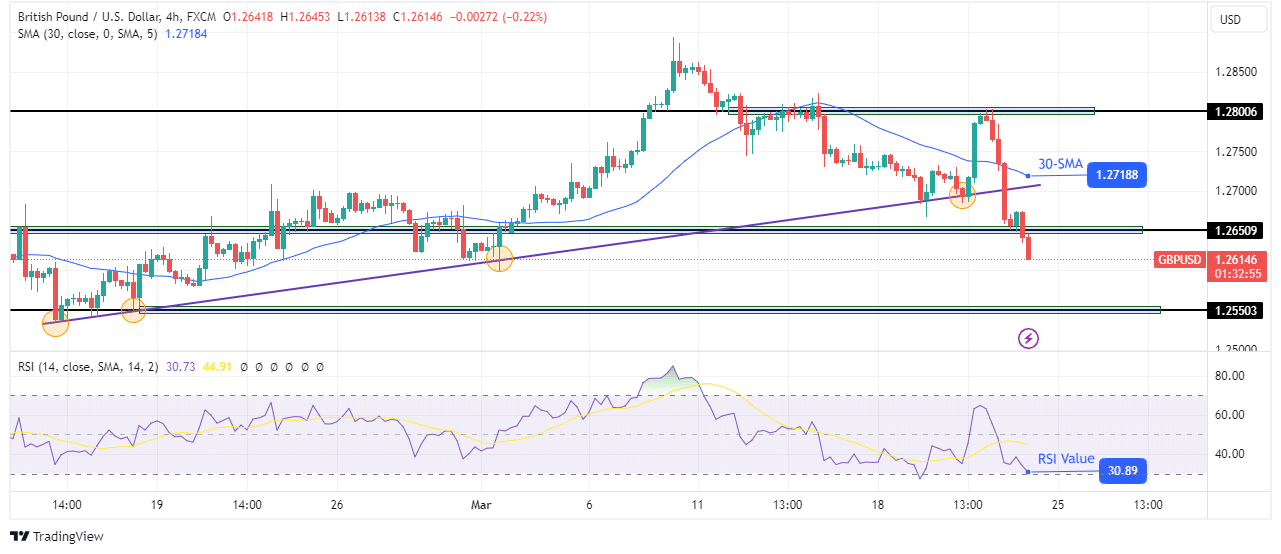

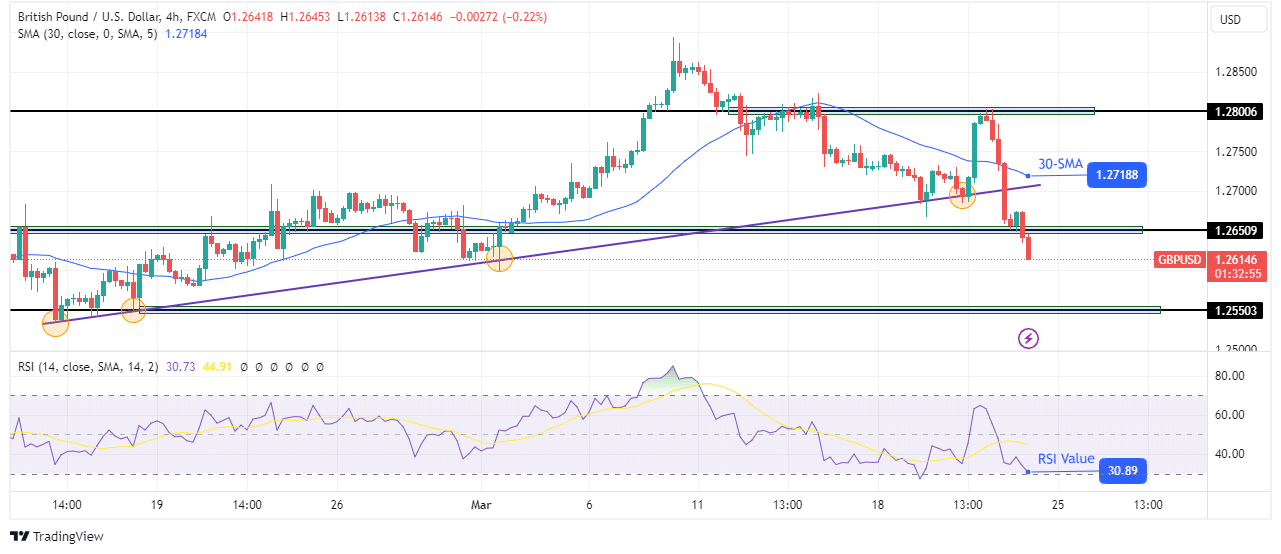

GBP/USD Technical Outlook: Key support broken

On the technical side, the GBP/USD price broke below the main support trendline to make a lower low. Moreover, the price broke below the key support level of 1.2650, pushing well below the 30-SMA. The RSI is trading near the oversold region, showing strong downward momentum.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

Notably, the bears showed the first sign that they were ready to take over when the price made a lower high near the key resistance level of 1.2800. They confirmed this new direction when the price broke below the previous low. Therefore, the price may soon retest the key support level of 1.2550.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.