- Retail sales and core retail sales in the US jumped in March.

- The probability of a Fed tapering in September rose to 46%.

- The data revealed a slight easing in the UK labor market.

The GBP/USD outlook suggests bearish momentum as the pound holds close to a 5-month low following US and UK data. While the US boasts surprisingly good sales figures, the UK has seen a slight decline in wage growth.

-Are you looking for the best AI trading brokers? Check out our detailed guide-

The dollar strengthened after another set of positive economic data from the US. Retail sales and core retail sales jumped in March, indicating strong consumer spending. This report followed hot inflation numbers and a blockbuster jobs report. Consequently, it gave policymakers another reason to doubt whether inflation is on a downward trend. Moreover, it led to a further decline in Fed rate cut expectations. The probability of a cut in July fell to 41%. Meanwhile, the probability of a cut in September rose to 46%.

Demand in the US economy has remained strong despite high interest rates. Meanwhile, most other major economies are slowing due to falling inflation. Therefore, there is a growing divergence in monetary policy perspectives.

Elsewhere, the pound weakened after data revealed a slight easing in the UK labor market. Growth in UK basic wages slowed in the three months to February, giving the Bank of England another reason to consider cutting rates. Wages without bonuses increased by 6.0%, compared to 6.1%.

However, the changing outlook for a rate cut in the US weighed on the BoE’s rate cut outlook. Investors are reducing expectations for a rate cut in the UK as the Fed may not cut interest rates until later in the year. If the BoE starts tapering much earlier, it could lead to a policy drift that would weigh on the pound.

GBP/USD key events today

- BOE Gov. Bailey speaks

- Fed Chairman Powell speaks

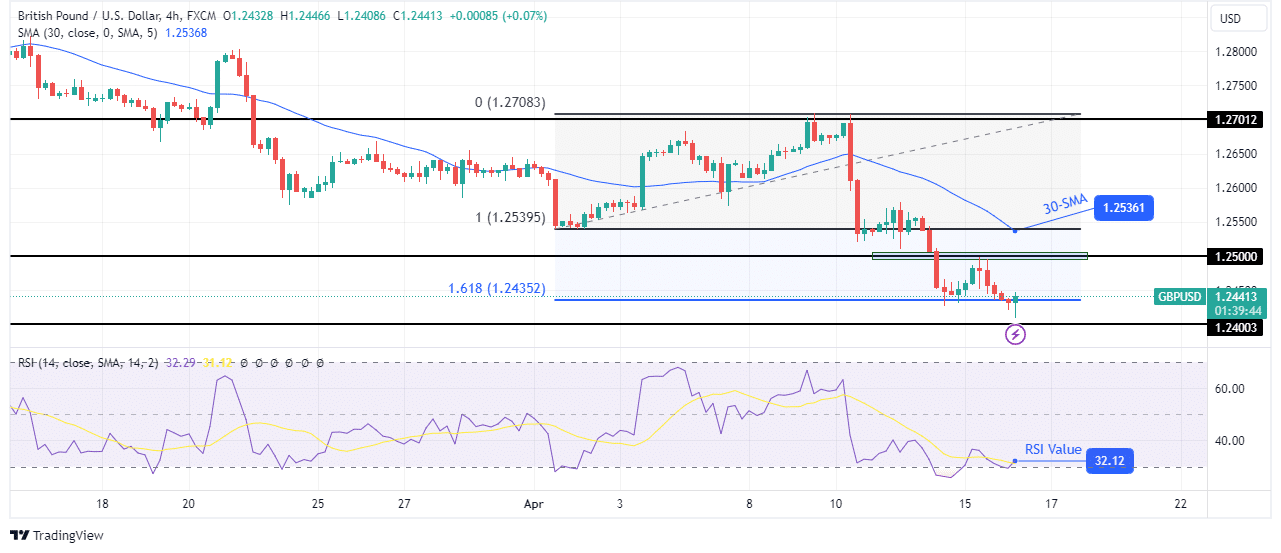

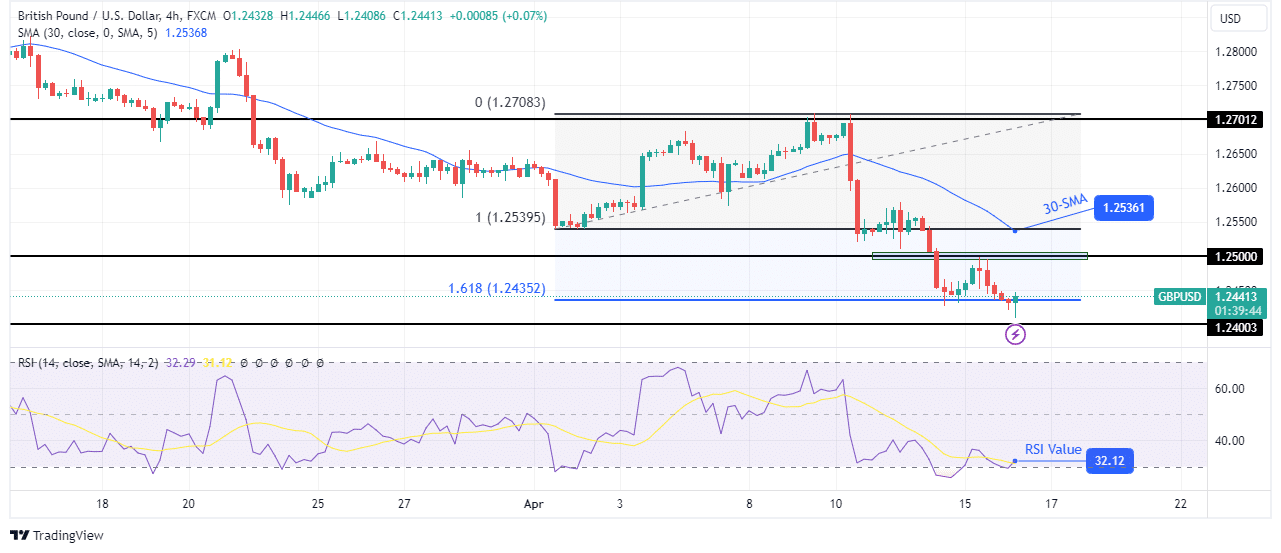

GBP/USD technical outlook: Weak support below 1.2500

On the technical side, the GBP/USD price broke below the key support level of 1.2500 and reached the Fib extension level at 1.618. Furthermore, the bearish bias is strong as the price is well below the 30-SMA with the RSI just above the oversold region.

-Are you looking for the best MT5 brokers? Check out our detailed guide-

However, the bearish move looks exhausted as the price makes fewer candles. At the same time, the RSI made a higher low, indicating weaker momentum. Therefore, the price could pull back to retest the key level of 1.2500 or 30-SMA before continuing lower.

Do you want to trade Forex now? Invest in eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.