- The pound fell last week on falling expectations of a Fed rate cut.

- The Fed will meet on Tuesday and is likely to keep rates unchanged.

- The Bank of England will meet on Thursday and is likely to keep rates at their current rate of 5.2%.

The GBP/USD outlook reveals a slight bullish bias as the pound recovers from last week’s slide ahead of major central bank meetings. Significantly, the pound is stronger because the market is pricing in a rate cut by the BoE more slowly than the Fed.

-Are you interested in learning more about Bitcoin price prediction? Click here for details –

However, the pound fell last week as the dollar strengthened on falling expectations of a rate cut. As the week began, markets had a 71 percent chance that the Fed would cut rates in June. However, data for the week showed that inflation was higher than expected. Accordingly, traders have reduced expectations of a rate cut, leaving the odds of a June cut at 57%.

Unfortunately, as the Fed’s rate cut bets decline, the pound is losing its rate cut edge. Initially, there was a wide gap in expectations for a rate cut between the US and the UK. Markets saw more cuts in the US than in the UK, boosting the pound. However, this perspective gradually changed, closing the gap.

The Fed will meet on Tuesday and is likely to keep rates unchanged. Meanwhile, the Bank of England will meet on Thursday and is likely to keep rates at their current rate of 5.2%. Notably, a survey on Friday revealed a fall in UK inflation expectations for 2024. So this paves the way for a rate cut in the UK. Still, policymakers could keep a neutral tone at the meeting.

GBP/USD key events today

It could be a slow day for the pound as there are no high-impact events. As a result, investors are likely to stay on the sidelines ahead of major political decisions during the week.

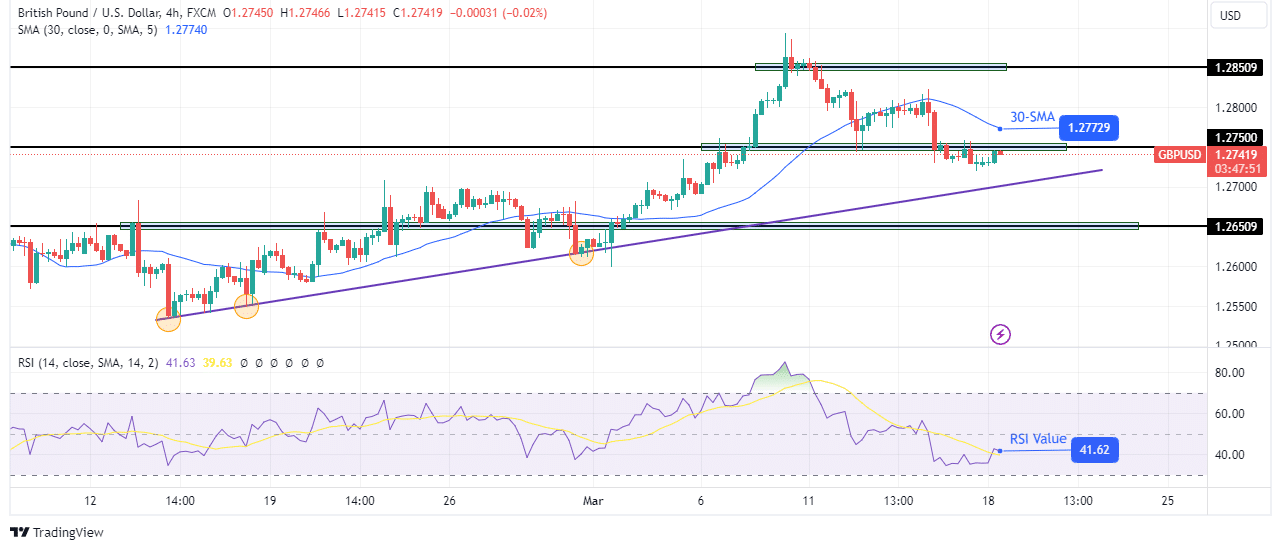

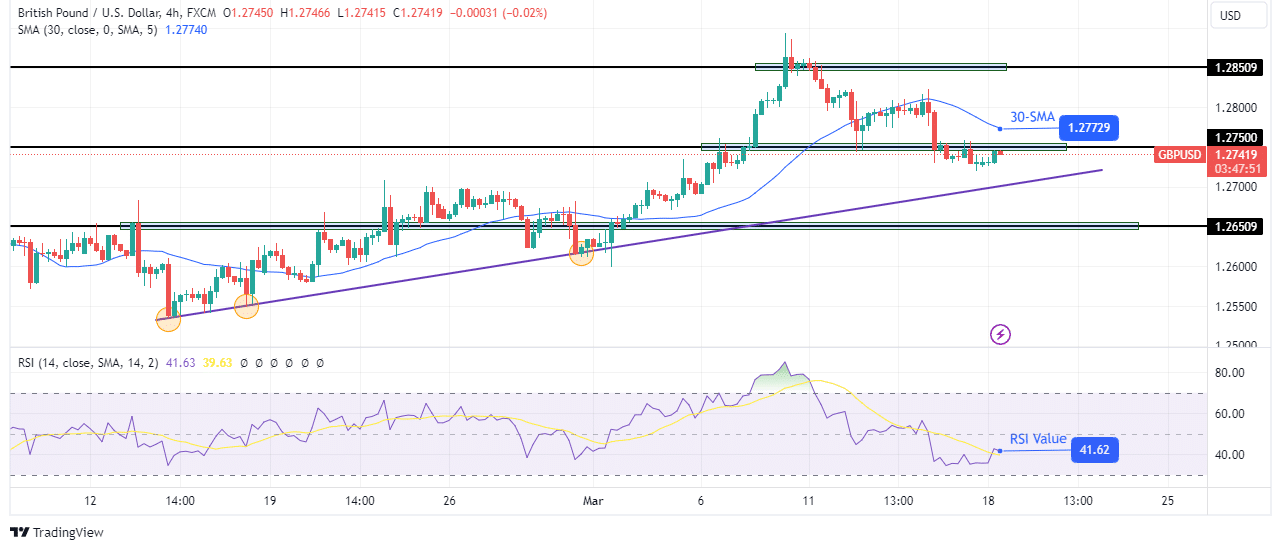

GBP/USD technical outlook: Bearish bias strengthens below 1.2750

On the technical side, GBP/USD broke below the key support level of 1.2750 to make a lower low, confirming the bearish bias. Furthermore, the 30-SMA is now down, showing a downtrend. At the same time, the RSI is trading below 50 in bearish territory.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

However, recent declines have been halted at the bullish trend line, as shown in the chart above. Bears must break below this trend line to confirm the new direction. Otherwise, the bulls could return to the trendline support to push the price to new highs above 1.2850.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.