- UK GDP rose 0.4% in May, above estimates of 0.2%.

- Inflation in services and wage growth in the UK remain high.

- Investors are waiting to see the US consumer inflation report for June.

The GBP/USD outlook points north as the pound rises after data revealed a bigger-than-expected expansion of the UK economy in May. At the same time, investors eagerly awaited the US inflation report.

–Are you interested in learning more about Bitcoin price prediction? Check out our detailed guide-

The pound hit a four-month high on Thursday after a UK GDP report showed the economy expanding faster than economists had forecast in May. GDP grew by 0.4% in May, above estimates of 0.2%. Consequently, the likelihood of a BoE rate cut in August has declined. If demand picks up again, it could increase inflation. Therefore, policymakers will be reluctant to start reducing borrowing costs.

At the same time, services inflation and wage growth in the UK remain high. Although inflation has reached 2%, underlying price pressures could continue to challenge the outlook for a BoE rate cut. At the moment, there is a 50% chance that the Bank of England will cut rates in August.

Furthermore, the outlook for a rate cut will continue to change depending on what the Fed does. Powell’s recent comments suggest caution despite softer inflation and a slowing economy. However, policymakers have noted weaker demand in the labor market that could pave the way for rate cuts.

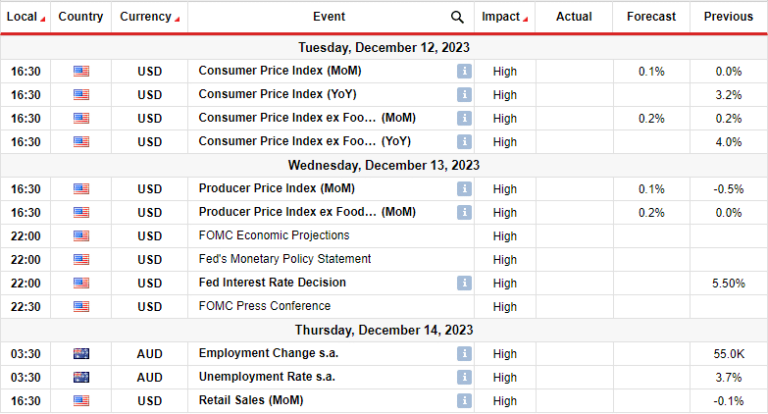

Investors are waiting to see the consumer inflation report for June. If further easing occurs, it could give policymakers the confidence they need to start cutting interest rates. A more dovish Fed will allow other major central banks to take similar stances.

GBP/USD key events today

- US Consumer Price Index Report

- First jobless claims in the US

GBP/USD Technical Outlook: Bullish momentum building above 1.2850

On the technical side, the GBP/USD price is climbing after breaking above the key resistance level of 1.2850. The bullish bias is strong as the price respected the 30-SMA as support and made a higher high. At the same time, the RSI is trading in overbought territory, supporting solid momentum.

–Are you interested in learning more about crypto robots? Check out our detailed guide-

The new high is a sign that the bulls are ready to continue the uptrend. Therefore, the price could soon return to the key psychological level of 1.2900. The bullish trend will continue as long as the price trades above the 30-SMA and the RSI remains above 50.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.