- The Fed’s Williams disputed the market consensus for rate cuts.

- Britain’s services sector experienced increased growth this month.

- The Bank of England confirmed its stance on keeping interest rates high on Thursday.

The GBP/USD outlook takes a subtle dip on Monday. The pair is retracing its steps from recent highs due to comments from New York Federal Reserve Bank President John Williams. On Friday, Williams disputed the market consensus for rate cuts, saying the Fed was not currently considering them and calling speculation premature.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

However, there is still bullish support for the currency. In particular, data on Friday revealed that Britain’s services sector experienced increased growth this month. The PMI showed a gauge of business activity rose to 52.7 from 50.9 in the services sector, the highest reading since June. This is only the second time since July that the index has exceeded the 50.0 growth threshold.

So, the economy, at least for now, can get out of recession. Moreover, this came a day after the Bank of England confirmed its stance on keeping interest rates high.

The Bank of England kept borrowing costs unchanged on Thursday, stressing the need to keep rates elevated to mitigate risks from persistently high inflation. However, financial markets are pricing in rate cuts for the coming year.

Economists pointed out that the data supports the Bank of England’s decision not to talk about reducing borrowing costs.

GBP/USD key events today

The currency could move sideways today as there are no key events coming out of the UK or the US today.

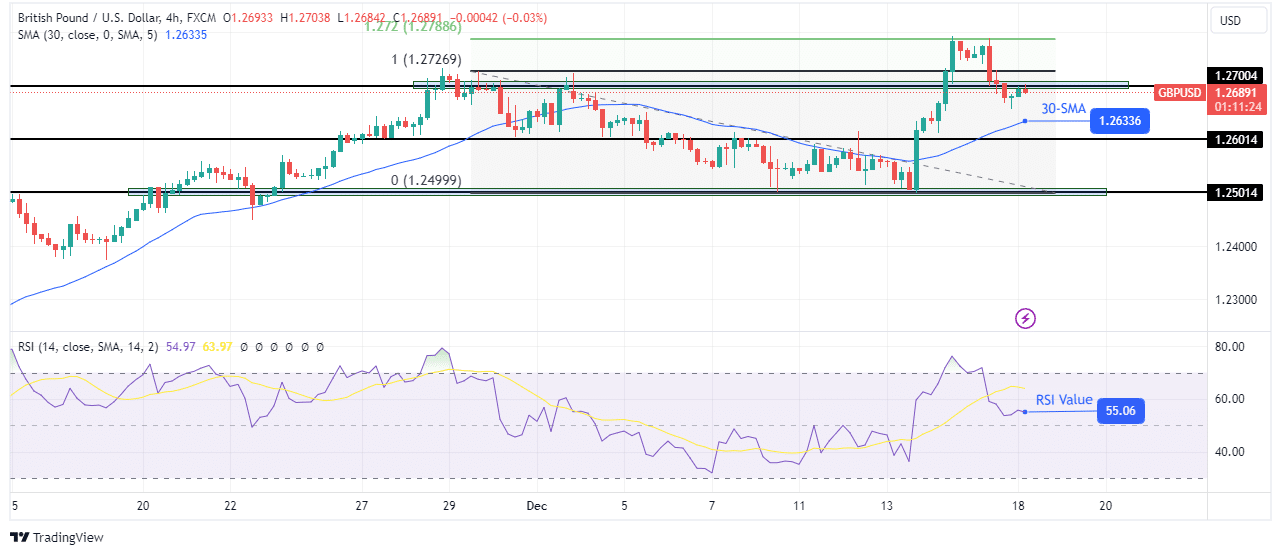

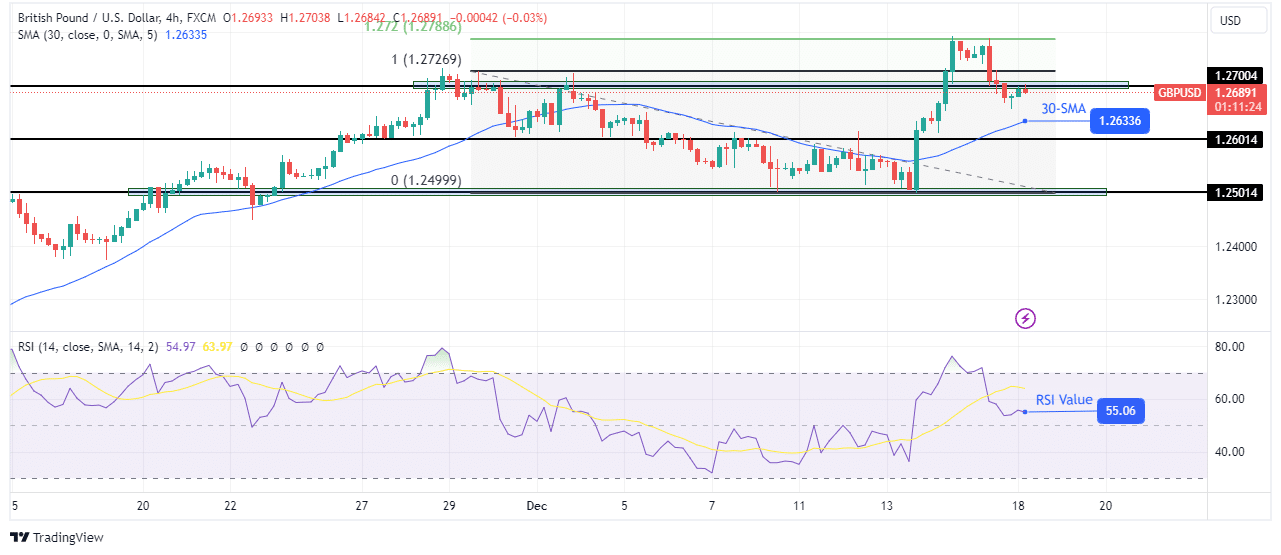

GBP/USD Technical Outlook: Price is taking a step back from recent highs

The price is pulling back on the charts after making new highs above the key 1.2700 level. Initially, the bullish trend stalled around the key 1.2700 level, allowing the bears to reverse the trend.

–Are you interested in learning more about forex tools? Check out our detailed guide-

Although the price was trading below the 30-SMA, the move was shallow, meaning the bears were not much stronger than the bulls. Furthermore, RSI has never been oversold. The weak downtrend stopped at the key support level of 1.2501, where the bulls took control with a bullish candle that broke above the 30-SMA.

The bulls made a strong move that extended to the 1,272 key fib level. Moreover, this level acted as a strong resistance, leading to a pullback. However, the uptrend is likely to resume soon, given the strong bullish bias.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.