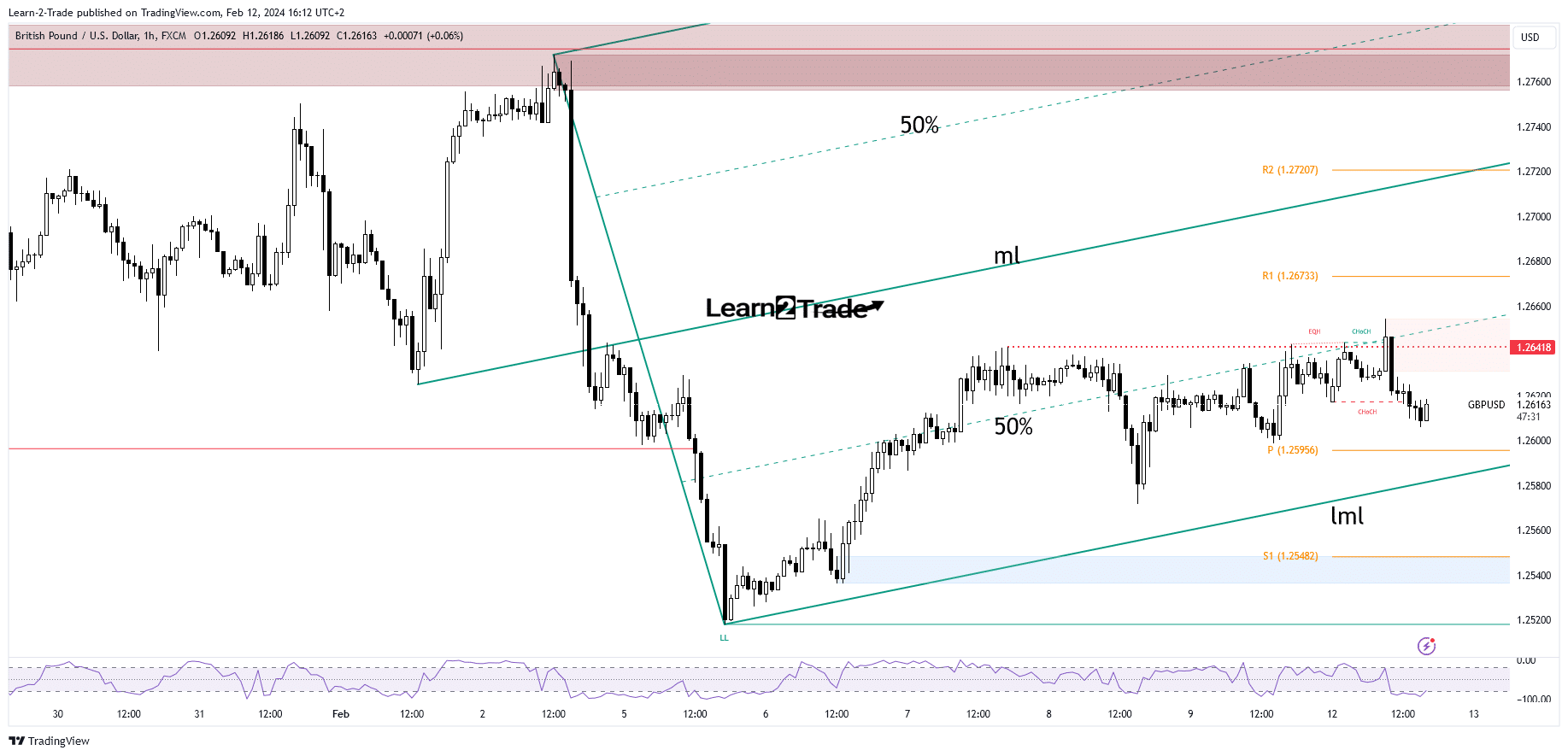

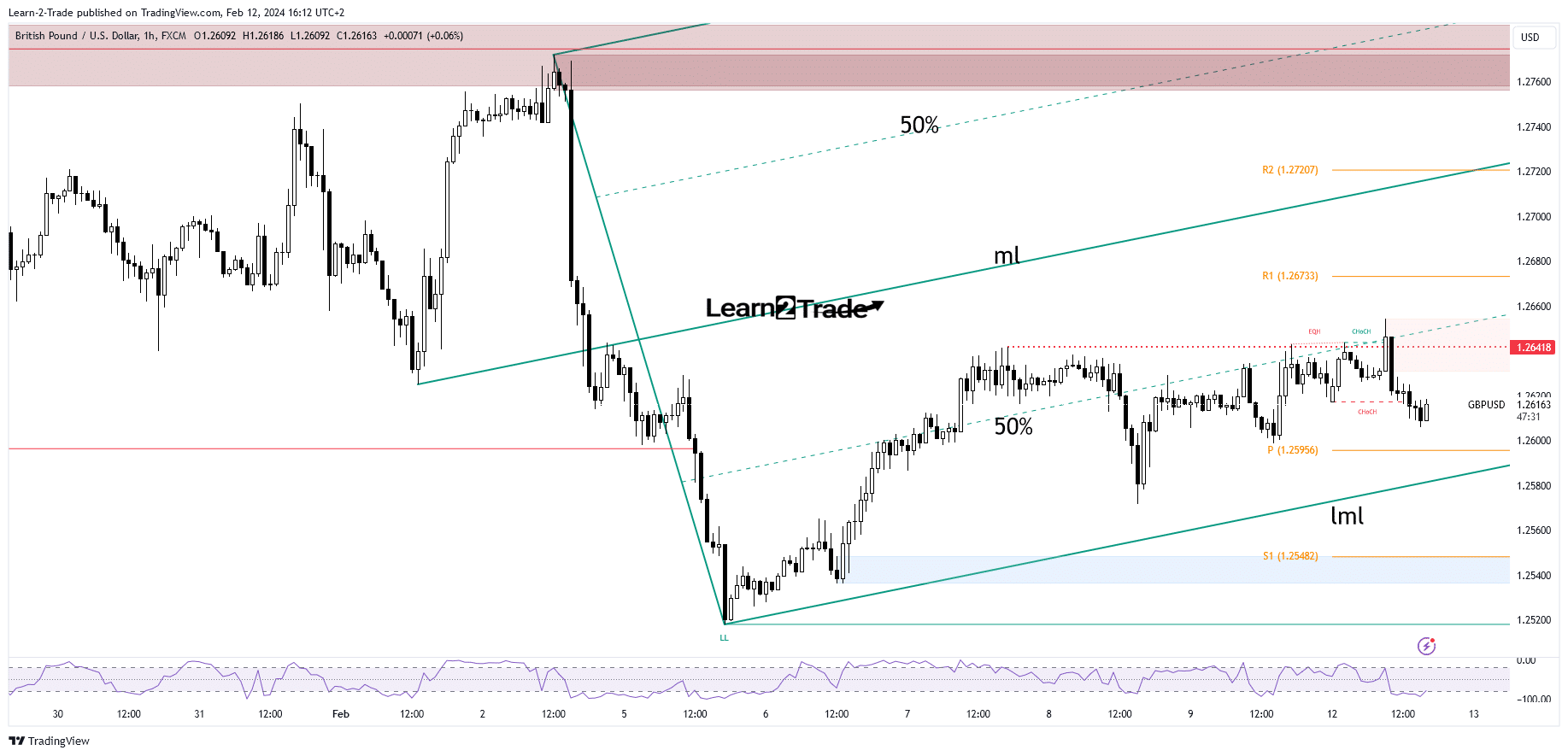

- Downward pressure on the GBP/USD price is high after false breakouts were registered.

- US inflation data should move the rate tomorrow.

- The lower middle line (LML) could attract a rate.

GBP/USD climbed to 1.2654 today, encountering strong resistance. The pair turned lower and is trading at 1.2616. Downside pressure is high in the short term amid broad dollar strength.

–Are you interested in learning more about copy trading platforms? Check out our detailed guide-

The dollar dominates the currency market ahead of US inflation figures. The consumer price index m/m is expected to register a growth of 0.2% in January compared to a growth of 0.3% in December. Year-on-year CPI may result in growth of only 2.9%, down from 3.4% growth in the previous reporting period, while Core CPI could again register growth of 0.3%. They represent high-impact events, so volatility should be huge.

The GBP/USD pair could register sharp movements in both directions. Lower inflation could weaken the dollar, as the Fed could start cutting the federal funds rate earlier. On the contrary, higher inflation should boost the dollar.

Furthermore, the UK will release important economic data tomorrow. The change in the number of claimants could be reported at 15.2 thousand, above 11.7 thousand in the previous reporting period. The average wage index could register a growth of 5.6%, while the unemployment rate is expected to fall to 4.0% from 4.2%.

GBP/USD Price Technical Analysis: Key resistance at 1.2641

The GBP/USD price retested the 50% Fibonacci line of the ascending fork. However, it registered only false breakouts and turned to the downside. A break above 1.2641 was also reversed, confirming buyer exhaustion.

–Are you interested in learning more about forex broker scalping? Check out our detailed guide-

It could now approach the weekly pivot point of 1.2595, which stands as static support. A failure to approach the middle line (ml) indicates a potential sell towards the lower middle line (LML).

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money