- The dollar was firm ahead of the Fed’s policy meeting on Wednesday.

- The outlook for rate cuts in the US differed significantly from other countries.

- Market participants expect the first BoE cut in August.

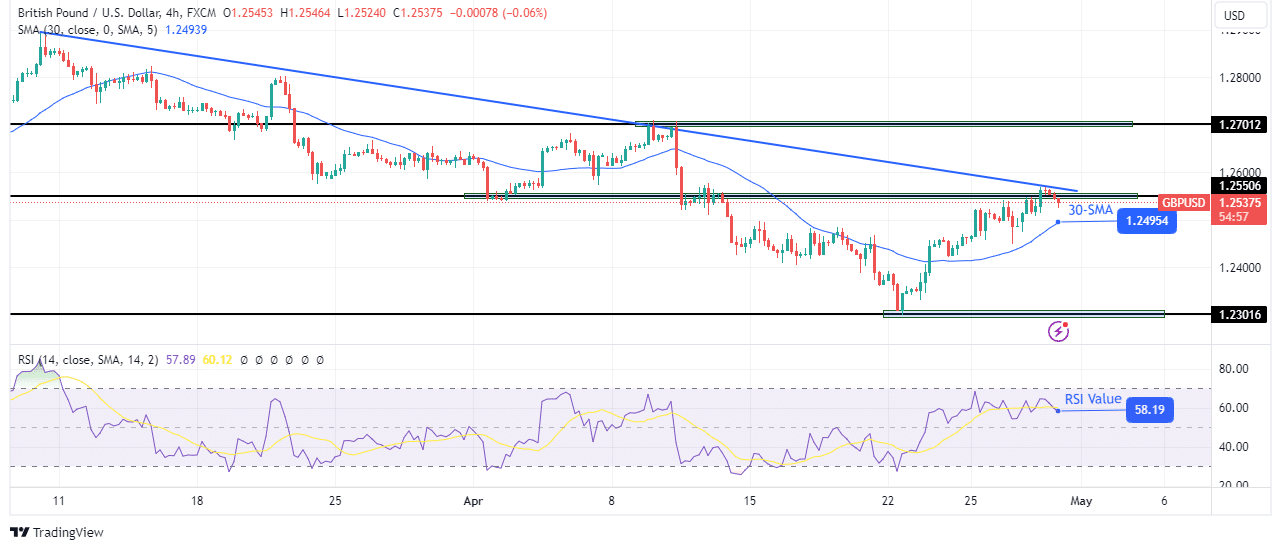

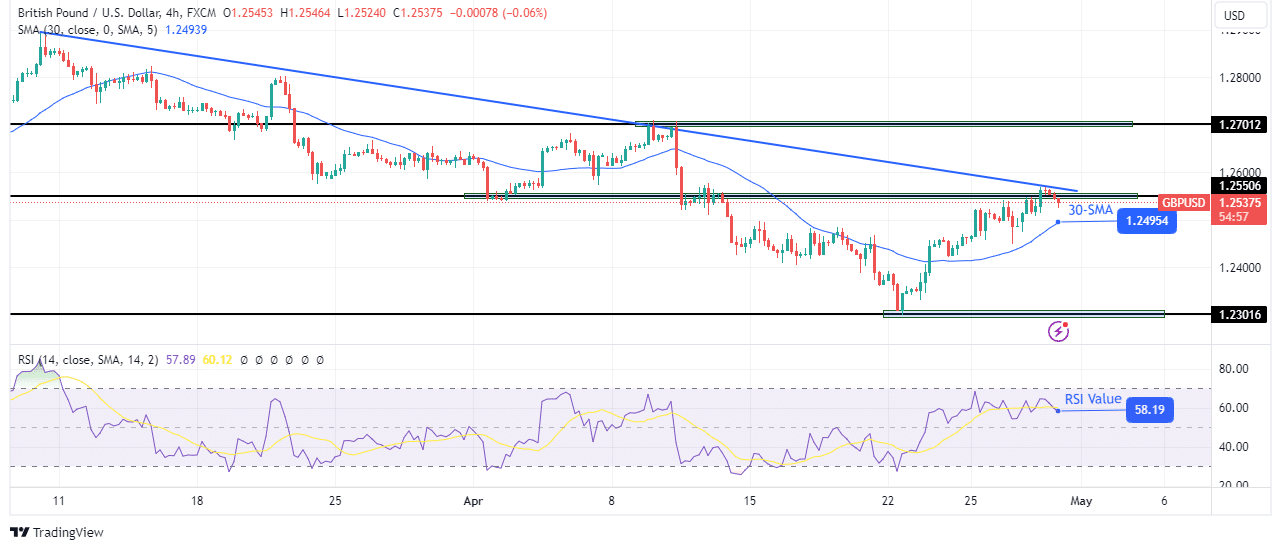

GBP/USD price analysis reveals mild bullish sentiment continuing from last week’s momentum. However, the dollar is looking to firm up ahead of the Fed’s policy meeting on Wednesday.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

Notably, the pound fell as the impact of last week’s upbeat data wore off, allowing traders to focus on policy differences between the BoE and the Fed. Moreover, investors are looking forward to the Fed meeting on Wednesday.

The latest economic reports from the US point to a delay in rate cuts. In addition, policymakers have taken a hawkish stance as they lose confidence that inflation will meet the central bank’s target. As a result, the outlook for rate cuts in the US has differed significantly from that of other countries, including Britain.

At tomorrow’s meeting, investors will focus on the central bank’s new economic projections. Moreover, they will be watching Powell’s speech to find out when the Fed might start cutting rates. Currently, markets have a less than 58% chance that the central bank will cut in September. At the same time, the probability of a decrease in December increased to almost 80%.

On the other hand, market participants expect the first BoE cut in August, well ahead of the Fed. This kept the pound subdued. However, it recently rallied after upbeat data on business activity from the UK pointed to a recovery in the economy. The rally stalled as market focus returned to the FOMC meeting.

GBP/USD key events today

- US Employment Cost Index (q/q)

- US CB Consumer Confidence

GBP/USD technical price analysis: The uptrend stops at a solid resistance zone

On the technical side, GBP/USD is trading in a strong resistance zone. However, the bias is bullish as it is trading above the 30-SMA and the RSI is in bullish territory. However, it faces downward pressure from the key resistance level of 1.2550 and a solid resistance trend line.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Consequently, bears could emerge to push the price lower and reverse the trend. They need to break below the 30-SMA with the RSI falling below 50 to do so. However, if the bullish momentum remains strong, the price could break above this resistance zone and rise to retest the key resistance level at 1.2701.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.