- The US will release inflation data later today.

- Data from Great Britain showed slower growth in the starting wages of permanent workers in March.

- UK and US monetary policies are converging.

Excitement is building in GBP/USD price analysis as the pound gains ground in anticipation of key US data. Investors are on edge, awaiting the upcoming US CPI report. This eagerly anticipated release has the potential to reshape perceptions of US rate cuts.

–Are you interested in learning more about buying NFT tokens? Check out our detailed guide-

The US will release inflation data later today, which will give a clear picture of the state of price growth in the economy. Fed policymakers have been watching inflation for the past several months to see if it is on track to reach 2%. A downtrend will give them enough confidence to adjust to the timing of a prime cut. However, the latest inflation report revealed that price growth has stalled. As a result, there is uncertainty about the prospects for interest rate cuts. Another unexpectedly hot report would likely further delay a rate cut and increase uncertainty. However, the decline would help policymakers decide on the best time to start cutting rates.

Meanwhile, in the UK, data on Monday showed slower growth in the starting wages of permanent workers in March. Falling wage increases would allow inflation to fall to the 2% target. Consequently, the Bank of England would be more willing to cut interest rates. At the same time, investors are waiting for data on British GDP on Friday.

Currently, monetary policies in the UK and the US are converging. This indicates that the Fed has become less dovish while the BoE is less hawkish. However, this could change with incoming US inflation data.

GBP/USD key events today

- US Core CPI m/m

- US CPI m/m

- US CPI y/y

- FOMC meeting minutes

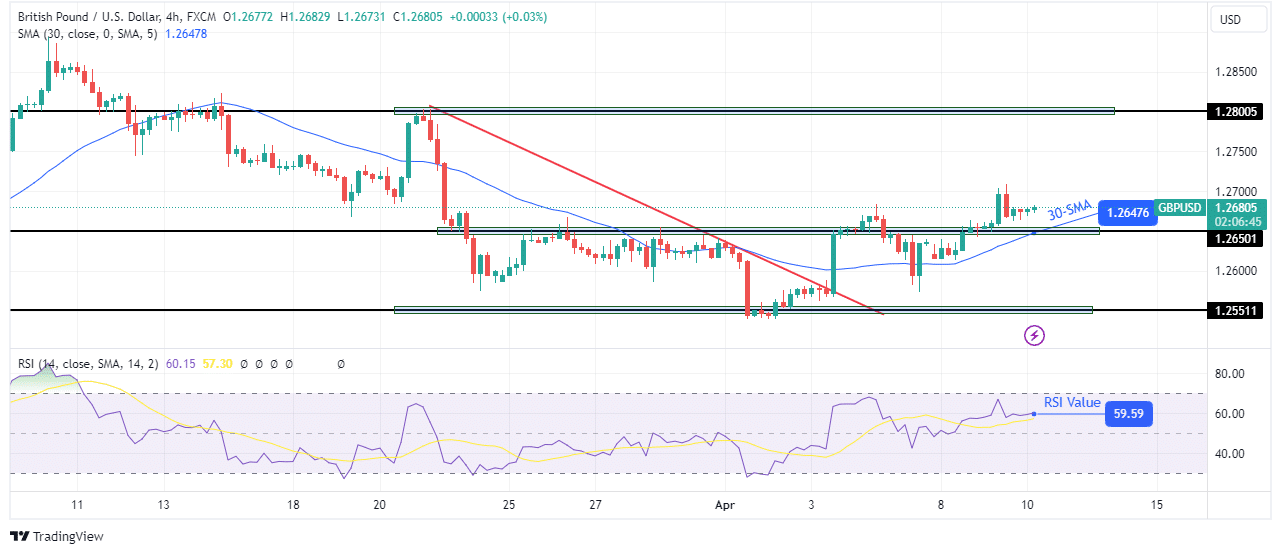

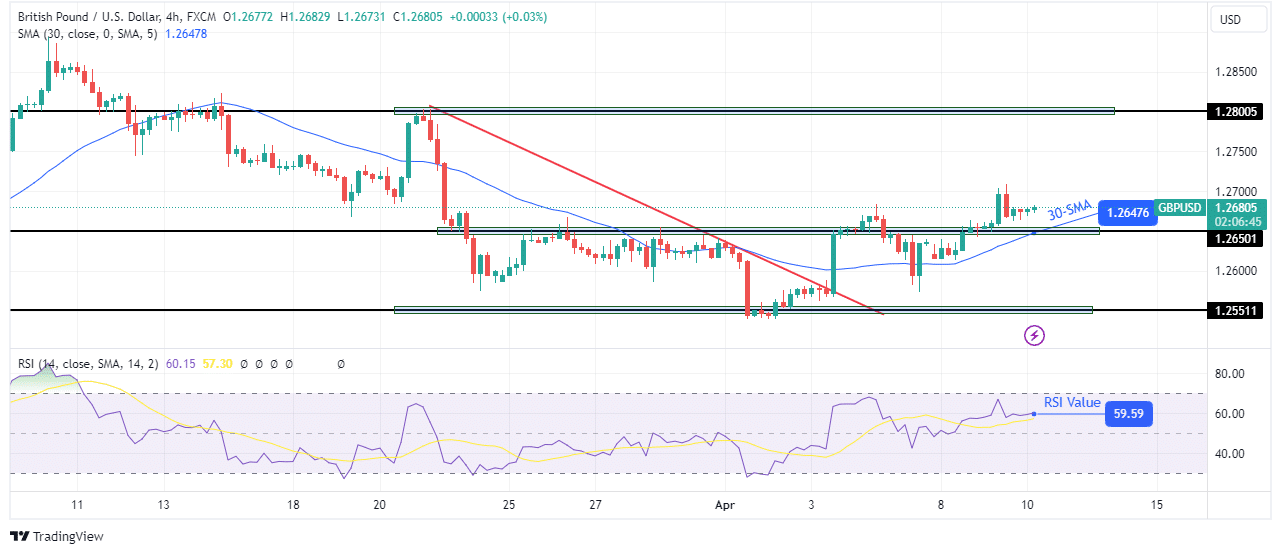

GBP/USD Price Technical Analysis: Higher value reinforces bullish sentiment

On the technical side, the GBP/USD price fully confirmed the new bullish direction by making a higher high. Moreover, the price broke above the key resistance level of 1.2650. The bullish bias is strong, with the 30-SMA turning up and the RSI above 50.

–Are you interested in learning more about the UK Trading Platform overview? Check out our detailed guide-

Therefore, the bulls are likely to target the next resistance at the key level of 1.2800. However, the trend could be shallow as the price remains close to the 30-SMA. However, the bulls will maintain control if the price remains above the SMA.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.