- Britain’s composite PMI rose to 54.0 in April from 52.8 in March.

- The BoE’s chief economist, Hugh Peel, said a rate cut remains a long way off.

- US business activity has cooled significantly, sending the dollar down.

A rally in the pound following the release of encouraging PMI data on Tuesday sparked a bullish outlook for the GBP/USD price analysis. Building momentum, investors cut their expectations of a Bank of England rate cut, fueled by the venomous comments. Meanwhile, the dollar was weak after PMI data revealed a drop in business activity in the US.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

Britain’s composite PMI rose to 54.0 in April from 52.8 in March, indicating a recovery in the economy. The recovery from the shallow recession is much faster than economists expected. Moreover, this could lead to an increase in inflation and wages, leading to a more cautious outlook for Bank of England policy.

Currently, markets expect the first rate cut in June or August. Notably, BoE chief economist Hugh Peel said a rate cut remains a long way off, stressing caution despite the recent fall in inflation. As a result, rate cut bets fell.

Meanwhile, the US composite PMI fell to 50.9 in April from 52.1 in March, indicating a slowing economy. Such poor data brings relief to Fed policymakers as it reflects a drop in demand. However, investors will await Friday’s core PCE inflation report to shape the Fed’s rate cut outlook. Markets are currently predicting a 73% probability that the central bank will cut in September.

GBP/USD key events today

Investors are not looking forward to strong reports from the US or the UK today. Therefore, they will continue to digest PMI data.

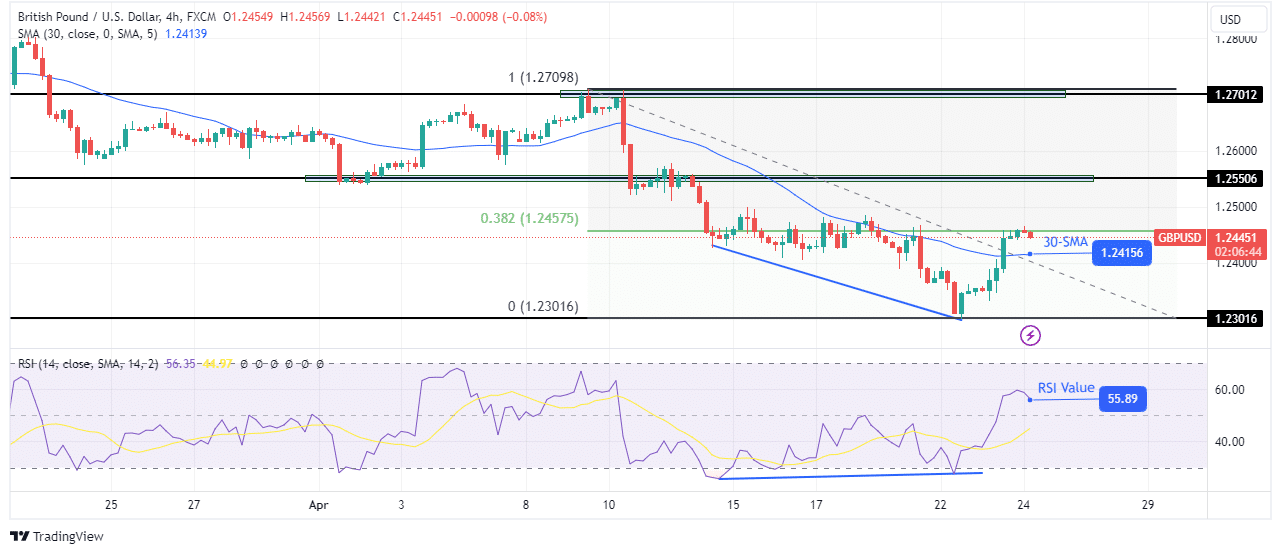

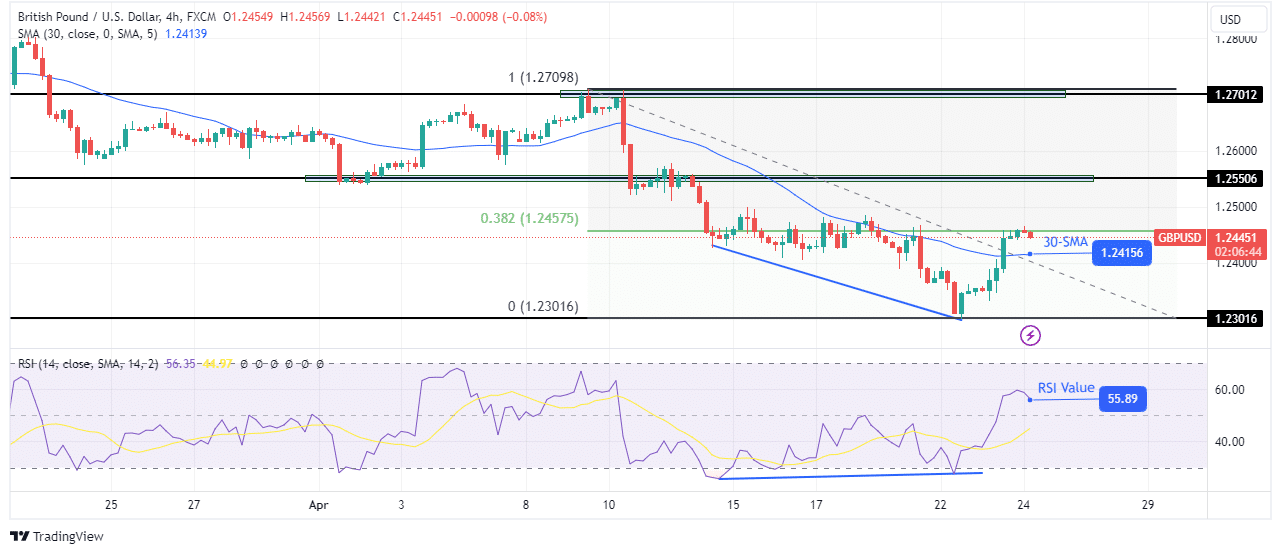

GBP/USD Price Technical Analysis: Bullish momentum stops at 0.382 Fib level

On the technical side, the GBP/USD price has broken above the 30-SMA, indicating a change in bullish sentiment. Similarly, the RSI broke above 50 and now favors bullish momentum. This change came after the price paused at the key level of 1.2301. At that point, the RSI made a bullish divergence that showed weakness in the downtrend. As a result, the bears gave up control when the price broke above the SMA.

-Are you looking for automated trading? Check out our detailed guide-

However, the bulls are now facing a retracement level of 0.382 Fib. This could trigger a pullback to retest the SMA as support before price targets the key resistance level of 1.2550.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money