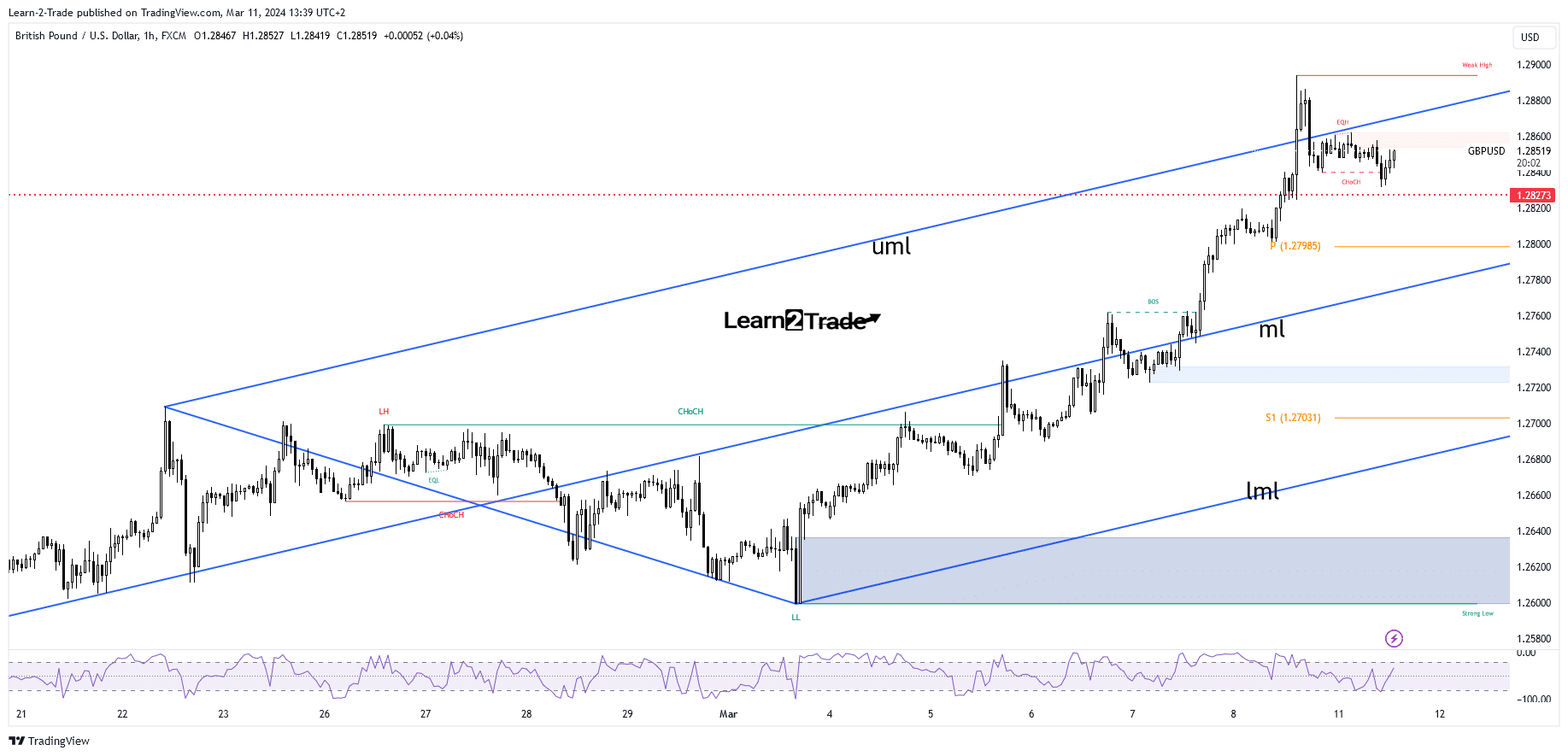

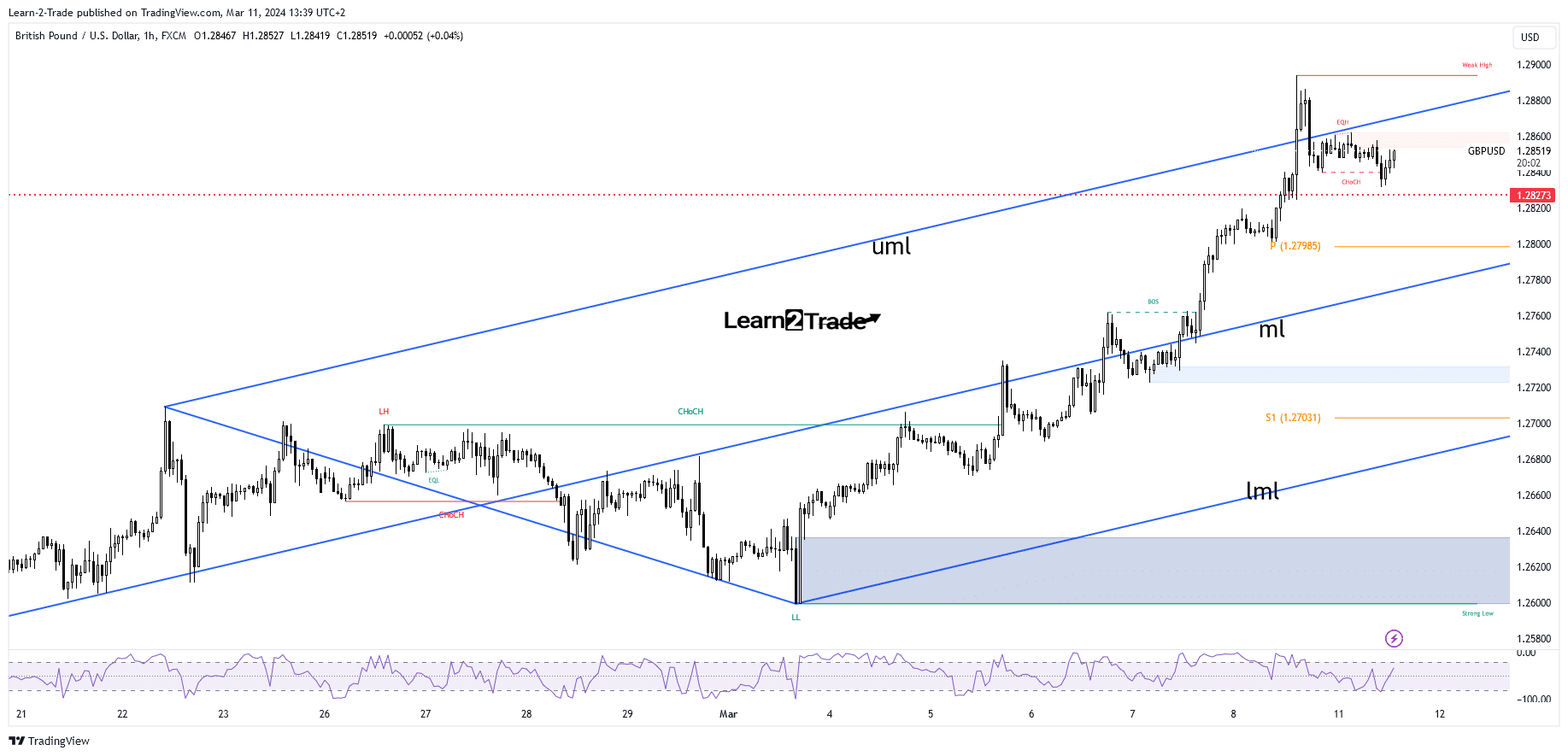

- Bias remains bullish despite temporary pullbacks.

- US inflation should move markets tomorrow.

- Failure to stay above the upper middle line signaled exhausted buyers.

GBP/USD turned lower after reaching a high of 1.2893 on Friday. The pair is trading at 1.2820 at the time of writing. The pair is correcting gains after a massive run.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

Basically, the US reported mixed data in the last trading session. NFP came in at 275,000 in February, versus expectations of 198,000 and above 229,000 in the last reporting period. However, the unemployment rate jumped from 3.7% to 3.9%, while average hourly earnings rose 0.1%, less than an estimated 0.2% increase.

Today, they could technically move the price. Meanwhile, the fundamentals should bring big action again tomorrow.

The change in the number of claimants in the United Kingdom is expected to be 20.3 thousand, up from 14.1 thousand in the previous reporting period. The unemployment rate should remain at 3.8%, while the indicator of average hourly earnings could announce a growth of 5.7%.

However, the release of inflation data in the US represents the most important event of the current week. CPI m/m may announce growth of 0.4% in February compared to growth of 0.3% in January. Year-on-year CPI could remain at 3.1%, while Core CPI could report an increase of 0.3%. Higher inflation could boost the dollar.

GBP/USD Price Technical Analysis: Support at 1.2800

Technically, the GBP/USD price bounced above the upper middle line (uml) of the rising villa, but failed to stay above this dynamic resistance, signaling exhausted buyers.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

The pair tried to retest this barrier to the upside, and could now approach the former resistance of 1.2800 which has turned into support.

The weekly pivot point of 1.2780 is also considered a potential incoming target. Failure to remove the upper midline (uml) can lead to a correction towards the midline (ml), which is a critical barrier on the downside. The bias remains bullish as long as it is above it.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money