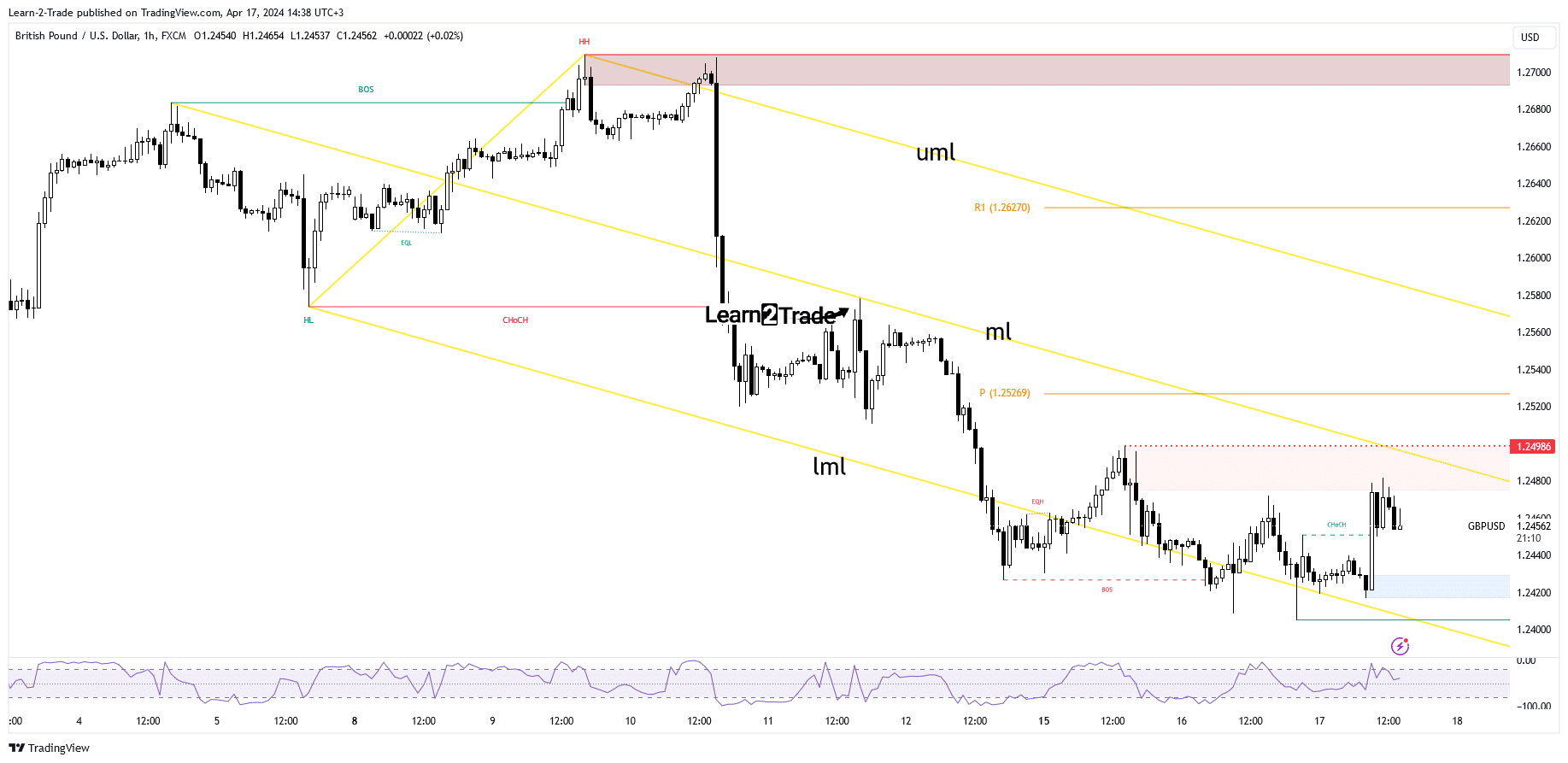

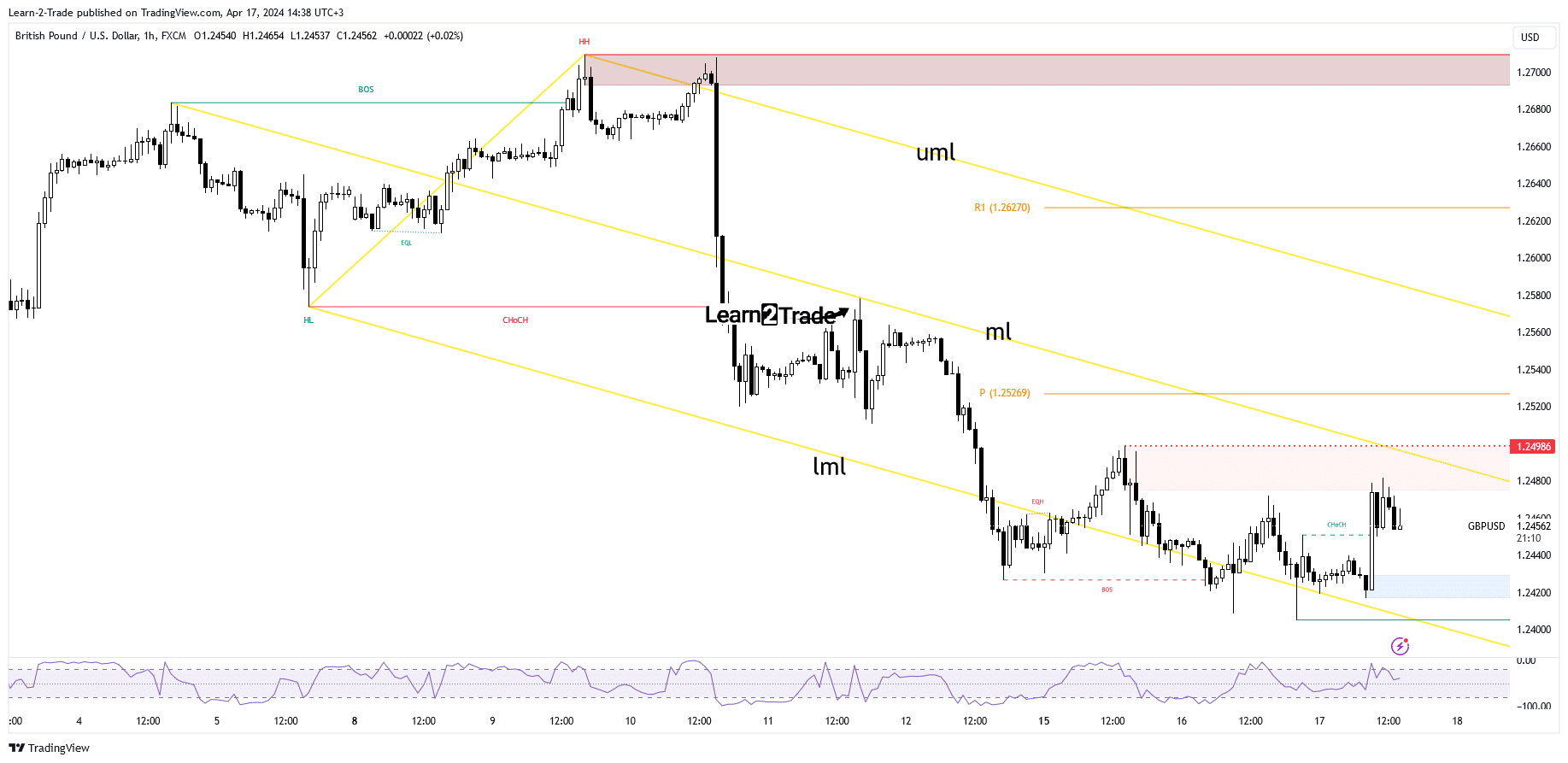

- Bearish pressure remains high as long as it is below the median line.

- A new higher high activates a higher jump.

- The price action signaled an oversold.

GBP/USD rallied today to reach as high as 1.2481 after the UK Consumer Price Index came in better than expected. Now the pair has pulled back a bit and is trading at 1.2457 at the time of writing.

-Are you looking for the best AI trading brokers? Check out our detailed guide-

In the short term, this couple lacks strong conviction. So we will have to wait for new opportunities before taking action.

Downward pressure remains high despite short-term bounces as the US dollar remains bullish. U.S. building permits, housing starts and capacity utilization were worse than expected, while industrial production rose 0.4% as expected.

Today, the British Pound took the lead as the UK Consumer Price Index reported a rise of 3.2% versus an estimate of 3.1%, while the Core CPI reported a rise of 4.2%, beating the estimate of 4.1%. However, the HPI and PPI inputs are worse than expected.

Tomorrow, US jobless claims, the Philly Fed manufacturing index, the leading CB index and existing home sales could move prices. Furthermore, UK retail sales data should bring big action on Friday.

GBP/USD Price Technical Analysis: Retest After Breakout

Technically, the currency pair failed to stay below the lower middle line (lml) of the descending villa, signaling the exhaustion of sellers. However, the bias remains bearish as long as it is below the median line (ml).

-Are you looking for the best MT5 brokers? Check out our detailed guide-

After today’s strong rally, the price could return to retest the demand zone above 1.2420. A higher bounce could be triggered after the removal of the middle line (ml) of the descending fork and the static resistance at 1.2498. On the contrary, a new lower low triggers more declines.

Do you want to trade Forex now? Invest in eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.