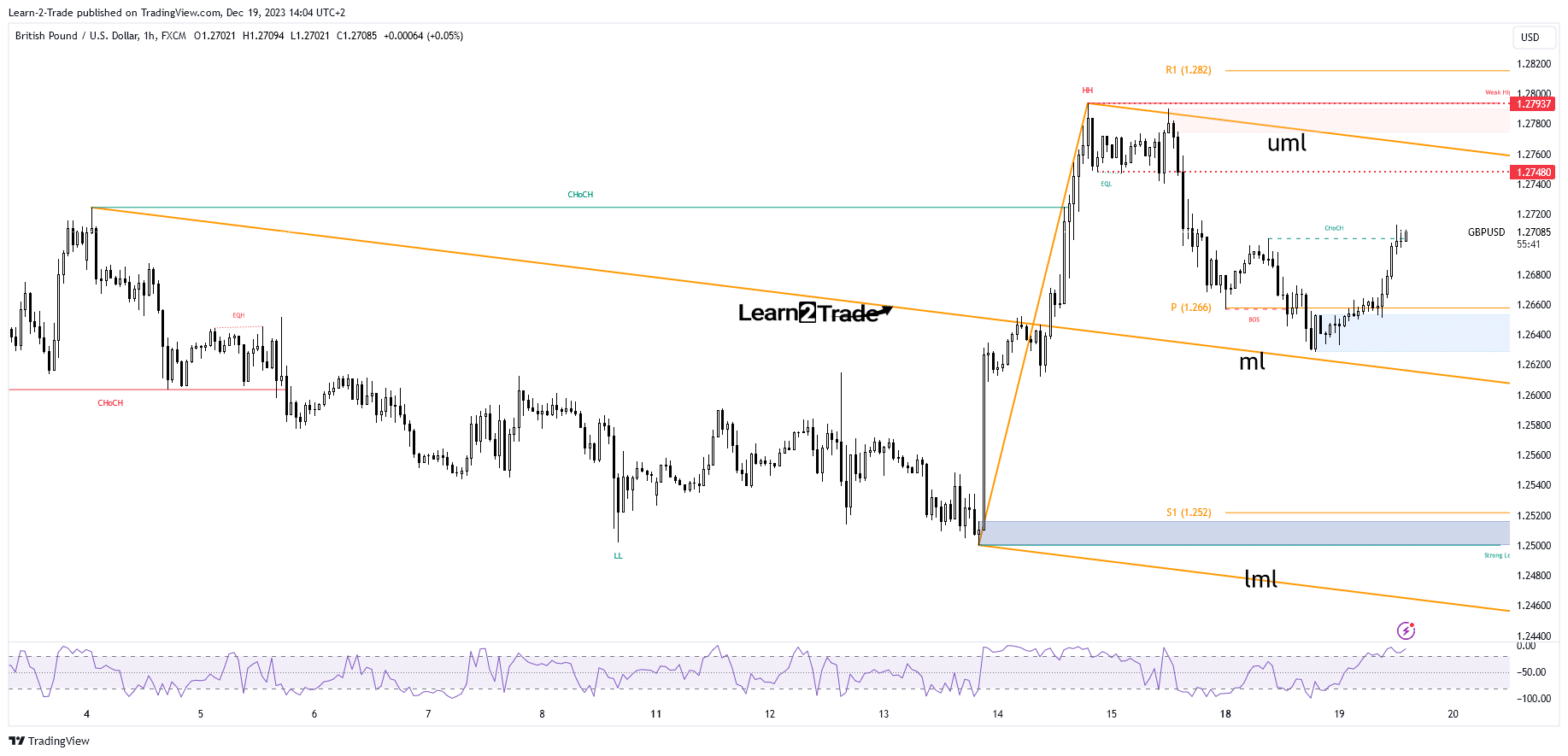

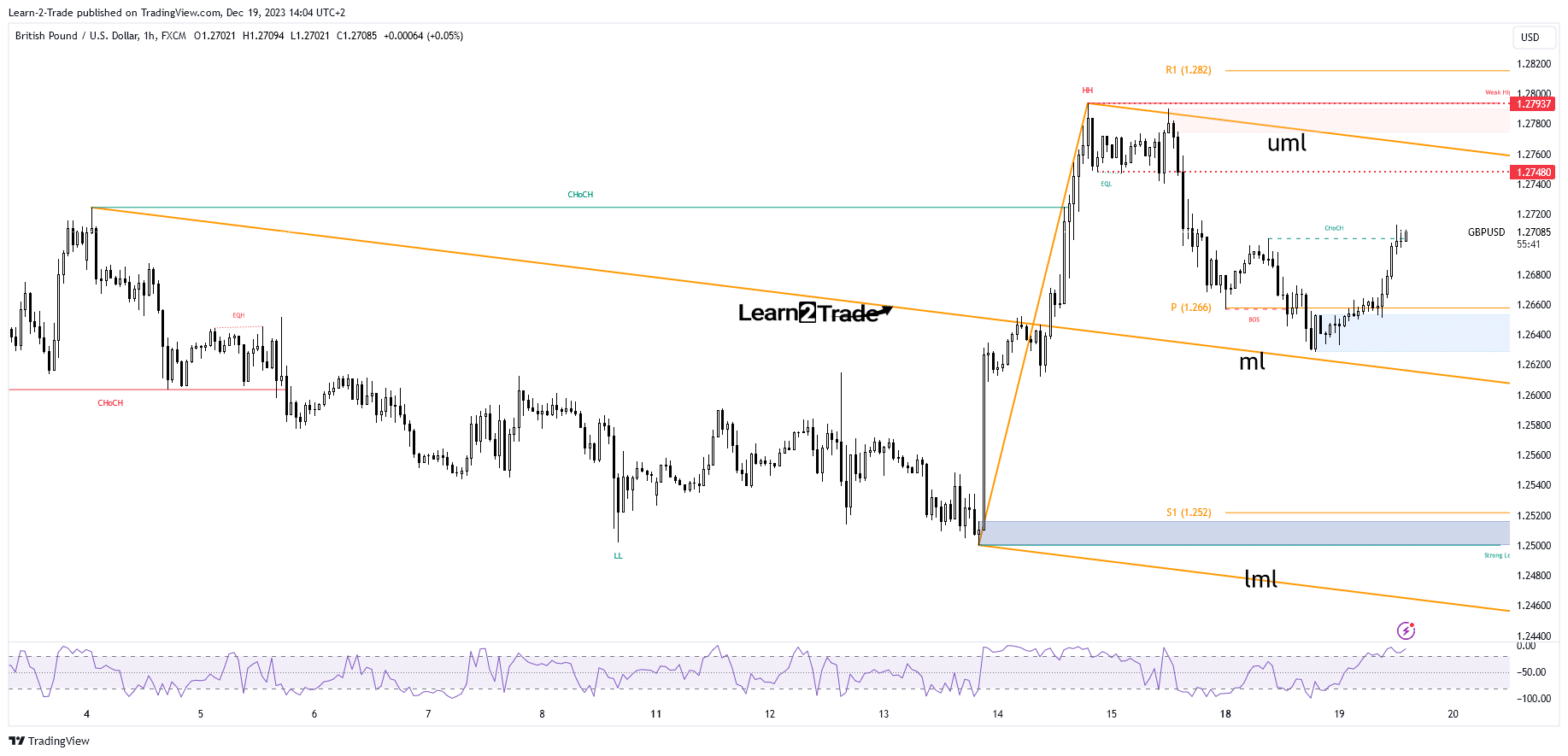

- The correction is completed above the middle line (ml).

- The upper midline (uml) is the main target.

- Canada’s CPI is due to run a bit later today.

The GBP/USD price rallied in the short-term after hitting yesterday’s low of 1.2628. Now, the pair is trading at 1.2713 at the time of writing. It looks likely to hit new highs as the US dollar is too expensive for now.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Basically, the British pound received a helping hand from the UK CBI Industrial Order Expectations indicator, which reached -23 points against the expected -28 points and was well above -35 points in the previous reporting period.

Later, the US will release data on building permits and housing starts. The indicators are expected to give worse data than the previous reporting period. However, the most important event is the US inflation data. The consumer price index could reveal a decline of 0.1% compared to an increase of 0.1% in the previous reporting period.

Tomorrow, UK inflation data could shake up the price. The CPI could post a 4.3% rise compared to a 4.6% rise in the previous reporting period, while the Core CPI could post a 5.6% rise in November, down from 5.7% in October. Also, the US publishes CB Consumer Confidence as a high-impact event.

GBP/USD technical analysis: bullish momentum

From a technical point of view, the GBP/USD price was in a short-term corrective phase. It was supposed to hit the middle line of the descending villas (ml), representing the main dynamic support and target.

–Are you interested in learning more about forex tools? Check out our detailed guide-

A pullback above the weekly pivot point of 1.2660 shows the exhaustion of sellers. It is now targeting the 1.2748 level (support turned into resistance). Also, the upper middle line (uml) represents a large dynamic resistance. So, it remains to be seen how they will react around these obstacles. False breakouts can herald another selloff.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.