- US employment data showed that the labor market is slowing.

- The U.S. nonfarm payrolls report showed a smaller-than-expected increase in jobs in August.

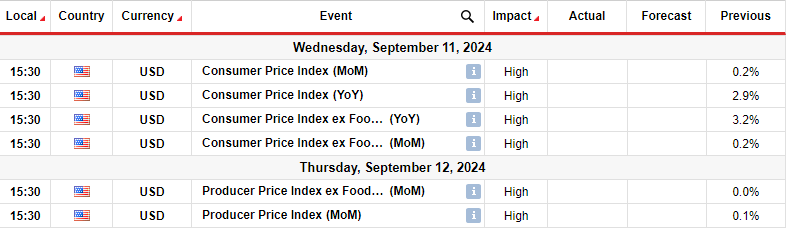

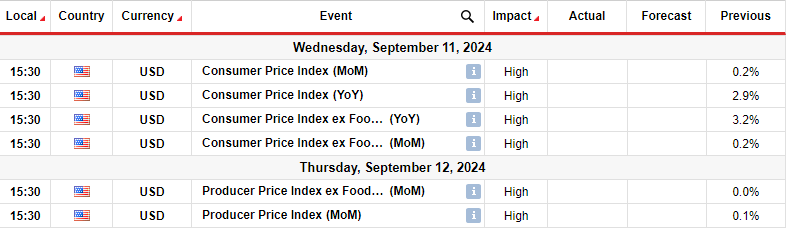

- US inflation data will be the last major report before the Fed’s policy meeting.

The GBP/USD weekly forecast shows a temporary break in a solid bullish trend as investors await the Fed’s first rate cut, while US NFP gives no clear direction.

GBP/USD Ups and Downs

The pound had a weak week, fluctuating amid mixed US economic data. Meanwhile, the UK provided little catalyst. Employment data showed that the labor market is slowing down. Vacancies fell more than expected, and private job growth slowed.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Meanwhile, the nonfarm payrolls report showed a smaller-than-expected increase in jobs in August. However, the unemployment rate remained stable at 4.2%. Meanwhile, data on business activity in the services sector showed a better-than-expected improvement, pointing to a resilient economy.

Next week’s key events for GBP/USD

Next week, investors will pay attention to UK employment and GDP data. Meanwhile, the US will release data on consumer and producer inflation. The pound has benefited in recent weeks on expectations of a smaller rate cut in the UK compared to the US.

Therefore, if UK wage growth confirms fears that UK services inflation will remain high, expectations of a BoE rate cut could fall, boosting the pound. Moreover, the pound would strengthen, given the declining US labor market. The Fed is in a better position to start reducing borrowing costs.

Meanwhile, US inflation data will be the last major report before the Fed’s policy meeting. Softer than expected figures will increase the likelihood of a 50bps drop in speed.

GBP/USD Weekly Technical Forecast: Bullish trend halts for short pullback

On the technical side, the GBP/USD price is in a bullish trend. Although the price is passing through the 22-SMA, it has maintained an upward trajectory. This means that he has made a series of major ups and downs. At the same time, the RSI was trading mostly above 50, supporting solid bullish momentum.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

The bulls recently broke above the critical resistance level of 1.3000. However, they failed to trade above the 1.3200 resistance, allowing the bears to take control. However, the bullish bias remains intact as the price is still above the SMA. Therefore, the pullback is likely to stop at the SMA and bounce higher. On the other hand, if it breaks the SMA and the 1.3000 level, it could find support on the bullish trend line. A new high above 1.3200 will continue the bullish trend.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.