- The US CPI report showed a drop in inflation.

- Employment data from the UK showed a significant drop in jobless claims.

- Next week, the UK will release its key inflation report.

GBP/USD’s weekly forecast shows more upside potential as softening US inflation increases Fed rate cut expectations, weighing on the dollar.

GBP/USD Ups and Downs

The GBP/USD pair ended the week on a very positive note as economic data from the US weakened the dollar. At the same time, data from Great Britain strengthened the pound. The US CPI was the main catalyst for the week, showing a drop in inflation. Consequently, investors have gained confidence that the Fed will cut rates in September.

–Are you interested in learning more about forex indicators? Check out our detailed guide-

Meanwhile, UK jobs data showed a sharp drop in jobless claims, pointing to a tight labor market that could prevent the BoE from cutting rates too soon.

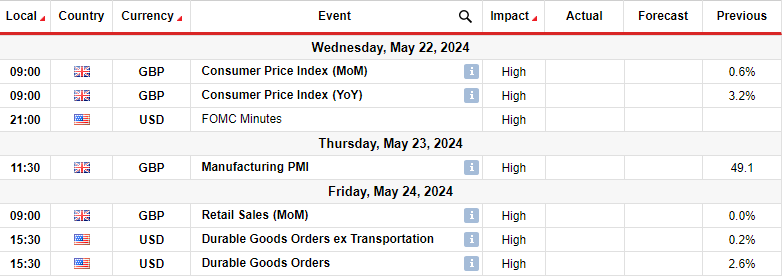

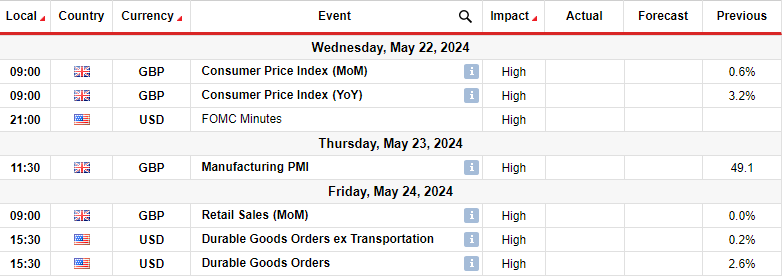

Next week’s key events for GBP/USD

Next week, the UK will release its key inflation report. At the same time, investors will focus on retail sales and manufacturing PMI. Meanwhile, the US will release FOMC meeting minutes and durable goods orders data.

The UK inflation report will significantly shape the outlook for a Bank of England rate cut. Currently, markets are pricing in a 55% chance that the BoE will cut rates in June. On Tuesday, BoE chief economist Hugh Peel said the central bank could be ready to cut rates in the summer. However, the labor market remains tight. If inflation remains high, this outlook could change significantly.

Meanwhile, the FOMC minutes will reveal what led policymakers to the latest decision to hold rates. It could also provide clues about what the Fed will do next.

GBP/USD Weekly Technical Forecast: Bulls target resistance at 1.2802.

On the technical side, the bias for GBP/USD has gone from bearish to bullish. At the same time, the price returned to the 1.2551–1.2802 range area. The previous bearish trend was paused and reversed at the 1.2300 level. Here, the price formed a morning star candlestick pattern, leading to a break above the 22-SMA and the key level of 1.2551.

–Are you interested in learning more about the next cryptocurrency to explode? Check out our detailed guide-

Furthermore, when the price broke above the SMA, it pulled back to retest it as support before making a new high. This confirmed that the bulls were ready to take control. There is currently a clear path for the pound to retest the 1.2802 resistance level. A break above this level would further strengthen the bullish bias.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.