- The data showed that annual inflation in the US fell further below 3% in November.

- Thursday’s figures reveal a worsening of the UK’s budget situation.

- UK inflation was lower than expected in November.

The dollar is caught in the influence of softer inflation signals and continues its decline, giving a favorable glow to the GBP/USD weekly forecast.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

GBP/USD Ups and Downs

The pound ended the week slightly higher, although it was almost flat after the fluctuation. It remained steady against the greenback as traders absorbed the latest on the UK’s budget deficit. Moreover, the impact of Wednesday’s November inflation data, which was lower than expected, continued to reverberate through the market.

Thursday’s data revealed a worsening budget situation for British Prime Minister Rishi Sunak, as the November deficit exceeded expectations. Notably, the pair fell on Wednesday to its lowest point in nearly two months after key inflation.

Meanwhile, the dollar index fell on Friday, hitting a near five-month low. The drop came after data showed annual US inflation slowed further below 3% in November. Accordingly, market expectations for a March interest rate cut in the US strengthened.

Next week’s key events for GBP/USD

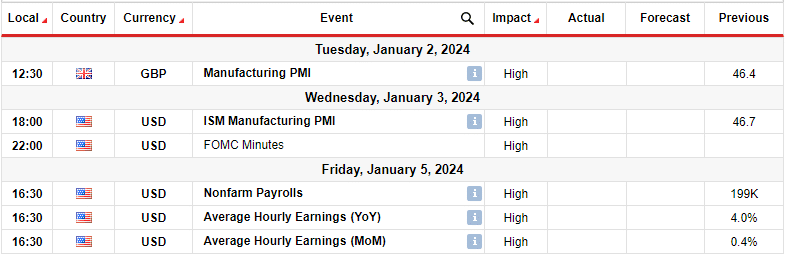

Markets will be closed next week for the Christmas holiday, so investors will be on the lookout for big events in the first week of 2024.

In the first week of 2024, traders will focus on data from the UK and the US, showing business activity in the manufacturing sectors. In addition, the US will release the minutes of the FOMC meeting, which will show what policymakers discussed at the last meeting in 2023.

Finally, the US employment report will show the state of the labor market. A higher-than-expected reading could dampen bets on a Fed rate cut, while the opposite is true.

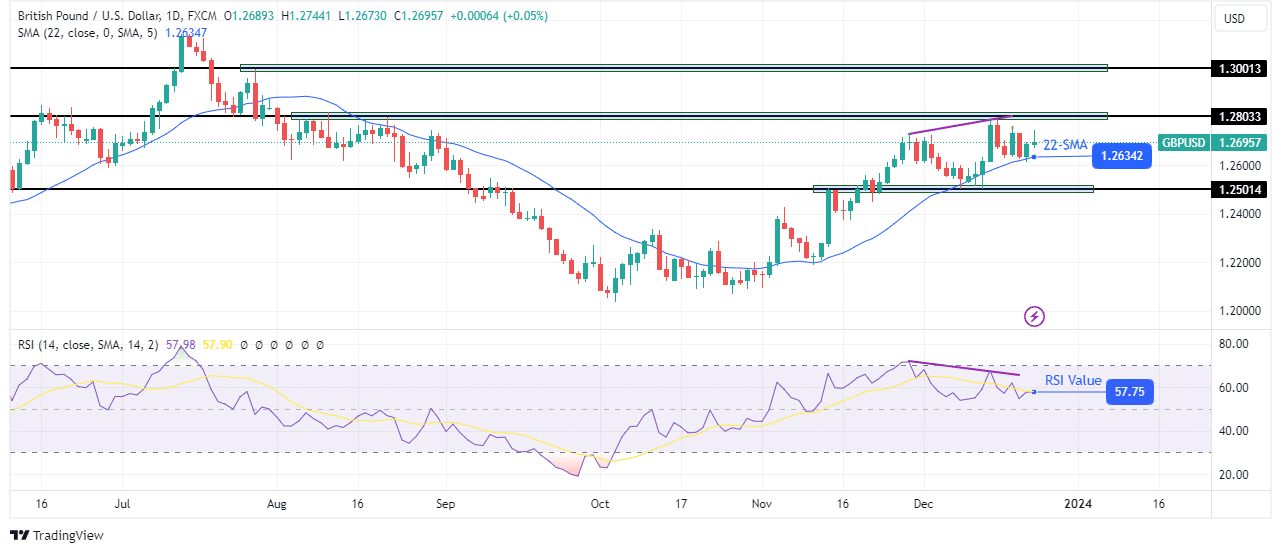

GBP/USD Weekly Technical Forecast: Bullish trend shows signs of slowing

The bullish trend on the 4-hour chart has slowed down after reaching the resistance level of 1.2803. Moreover, the slope of the 22-SMA has become shallower, and the price is not making big swings from the SMA. At the same time, bears are showing some strength as they continue to challenge SMA support.

–Are you interested in learning more about forex tools? Check out our detailed guide-

Meanwhile, the RSI made a bearish divergence. While the price made a new higher high, the RSI made a lower high, indicating weaker bullish momentum. With the price already trading close to the SMA support, a bearish divergence could lead to a trend reversal. However, bears need to break below the 22-SMA and the 1.2501 support level to confirm a reversal.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.