- GBP / USD Sunday forecast remains bullash in the middle of wide dollar weakness.

- The weaker American data and alleviation of American trading tensions support a pound.

- All eyes are at Boe and FOMC meetings due to weeks.

The welfare forecast GBP / USD remains strongly because the couple affects its third consecutive week in gains. The price marked the 39-month peak in 1,3635 before pulling in front of the weekend.

-If you are interested in forex trading and then read our guide to start-

Earlier of the week, he gained the traction traction after consolidation period. The weaker dollar and improved sensual risk helped customers. However, the key catalyst progressed in the National Trade Negotiations, he concluded in London with an agreement on facilitating export limitation, including rare land countries. Although the announcement did not have any details, it increased the risk appetite and weighed at Greenback Safe.

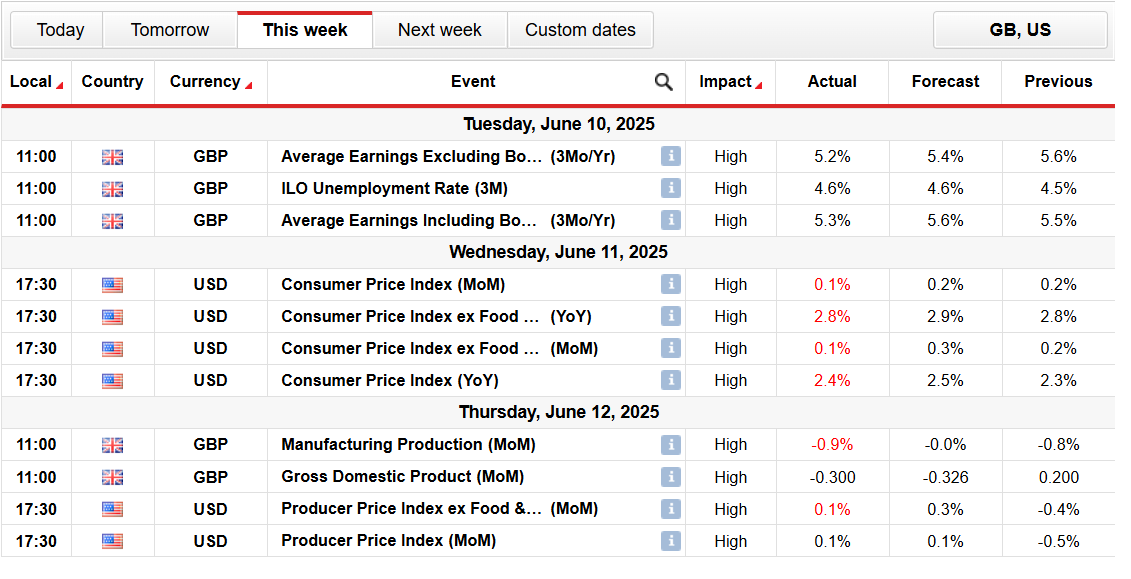

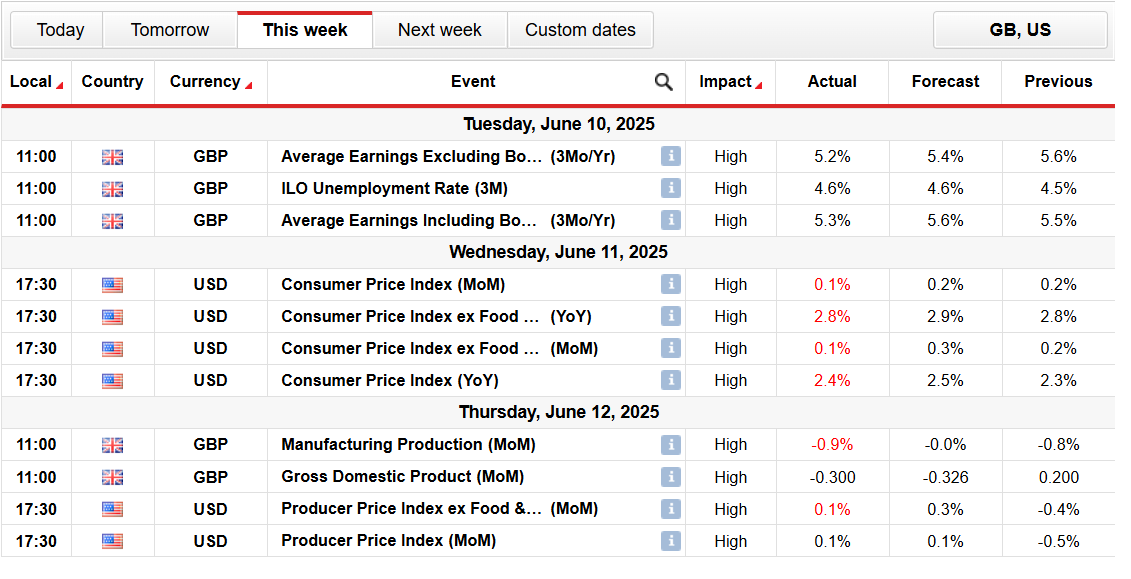

The US inflation data surprised the port market, and 0.1% increase on a monthly basis, which drew annual inflation at 2.4%, missing an estimate of 2.5%. Basic inflation also remained until a fall, increasing the chances of inaugurated fed. This was further encouraged by the Softens of American PPI data and growing weekly job receivables, which deepened the losses of USD and provided additional power on the pound.

However, accumulated showed it was short-term. Geopolitical tensions that later set fire to the attack of Israel later in Iran, killing Iranian military officials and scientists. Iran responded to retaliation, which escalated fear of wider conflicts.

Demand for a safe haven for the American dollar has risen on the news that launched a significant return return to more than a hundred PIP in GBP / USD pair. The pressure down is further intensified by the consumer feelings of UOM, which increased to 60.5, significantly above the expected 53.5.

Main Events for GBP / USD for the next week

Looking forward, next week, market participants will focus on the upcoming meetings of the Central Bank. And the American Federal Reserves and the English Bank are set to announce their key political decisions in the middle of the week. The consensus does not propose any changes from Feds, which is expected to hold 4.25% -4.50%, or BOE, which is also expected to hold rates to 4.25%.

Moreover, the US data and the UK retail sale, together with the requirements of CPI and the US and the US, will be important. Meanwhile, geopolitics and further comment Fed will also shape Outlook.

GBP / USD Sunday technical forecast: Bulls that support 20-SMA

The GBP / USD daily plan proposes consolidation in a wide postground. The withdrawal on Friday remained strongly supported by 20-day SMA. In the meantime, in the 1.3420-60 area, a strong support zone appears. The daily daily RSI is in 58.00 with a slope on the flumy, indicating further consolidation.

– Did you look for the best intermediaries in AI? See our detailed guide-

On upside, resilience is on 1,3600, which is a round number in front of 1,3635, which is a fresh 39-month peak. Breaking levels can collect enough towing for testing 1,3700.

Looking for forex trading now? Invest in Ethorro!

67% of retail orders lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.