- Investors fully expect two interest rate cuts from the BoE by December.

- Data on business activity in the US and UK showed further expansion in June.

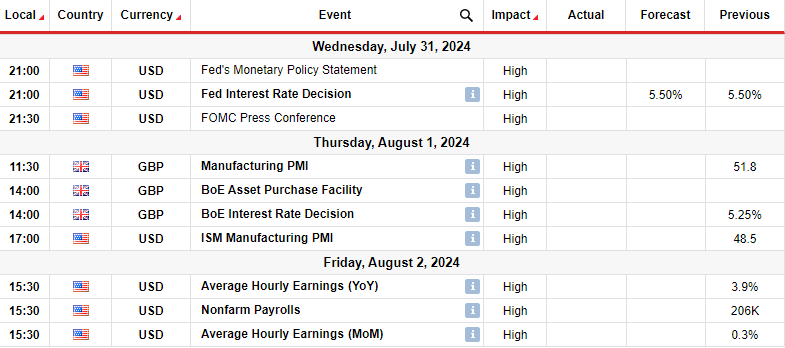

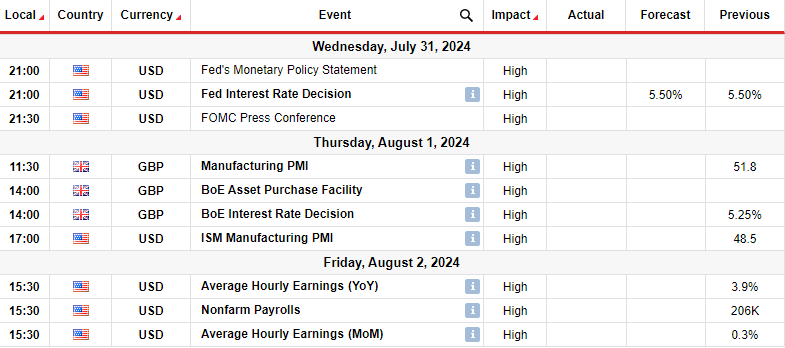

- Investors will pay close attention to the monetary policy meetings in the US and the UK.

GBP/USD’s weekly forecast heads south as markets move towards a more dovish outlook for the Bank of England.

GBP/USD Ups and Downs

GBP/USD fell last week as expectations for a rate cut from the Bank of England increased. At the same time, the dollar strengthened as data showed economic resilience and easing inflation. Investors fully expect two interest rate cuts from the BoE by December. However, the timing remains unclear. Bets on a rate cut rose as bets on a September Fed cut.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Meanwhile, data on business activity from the US and UK showed further expansion in June. So both economies are doing well despite high rates. Additional US data reveals stronger-than-expected economic growth in Q2 and a drop in jobless claims. The week ended with inflation reaching the expected 0.2%.

Next week’s key events for GBP/USD

Investors will pay close attention to monetary policy meetings in the US and UK next week. The Fed will meet on Wednesday and is likely to keep interest rates unchanged at 5.50%. Meanwhile, the Bank of England will meet on Thursday and there is a 50% chance that policymakers will vote for lower borrowing costs.

In addition, markets will focus on the all-important US monthly employment report. The latest report showed slower job growth and an increase in the unemployment rate. If this trend continues, policymakers may take a more dovish tone. At the same time, the dollar would fall, allowing GBP/USD to recover.

GBP/USD Weekly Technical Forecast: Bears challenge bullish trend at 22-SMA

On the technical side, the GBP/USD price fell back to the 22-SMA after reaching new highs. However, the bullish bias remains intact, with the price above the SMA and the RSI just above 50. The bullish trend continued when the price broke above the key resistance level of 1.2800.

–Are you interested in learning more about KSRP price forecasting? Check out our detailed guide-

Bears triggered a pullback before the price reached the key level of 1.3050. If the bullish trend remains in play, the price will bounce off the 22-SMA to revisit the resistance at 1.3050. However, if the bears take control, it can break below the SMA and support at 1.2800.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.