- Data from Great Britain revealed a significant jump in monthly unemployment claims.

- US data revealed a lower-than-expected consumer inflation figure in May.

- The Fed’s forecasts at the FOMC meeting showed just one rate cut in December.

GBP/USD’s weekly forecast shows more downside potential as Fed rate cut forecasts overshadow recent cooler inflation numbers.

GBP/USD Ups and Downs

The pound had a bearish week amid a flurry of economic reports from the US and UK. Earlier in the week, data from the UK revealed a significant jump in monthly jobless claims, showing a slump in the labor market weighing on the pound.

–Are you interested in learning more about Bitcoin price prediction? Check out our detailed guide-

However, that move was later reversed when US data revealed a lower-than-expected consumer inflation figure in May. Investors raised bets on a Fed rate cut in September, pushing the dollar lower. Unfortunately, the Fed’s forecasts at the FOMC meeting showed only one rate cut in December, which helped the dollar recover at the end of the week. This recovery continued despite softer-than-expected wholesale inflation data.

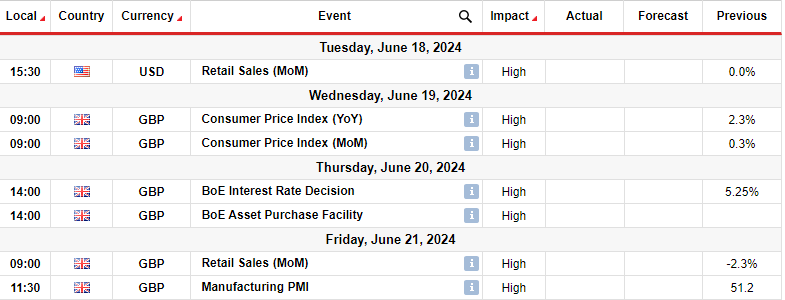

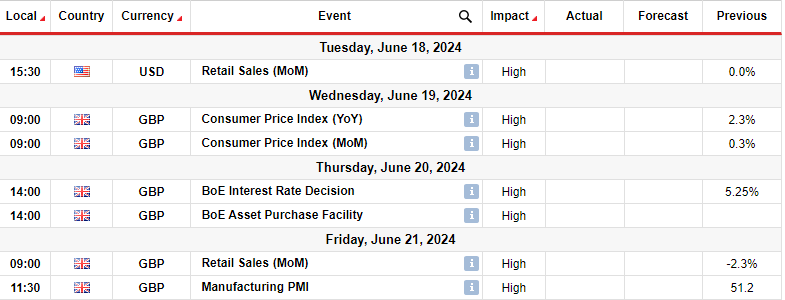

Next week’s key events for GBP/USD

Next week, the UK will release several major reports, including CPI, retail sales and manufacturing PMI. At the same time, investors will be paying attention to the Bank of England’s policy meeting on Thursday. Meanwhile, the US will release only its retail sales report.

The UK consumer inflation report will significantly shape the outlook for interest rates. Inflation in the country is on a downward trend and is currently at 2.3%, close to the central bank’s target. However, in the latest report, economists expected it to reach 2.1%. Another higher-than-expected figure would dampen bets for a cut in August.

Meanwhile, the Bank of England is likely to keep rates on hold at its policy meeting.

GBP/USD Weekly Technical Forecast: Break below 22-SMA prompts sentiment reversal

On the technical side, the GBP/USD price broke below the 22-SMA after failing to break the critical resistance level at 1.2800. At the same time, the RSI broke below 50, signaling a change in sentiment to the downside.

–Are you interested in learning more about the basics of forex? Check out our detailed guide-

The previous bullish move paused at 1.2800 and the bears started to show strength with large candles. A change in sentiment will allow them to revisit the support level of 1.2600. If the bears can break below this level to start making lower highs and lows, they will confirm a new downtrend. Moreover, the decline could continue to the key level of 1.2400.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.