- The UK labor market has shown resilience, with jobless claims falling.

- US data showed higher than expected consumer and producer prices.

- Experts believe that the US central bank will cut rates by 25 basis points.

The weekly GBP/USD forecast supports the bullish trend as the FOMC meeting could lead to further dollar weakness.

GBP/USD Ups and Downs

The GBP/USD pair had a bullish week after a mix of UK and US economic reports. In particular, the UK labor market has shown resilience, with jobless claims falling. Meanwhile, the economy has stagnated, with no growth, indicating a weaker-than-expected recovery.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

On the other hand, US data showed higher than expected consumer and producer prices, reducing the likelihood of a super-major rate cut. Accordingly, the dollar rose. However, this changed late on Thursday after reports indicated that the 50 basis point rate cut was very important. The dollar fell, allowing the pound to close on a bullish candle.

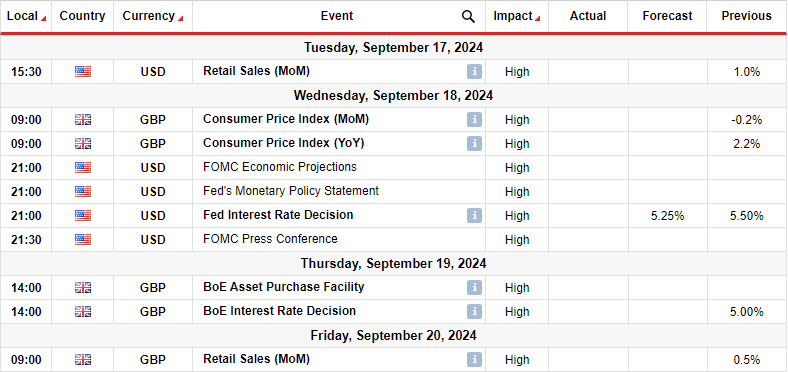

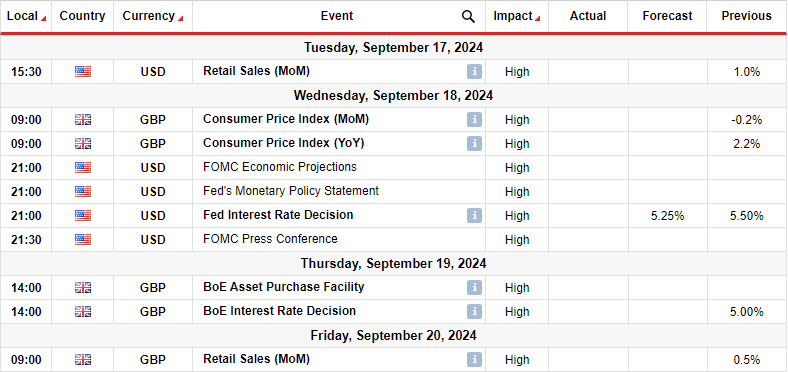

Next week’s key events for GBP/USD

Next week, high-impact UK events will include consumer inflation and retail sales reports and the Bank of England’s policy meeting. Meanwhile, in the US, the market will focus on the FOMC meeting and retail sales data.

Experts believe that the US central bank will cut rates by 25 basis points. However, there is still uncertainty about this, as some expect a more significant reduction. Because of this, there could be a lot of volatility in the markets on Wednesday. Meanwhile, the Bank of England may keep rates unchanged due to better-than-expected recent economic data. However, this outlook could change if inflation declines more than expected.

GBP/USD Weekly Technical Forecast: Bulls re-emerge at solid support zone

On the technical side, the GBP/USD price is in a developed bullish trend, with higher highs and higher lows. At the same time, the price was mostly trading above the 22-SMA, which is a sign that the bulls are in the lead. Meanwhile, the RSI has been trading in bullish territory, touching the overbought region several times.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

The uptrend recently reached the critical resistance level of 1.3200, but the price failed to sustain a move above it. Accordingly, the bears took control, initiating a retreat in support of the 22-SMA. The SMA coincided with the psychological level of 1.3000 and the 0.382 Fib, creating a solid support zone. Price has formed a strong bullish candle indicating that it could bounce higher to retest the 1.3200 level. A higher high will strengthen the bullish bias.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money