- Inflation reports from the US showed further easing, supporting the Fed’s pivot.

- Policymakers were bullish at the Fed’s meeting on Wednesday, signaling an end to interest rate hikes.

- The BOE maintained its hawkish tone, saying inflation remained a concern.

The GBP/USD weekly forecast shows a bullish trajectory. The narrative unfolds with the Bank of England sticking firmly to its hawkish stance, contrasting with the Federal Reserve’s more dovish outlook.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

GBP/USD Ups and Downs

GBP/USD had a bullish week amid differences in the policy outlook between the US Federal Reserve and the Bank of England. The main catalysts for last week’s move included US and UK policy meetings and US inflation reports.

In particular, inflation reports from the US showed further easing, supporting the Fed’s pivot. As a result, policymakers at the Fed’s meeting on Wednesday were impatient, signaling the end of rate hikes. Meanwhile, the BOE maintained its hawkish tone, saying inflation remained a concern, sending the pair higher.

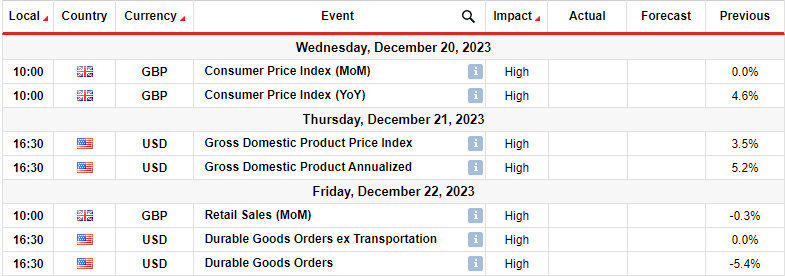

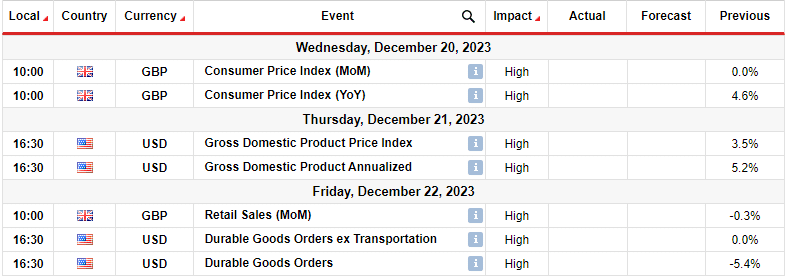

Next week’s key events for GBP/USD

GBP/USD traders will focus on the UK inflation report next week. On Thursday, the Bank of England was hawkish. Furthermore, Governor Andrew Bailey emphasized that the fight against inflation is ongoing.

The inflation report will therefore weigh on the outlook for a rate cut in the UK. In addition, the UK will release retail sales data showing whether or not consumers are spending big. Accordingly, this will also show the state of demand and inflation in the economy.

Meanwhile, economic data from the US will include gross domestic product and orders for core durable goods.

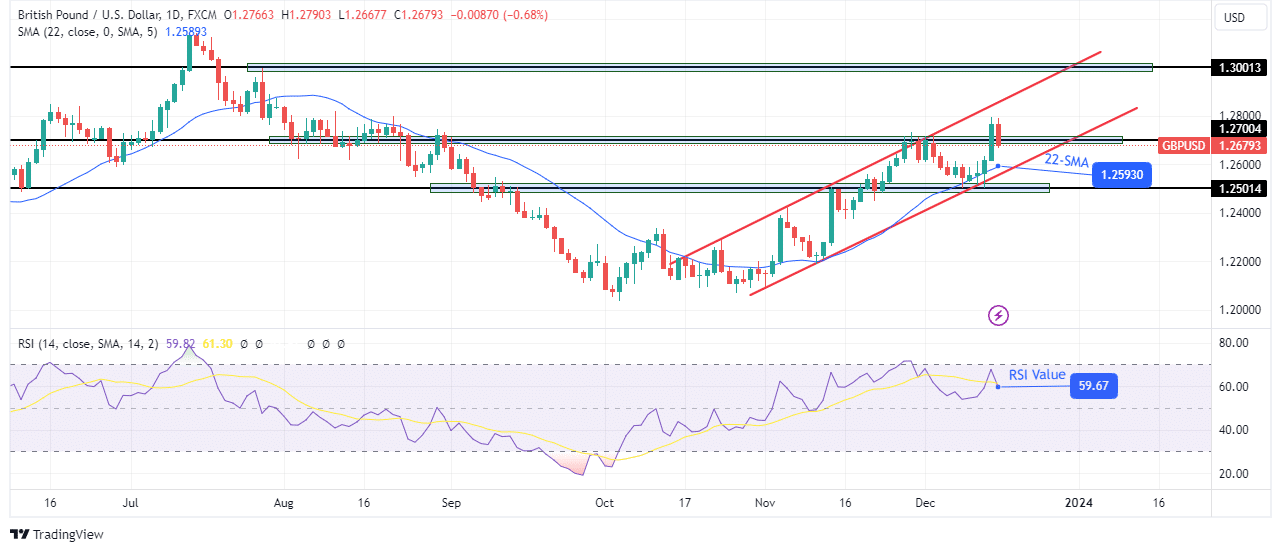

GBP/USD Weekly Technical Forecast: Bulls target 1.3001 resistance level

On the daily chart, GBP/USD is trading in a bullish channel, respecting the channel’s support and resistance. At the same time, the price makes more highs and lows, further confirming the bullish trend. The latest high was near the key level of 1.2700, while the latest low was near the key level of 1.2501. However, the uptrend exceeded the recent high when the bulls broke above 1.2700. Therefore, the bullish trend is likely to continue.

–Are you interested in learning more about forex tools? Check out our detailed guide-

Moreover, the indicators on the chart show further growth potential. The 22-SMA acted as support, pushing the price higher each time it pulled back. Meanwhile, the RSI is trading above 50, indicating stronger momentum for the bulls. Therefore, there is a good chance that the price will continue to rise next week as the bulls target the resistance level of 1.3001.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.