- The dollar was on the front foot after Powell’s hawkish speech.

- BoE policymaker Jonathan Haskell said he would need more evidence that inflation was cooling.

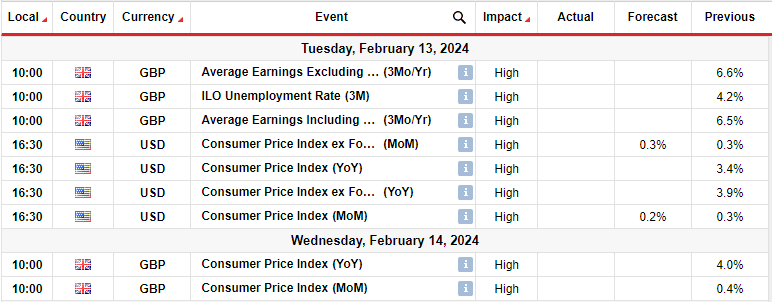

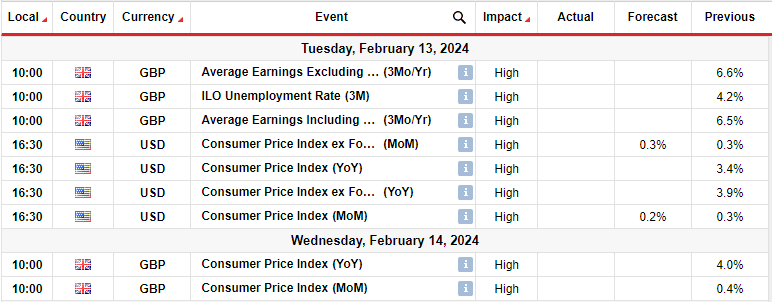

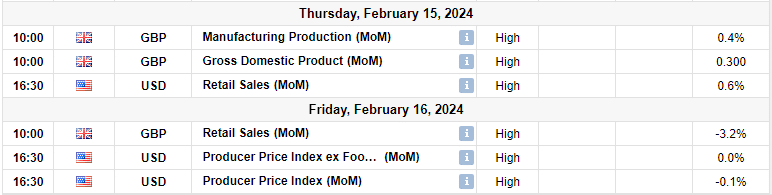

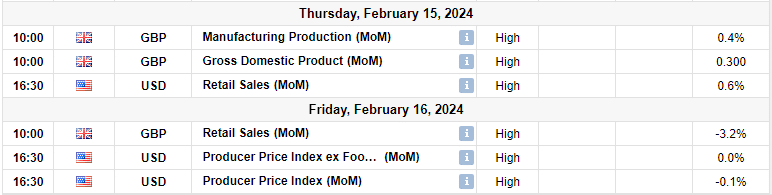

- The US and UK will release headline inflation and retail sales reports.

The GBP/USD weekly forecast has a neutral stance as both the pound and the dollar strengthen on falling interest rate cut expectations.

GBP/USD Ups and Downs

Although the pound fell last week, it had regained most of that movement by Friday. At the start of the week, the dollar was on top after Powell’s hawkish speech. In particular, Powell took another opportunity to emphasize that the Fed will not cut rates until inflation is on a clear path to the 2% target. As a result, the probability of a March rate cut fell to 16.5% from 65.9% a month ago.

–Are you interested in learning more about copy trading platforms? Check out our detailed guide-

In addition, upbeat data from the US, including business activity in the service sector and jobless claims, supported the dollar. However, the pound strengthened on Friday. BoE policymaker Jonathan Haskell said he would need more evidence that inflation is cooling before reversing his hawkish stance.

Next week’s key events for GBP/USD

The US and UK will release headline inflation and retail sales reports. Investors will be watching US consumer and manufacturing reports on inflation and retail sales. Traders will get clues about the outlook for the Fed’s monetary policy. Falling inflation could reverse bets for a March rate cut. Meanwhile, high inflation is unlikely to leave any room for the Fed to hike in March.

Similarly, UK inflation and sales reports will show the state of the UK economy. Accordingly, there could be a change in the outlook for UK rate cuts.

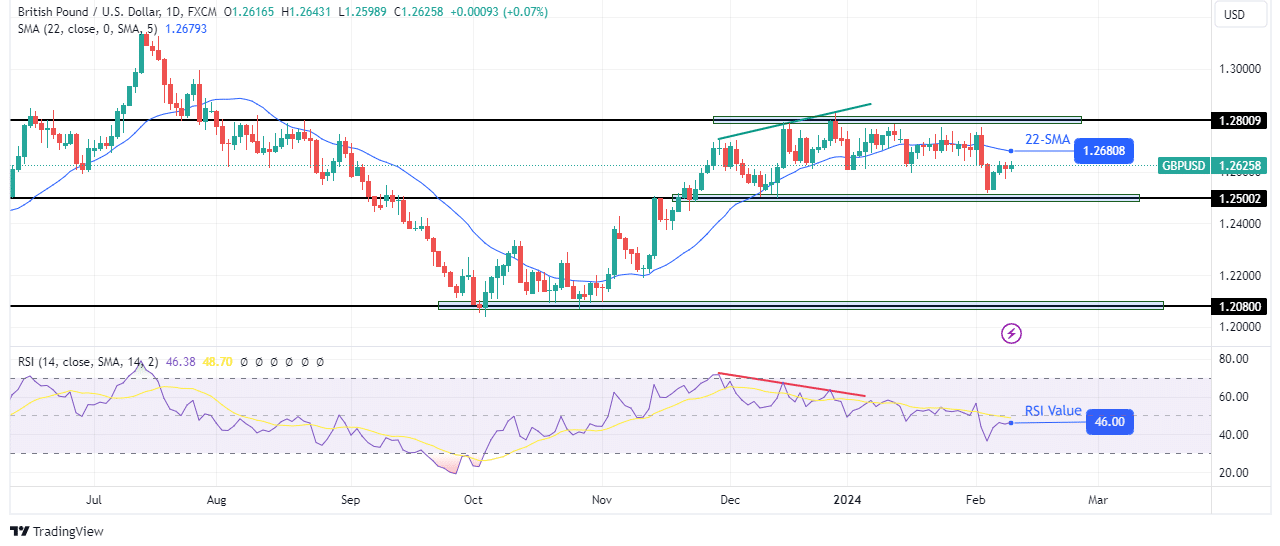

GBP/USD Weekly Technical Forecast: Trend Reversal as Bearish RSI Divergence Develops

The GBP/USD trend reversed to the downside after reaching the key resistance level of 1.2800. The bulls weakened as the price approached the 1.2800 level. As a result, the RSI made a bearish divergence. As the bullish momentum faded, the bears strengthened and pushed below the 22-SMA support.

–Are you interested in learning more about forex broker scalping? Check out our detailed guide-

At this point, the price is pulling back and could retest the 22-SMA as resistance before continuing lower. However, before lowering the price, the bears have to face the support level of 1.2500. A break below this level would allow the price to retest lower support levels such as 1.2080.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money