- Fed policymakers agreed that inflation was under control.

- US job creation and initial jobless claims fell.

- Private sector employment and nonfarm payrolls rose, strengthening the dollar.

The GBP/USD weekly forecast is slightly bearish as strong strength in the US labor market means a potential delay in the Fed’s plans to cut interest rates. Consequently, it challenges earlier March expectations.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

GBP/USD Ups and Downs

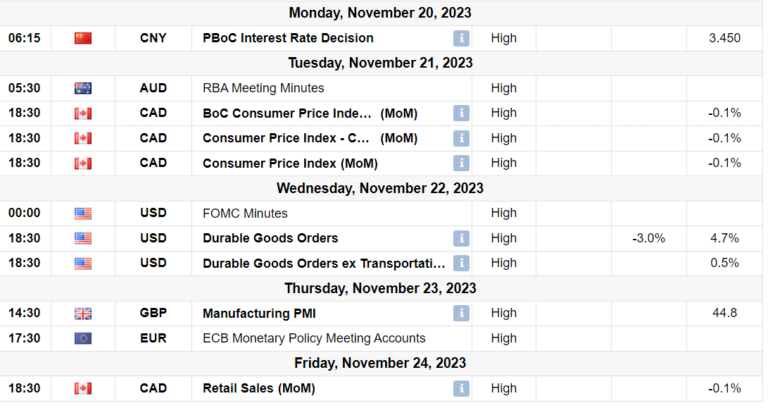

The pound had a slightly lower week as the price oscillated amid influential US data. The week started with minutes from the Fed’s December meeting. At the meeting, policy makers agreed that inflation is under control.

In addition, a series of US employment reports showed a strong labor market. Job openings and initial jobless claims fell. Meanwhile, private sector employment and non-farm payrolls rose, strengthening the dollar against most major currencies.

Next week’s key events for GBP/USD

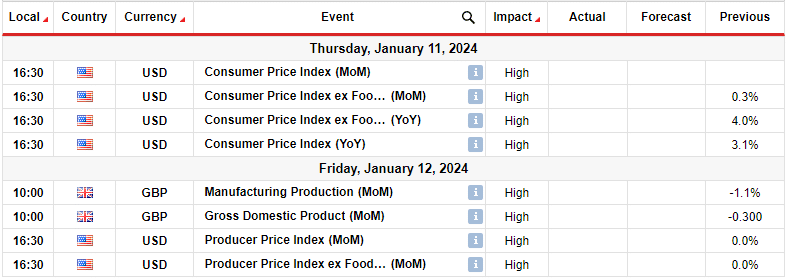

Next week, the US will release key figures showing consumer and producer inflation. Meanwhile, the UK will release data on manufacturing output and gross domestic product.

After Friday’s strong US jobs report, all focus will be on the inflation report. In particular, Richmond Fed President Thomas Barkin said that strong US job growth and a low unemployment rate indicate that the Federal Reserve has not reached the stage where its attempts to manage inflation represent a direct compromise with its goal of maintaining maximum employment.

Therefore, if inflation remains high, this could mean longer rates. On the other hand, if inflation falls, the Fed is likely to continue its plan to cut rates this year.

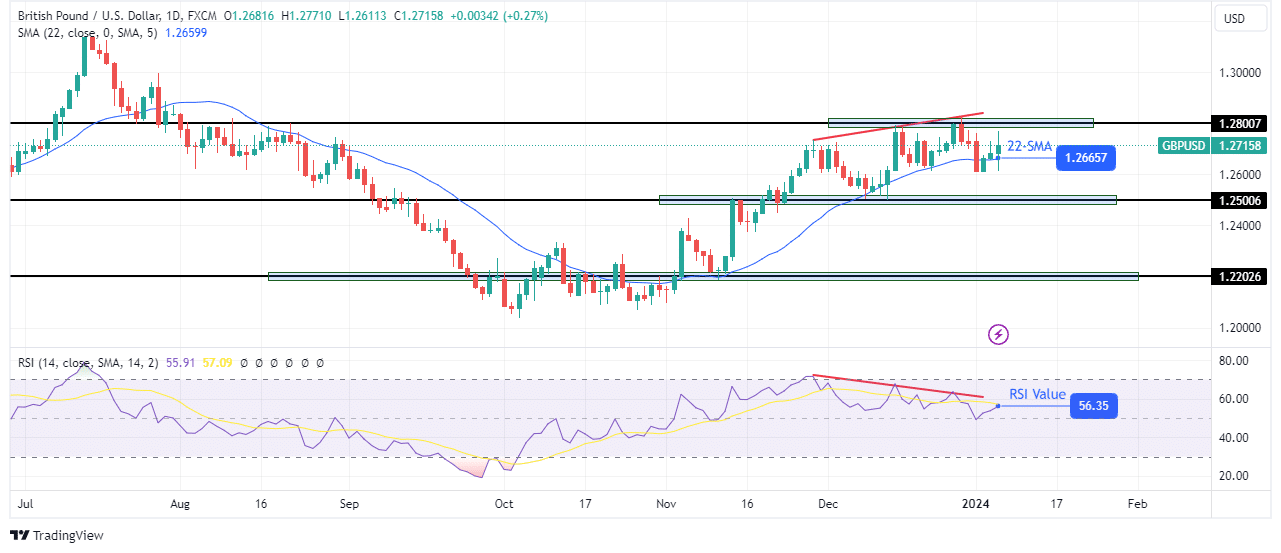

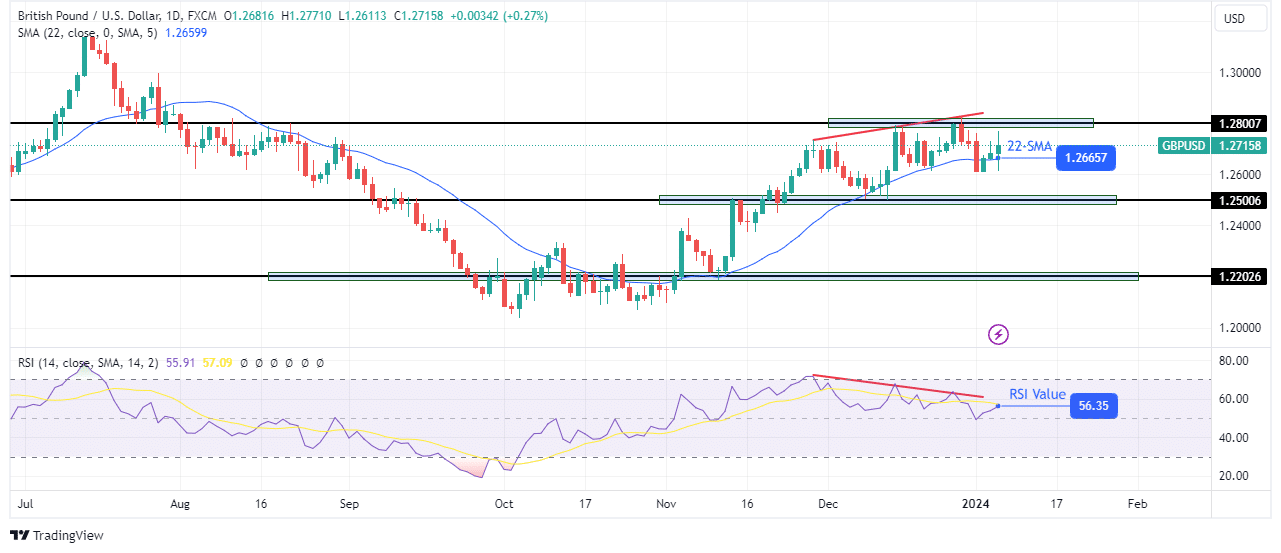

GBP/USD Weekly Technical Forecast: Bullish momentum fades near 1.2800 resistance

The pound is bullish on the charts, with the price rising to the 1.2800 resistance level. However, the bullish move became shallower and the price held close to the 22-SMA. At the same time, the slope of the SMA is not as steep as when the bulls took over. These are all signs that the bulls have weakened. In addition, the RSI has made a bearish divergence, moving lower as the price makes new highs. This indicates a weaker bullish momentum.

–Are you interested in learning more about Telegram Groups for Forex Signals? Check out our detailed guide-

Currently, the price is trading with the nearest resistance at 1.2800 and the nearest support at 1.2500. Therefore, if the bears take control, the price is likely to retest the 1.2500 support. Meanwhile, bears could target lower support levels such as 1.2202 if the divergence leads to a reversal.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money