- The wee a GBP / USD forecast is optimistic after the USA store.

- Some BOE policy makers were not ready to reduce interest rates.

- The dollar had a solid week due to optimism on mitigating trade tensions.

GBP / USD Sunday forecast is optimistic because it relieves the UK Trade Agreement relieves growth concern in Britain.

UPS and Padua GBP / USD

The GBP / USD pair had a bull Sunday, but under its high forces closed due to the dollar power. Pouma had a good week after the United States signed a trade with the greatest, leaving the basic tariff of 10%. Moreover, the meeting of Boe politics revealed that some policy makers are not ready to reduce interest rates. As a result, the expectations are broken.

–Are you interested in learning more about MT5 brokers? See our detailed guide-

However, the dollar also had a solid week after Fed remained cautious and for optimism on mitigating trade tensions. The US contract opened the door for the American Treaty in China.

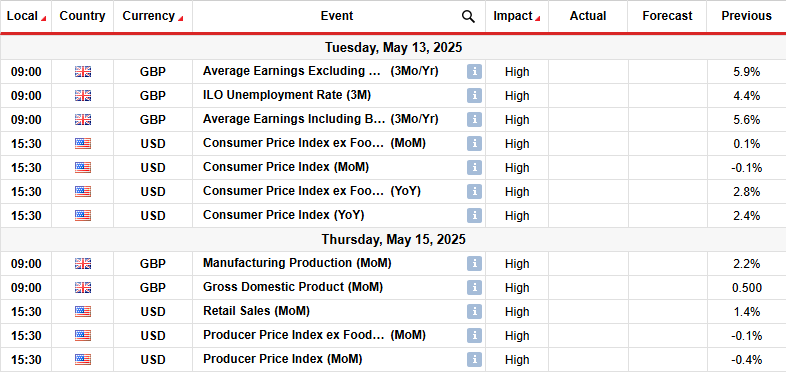

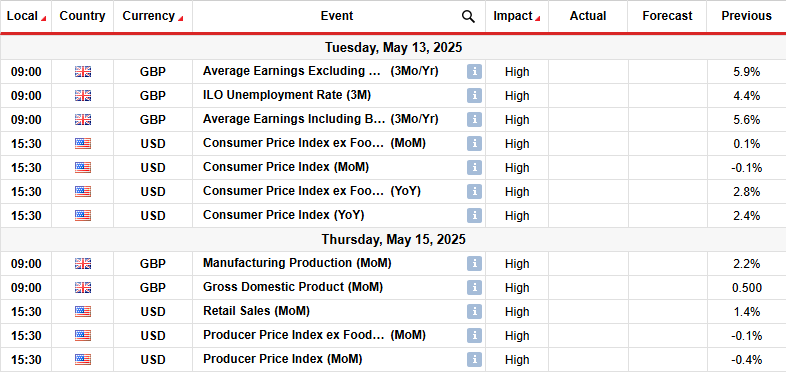

Key events next week for GBP / USD

Next week, market participants will focus on data from the United Kingdom, including employment, production of production and GDP. Meanwhile, the US will free data on consumer inflation, sales and wholesale inflation.

Employment in the UK and GDP reports will shape the look for the future bank of England politics. The numbers will ruin lower expectations to reduce feet, supporting the pound. On the other hand, cracks in the economy would encourage pressure to reduce prices.

The same will happen in the United States with inflation and sales data. Greater inflation and weak sales would reflect the influence of Trump tariffs.

GBP / USD Sunday technique Technical forecast: Books are re-set by SMA line

On the technical page, the price of GBP / USD has drifted back to re-set support 22 SMA after a break near the level of resilience at 1.3401. Despite the return, the price looks ready to bounce more. It is ranged above SMA, and RSI is over 50 years of age, supporting the bias of the bakery.

–Are you interested in learning more about Thailand forex brokers? See our detailed guide-

The GBP / USD has been maintaining a Bikar trend for a while, despite the 22-SMA. At the same time, it respected supporting the support below SMA, bouncing a new peak from the line. The latest high available is close to the key level 1.3401. Here, the price stopped to consolidate as it was caught.

Given the powerful bias of the bakery, the price could break over 1,3401 next week for higher high. Such a move would enable the bulls to target the key level 1,3603.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.